Workday Finance Training – An Accounting and Financial Management Technology

Initiation

Bonjour!

Having the opportunity to see you again has been a pleasure. I think you should look into the following:

New technology, Workday Financial Management, will allow you to take your profession to the next level.

What do you mean by “Workday Financial Management”?

Finance in the workplace plays a crucial role. It had a global accounting and cash management system in place.

Finance in the workplace plays a crucial role. It had a global accounting and cash management system in place.

Your financial patterns are swiftly and effectively managed, as are unknown components like long-term security, a fully auditable organizational action framework, and a multi-dimensional introduction, thanks to this system.

How does it all work??

How does it all work??

Using Workday Financial Management, you can see every aspect of your organisation in the cloud. One cloud-based system records and supports all transactions, which is vital for a business. As soon as it is accepted, your accounting department will have immediate access to business data.

Why do we have to make a decision?

Workday can help you achieve a quicker and more accurate financial close by streamlining your chart of accounts. Managing various operational entities, corporations, or business divisions allows you to do removals, intercompany transactions, provisions, revisions, and consolidated reporting.

Workday can help you achieve a quicker and more accurate financial close by streamlining your chart of accounts. Managing various operational entities, corporations, or business divisions allows you to do removals, intercompany transactions, provisions, revisions, and consolidated reporting.

Effective money management is crucial now…

In order for a firm to grow and prosper, it will need more money to do so. Planning and preparing for these monetary necessities is critical. Financial managers must make a choice between relying on their own resources and borrowing money from other sources.

Workday Finance Management has the following advantages.

Organizational insight, real-time financial management capabilities, and continuous audit and internal control monitoring are all provided by Workday Financial Management.

Benefits that are most important

Provide executives and also company supervisors with acceptable, relevant financial projections that may be accessed on the devices of their choice.

Provide executives and also company supervisors with acceptable, relevant financial projections that may be accessed on the devices of their choice.

In addition to the usual constant audit capabilities, we offer the best in the business. Assume responsibility for the business process and make any necessary changes without causing any disruptions.

Ensure that all customers, including employees, executives, managers, and auditors, have access to an ongoing and user-friendly user experience.

Incorporated into this Workday tool are the following benefits provided by the software:

Access to all of your financial assets from one screen.

Inventory management and business asset management platform is also available, allowing for better inventory and expenditure management.

It aids in the collection of business reports on bills, both paid and pending, from the company’s business accounts. With the program’s design in mind, dashboards may be developed utilizing custom reports and a variety of data sources.

Make a list of the people who have purchased this software.

Clients who use this software include:

Unit 4 for Networking and Telephony

Microsoft

Automation Anywhere

Capgemini

Collaborative Solutions

Patagonia, Inc.,

Netflix company

The future of Workday Finance Management can be found here.

CRM, procurement, business reports, asset management, and more are all included in Workday Financial Management. It is easier to understand the numbers when they are presented in dimensional form. Real-time data is provided by the software to assist in decision-making. Multi-currency and multi-entity features allow it to be used in global business.

CRM, procurement, business reports, asset management, and more are all included in Workday Financial Management. It is easier to understand the numbers when they are presented in dimensional form. Real-time data is provided by the software to assist in decision-making. Multi-currency and multi-entity features allow it to be used in global business.

The software’s user interface (UI) is simple and intuitive to use. Among the program’s capabilities are procurement, purchase orders, corporate assets, invoicing, revenue recognition, revenue management, grant administration, and real-time spend analytics.

To learn this new technology, where can I go for instruction?

Web sites, blogs, and online classes are all ways to learn about Workday’s financial management software.

To fully grasp a new course, it is necessary to have the correct direction and training.

A well-trained employee is more productive and efficient.

If you’re not a working professional, you’ll need to learn how to utilize the software for workday money management.

Enrolling in an online training program is preferred.

Enrolling in an online training program is preferred.

Along with that, I finished my online training, which saved me a lot of time and allowed me to get to know the material much better.

Students can make use of a well-equipped classroom, expert instructors, and a technical support team that is available around the clock.

Is it necessary to go through a lot of training?

Everyone should, in my opinion, participate in some form of training to improve their abilities and knowledge.

To master IT and computer skills, one must receive first-rate instruction.

The importance of training cannot be overstated because it opens the door to numerous promising career paths.

In online training, you’ll have access to a tool or tenant access that will help you apply the subject matter in a real-world context.

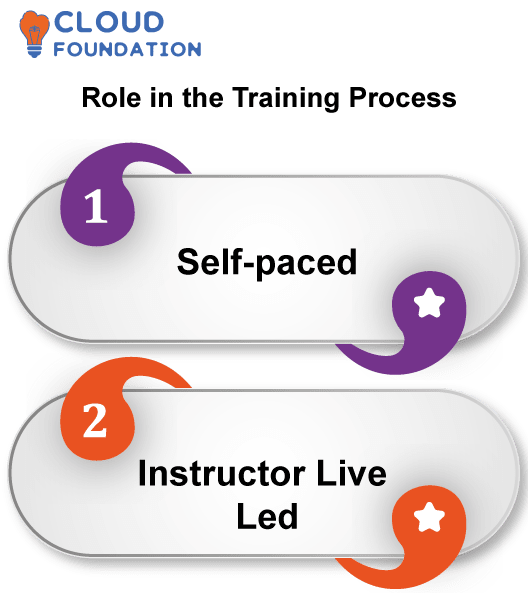

What role could I play in the training process?

There are two techniques to teach financial management in the workplace: i.e

Self-paced: The ability to learn at your own pace is provided through the use of recorded videos and pdfs that may be accessed indefinitely. We can use it to plan out how much time we’ll spend studying.

Self-paced: The ability to learn at your own pace is provided through the use of recorded videos and pdfs that may be accessed indefinitely. We can use it to plan out how much time we’ll spend studying.

Instructor Live Led: Training that is led by a Live Instructor: We have a team of the best instructors and tech support available around the clock to help you with any concerns you may have.

Let’s get into the nitty-gritty of certification for a moment:

To become a certified trainer in workday financial management, a candidate must first pass the certified professional certification exam.

After finishing your course, you must take the certification exam. Following your certification, you must post your revised resume to numerous job sites so that potential employers and colleagues may easily locate you.

Let me conclude by saying:

Essential business elements such as bank reconciliation, asset management, revenue management, and CRM are covered by the Workday Financial Administration. These include project and task management, business process management, and analytics of spending and sales, among other things.

While working in the office or on the go you may access your workday financial management software in complete transparency thanks to Workday’s web-based and mobile-friendly financial management solution, Workday.

CloudFoundation is a great resource for learning about Workday Finance, and I believe I’ve given you all the information you need.

Akhila

Author

Hola! I believe words cause magic and here Iam helping you become aware of advancing technologies, because the future of communication starts here.