Workday Payroll Training | Workday Payroll Online Course

⏰18 hours | ▶️ 36 Videos | 📣 9452 Participants |🎓 6157 Reviews | 4.9 ⭐⭐⭐⭐⭐

Choose a Plan that Works for You

Self Paced

Unlimited Access- Advanced sessions

- Interview Q&A

- Free study Materials

- Premium Technical support

Instructor Led Live Training

Unlimited Access- Live Instructor

- Advanced sessions

- Interview Q&A

- Premium Technical Support

Corporate Training

Unlimited Access- Live Instructor

- Advanced sessions

- Interview Q&A

- Premium Technical Support

Upcoming Batches PST

Weekday

| June 09(1 HR A DAY) |

| 07:30 PM PST |

| Enroll Now → |

Weekday

| June 24(1 HR A DAY) |

| 07:30 AM PST |

| Enroll Now → |

Weekend

| June 29(1 HR A DAY) |

| 07:30 AM PST |

| Enroll Now → |

Upcoming Batches IST

Weekday

| June 10(1 HR A DAY) |

| 08:00 AM IST |

| Enroll Now → |

Weekday

| June 24(1 HR A DAY) |

| 08:00 PM IST |

| Enroll Now → |

Weekend

| June 29(1 HR A DAY) |

| 08:00 PM IST |

| Enroll Now → |

Workday Payroll Training creates an excellent analytics integration global payroll system by building comprehensive control over Data processes and costs in every auditing report.

ERP software on the cloud is called Workday Payroll. The control, adaptability, and intelligence you require to serve the particular company are provided with Workday Payroll.

Along with thorough and educational Workday Payroll Integration Training, the comprehensive and effective Workday Payroll Processing Steps help businesses optimize their payroll operations, minimize errors, and guarantee a seamless transition to the workday system, all of which save time and money while enhancing payroll accuracy and effectiveness.

We provide special Workday Payroll Online Training to help you hone your payroll processing abilities and become interview-ready.

Therefore, enroll in a classroom course for workday payroll taught by instructors who have achieved Cloudfoundation certification.

With this payroll process coaching, you may resolve everyday processing duties for all tax compliances and management tools.

Get trained with us right now and receive the certificate of completion for this Workday Payroll Tutorial.

Take advantage of fantastic career prospects by upgrading your resume and getting our help for your interview preparation.

ERP software on the cloud is called Workday Payroll. The control, adaptability, and intelligence you require to serve the particular company are provided with Workday Payroll. We provide special Workday Payroll training to help you hone your payroll processing abilities and become interview-ready.

The payroll setup, process flow, sources of payroll data, and access to payroll applications and dashboards are all reviewed to give an overview of this course. The sitemap’s payroll categories would be navigated by students, who would also learn how to find payroll information in a worker’s profile, explain payroll setup, name the steps in the payroll process, and pinpoint the sources of payroll data.

Learn valuable skills and become certified in Cloudfoundation Workday Payroll to advance your career. Our comprehensive program covers the workday payroll structure, calculating earnings and deductions, establishing payroll taxes, establishing payroll accounting, configuring banking and settlement, processing payroll on cycle and off cycle, etc.

Our trainers are professionals. Therefore, the Workday Payroll Tutorials they teach are more hands-on and valuable. By signing up with Cloudfoundation, you’ll get access to a Workday Payroll training course designed by industry experts and taught by verified instructors.

Note: Please be aware that Workday does not endorse us in any way. Introducing them to the best available independent tutors, we help students find the guidance they need.

