What is Workday Payroll & Workday Payroll Services?

Hello peers, I hope you are eagerly waiting for the new blog, come let’s have a deep knowledge on “what is payroll and its services”, before this have a look on the workday payroll certification, and have a brief note on workday payroll training.

Overview of Workday Payroll: What is to Workday Payroll?

Cloud-based Workday Payroll HCM covers HR, talent and finance are simplified within Workday HCM.

Workday Payroll provides companies with a flexible solution for overseeing payroll operations by seamlessly administering payroll processes, payroll taxes and employee pay information. With Workday’s customizable features they can tailor payroll operations specifically to the business.

Workday Payroll integrates well with HCM, Time Tracking and Financial Management software packages – creating one single source for HR and payroll data collection to enhance accuracy and efficiency.

Introduction to Workday Payroll

Workday Payroll is highly configurable and scalable to meet the needs of start-ups to large enterprises alike, while protecting data using role-based access control and encryption technology. Intuitively crafted, Workday Payroll may enhance both HR and finance operations – its robust architecture offers simplicity that may improve HR management practices as well.

Define Workday Payroll

Workday Payroll is a cloud-based payroll solution. This service automates payroll preparation and payment for enterprises while tracking employee benefits, deductions, taxes and any related payroll matters.

Workday Payroll seamlessly connects with Workday products like Human Capital Management to manage employee data, taxes, and payroll processing. They offer services through Workday Payroll that streamline your processes while meeting tax regulations.

Workday Payroll services

Workday Payroll is an intuitive cloud-based payroll management solution created to assist organizations of any size streamline their payroll processes and optimize employee pay calculation as well as tax filing.

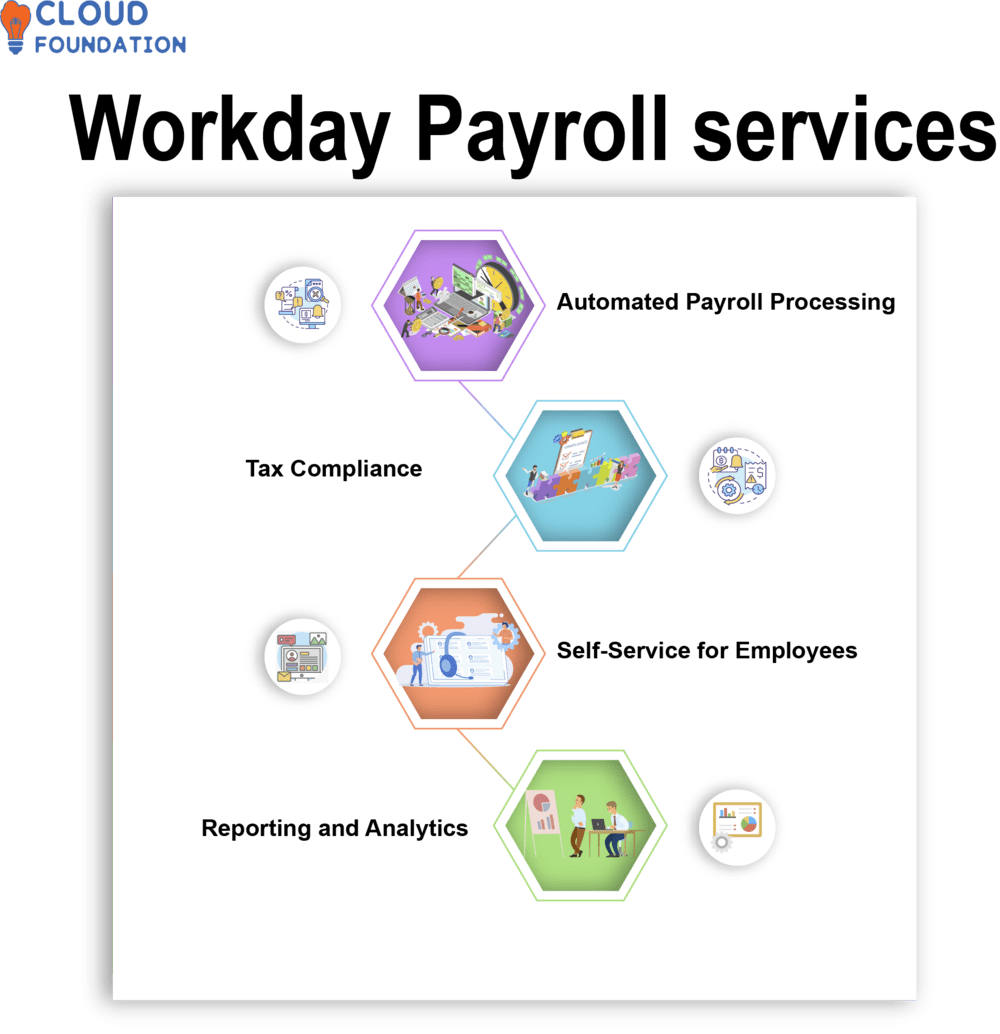

Workday Payroll offers businesses several key features:

Automated Payroll Processing: Workday Payment makes the payroll process fast and accurate by automating its automation capabilities to enable fast payments with fast processing speeds – including handling complex calculations such as deductions or schedules and rates with ease.