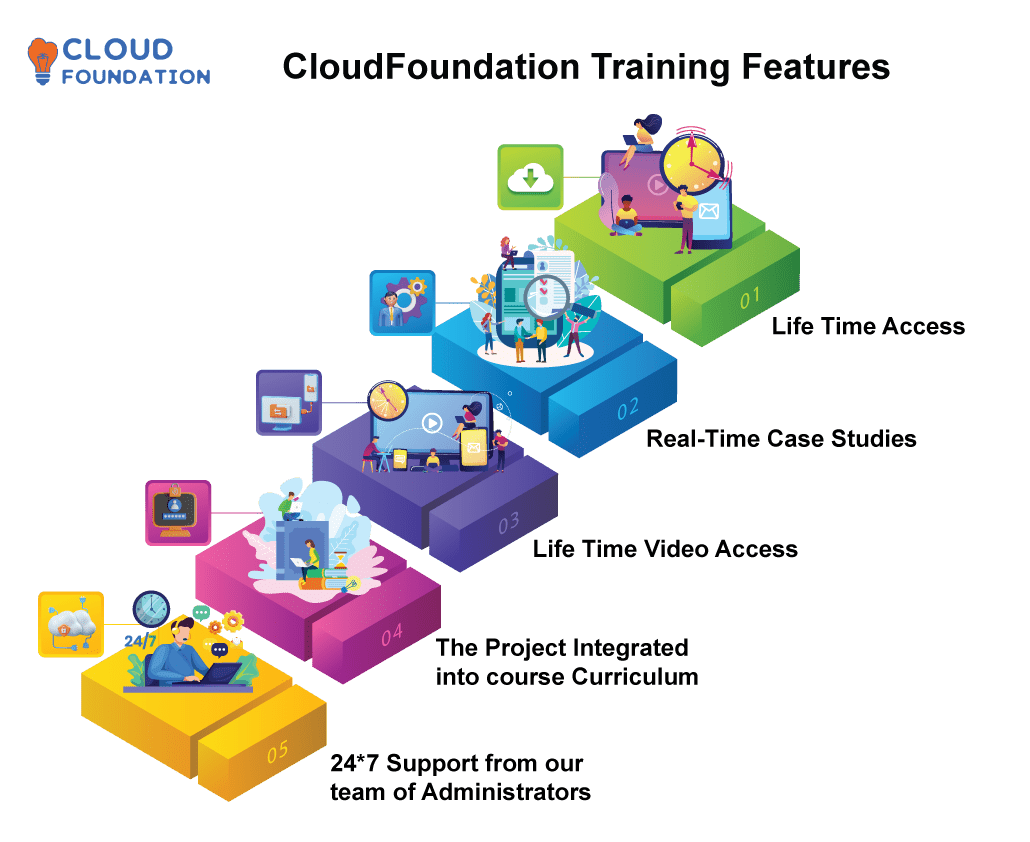

Features

Course Content

1. Introduction to Workday Payroll.

2.Setup the Payroll Processing Framework

Period Schedule structure

Run Categories

Rules for payment election definition

Pay Groups

3. Defining Earnings and Deductions

Earnings

Deductions

Info required to define Earnings and Deductions

Explore Bonus Earning

Paycomp Groups

Criteria

Calculation details

Compensation Elements

Time earnings

Benefit plans

Paycomp security group

Costing

Limits

ROE(Canada)

4. Federal, State and Local Tax Reporting

Summary of the Tax System

Organize payroll taxes

Create a company.

Setup for Business, Federal, State, and Local Taxes

Clarify the Tax authority exception

Organize employee tax elections

different jurisdictions for work taxes.

5. Set up Withholding Orders Overview of Withholding orders

Determine the available funds for a withholding order.

Make a recipient for deductions.

Keep a record of the withholding order’s specifics.

Altering the support order

Change or Cancel a Support Order

Priority of processing for a withholding order

View the Worker’s Withholding Orders.

6. Set up Payroll Accounting Overview of Payroll Accounting Run Payroll Accounting and Review Accounting Results

7.Set up Banking and Settlement

A summary of the banking and settlement configuration

Banking and Settlement Configuration prerequisites

Create payment election regulations.

Create a payroll payslip.

Set up check printing settings Specify bank accounts

Establish Routing Rules

note runs before

Set Up Settlement.

8. Configure Roles and Security

Overview of Roles and Security Groups

Pay component Based Security.

9. Define Business Process

Overview of Business Processes

Payroll Specific Business Process Chapter.

10. Payroll Input and Processing

Overview of payroll input process

Enter an override

Make a special Entry

Loan configuration and Re payment.

11. Payroll process On cycle and Off cycle

Run and Complete a Payroll

Process an off cycle Manual Payment

Process an off cycle Reversal

Process an off cycle on Demand Payment Testing Approach – 2hour.

FAQ’s

❓How much does Workday payroll cost?

✅ Workday does not publish any pricing information on its website and instead prefers to engage with the concerned companies directly in order to provide a quote that is specific to the needs of that particular business.

To use Workday, businesses must pay a yearly fee. It’s safe to say that Workday will nearly always cost you more than any other comparable service out there.

❓ Can you use Workday for payroll?

✅ Payroll services are available through Workday in the US, Canada, the UK, and France. We provide certified integrations with Global Payroll Partners and make it simple to interface with third-party suppliers worldwide if you have employees in other locations.

The Workday Payroll Management solution streamlines and simplifies the process of calculating employee salaries and benefits.

We live in a world where every company relies heavily on Workday, and everyone knows how important it is. Workday became the de facto method of operation for companies of all sizes. The use of Workday continues to grow in popularity every day.

❓ How does Workday payroll work?

✅ Complete management of payroll tasks, information, and expenses is at your fingertips with Workday Payroll. Traditional payroll systems have some drawbacks that can be avoided with the use of more user-friendly software. Command of the procedure: Manage the method by which the gross-to-net ratio is determined during various payroll processing types.

Human Resource Management (HRM) and Payroll functions are just two of the many tools available in Workday’s HCM Suite, of which Workday Payroll is a subset.

❓ What is Workday payroll?

✅ Your payroll operations, data, and expenses are all under your control with Workday Payroll. Utilize simple payroll setup and administration solutions to get rid of the problems present in conventional systems. • Management of the process: Control the calculation of gross-to-net for various payroll run types.

A cloud-based payroll administration system called Workday Payroll was created to aid companies in managing their payroll procedures more successfully.

❓What Is Workday Payroll Training?

✅Workday Payroll Training provides users with instructions for using Workday payroll software efficiently, including setting up payroll processing, personnel data administration and report generation. This training typically covers payroll setup and processing, personnel data management, and report creation.

❓Who is Workday Payroll Training for?

✅ Workday Payroll Training is intended for anyone responsible for payroll administration, including HR professionals, accountants or finance managers.

❓What are the benefits of Workday Payroll Training?

✅Workday Payroll Training has multiple advantages, such as increased processing efficiencies and accuracy, compliance with payroll rules and an enhanced employee experience.

❓How long should Workday Payroll Training take?

✅Training length may depend on the specific program or training needed – some programs could finish within days or weeks, while others can span months.

❓Is Workday Payroll Training available online?

✅Workday Payroll Training can be found online through various sources, giving users the flexibility and freedom to study quickly and in their own time.

❓What is the Cost of Workday Payroll Training?

✅Training costs depend on which provider provides it and on the type and extent of training necessary. While some providers offer free or limited education sessions, others may charge fees for more advanced instruction or intensive course material.

TAGS

Workday Training Workday HCM Payroll Courses, Workday Payroll Training Manual, Workday US Payroll Certification

Drop US a Query

Suggested Courses

MuleSoft Training

⭐⭐⭐⭐⭐

😃 221 Learners

Pega Training

⭐⭐⭐⭐⭐

😃 391 Learners

SailPoint Training

⭐⭐⭐⭐⭐

😃 106 Learners

WorkDay Training

⭐⭐⭐⭐⭐

😃 158 Learners

A few of our students

Contact Us