The system supports complex pay calculations with deductions or rates as needed based on pay schedule or rates set in place in an organization’s contracts or policies.

Tax Compliance: Workday Payroll ensures tax compliance by automatically calculating and withholding taxes according to federal, state and local rules for payroll withholding, thus helping businesses stay compliant and avoid penalties.

Self-Service for Employees: Workday Payroll provides workers access to pay statements, tax forms, and other payroll-related data through an intuitive self-service portal, making HR staff’s jobs simpler by decreasing paperwork burden.

Reporting and Analytics: Workday Payroll provides companies with real-time reporting and analytics of their payroll data so they can make intelligent decisions regarding payroll processes and budgets.

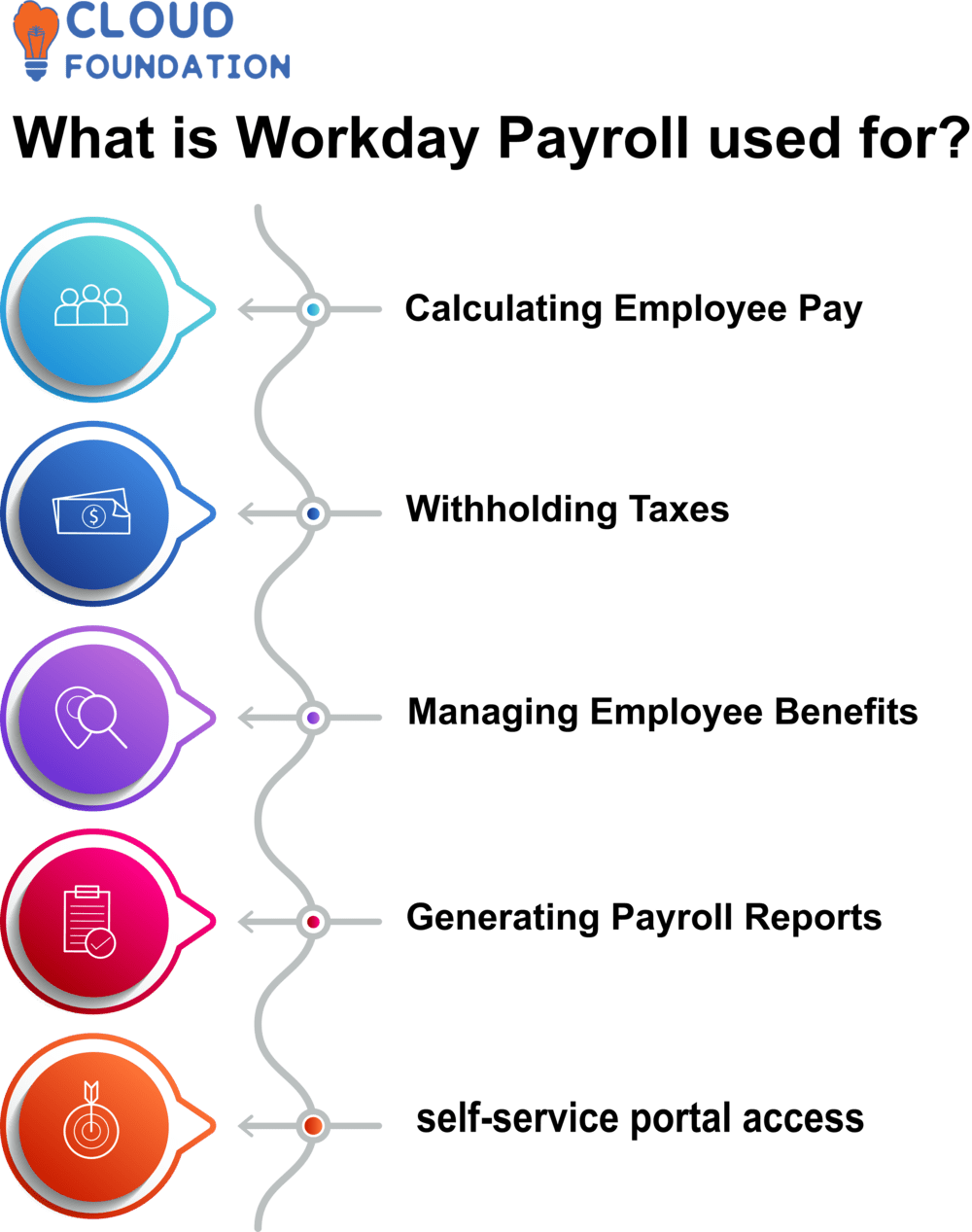

What does Workday Payroll do, and what is Workday Payroll used for?

Workday Payroll is an innovative cloud-based payroll management solution designed to automate and streamline payroll for companies of any size, automating and streamlining this essential function for them.

Utilised across numerous payroll-related operations (for instance: employee onboarding/off boarding).

Calculating Employee Pay: Workday Payroll allows businesses to calculate employee wages based on their specific pay system – salary, hourly wages and bonuses are among many possibilities.

Withholding Taxes:Workday Payroll’s withholding taxes feature quickly calculates and deducts federal, state and local taxes from employee paychecks automatically to comply with tax law regulations and ensure adherence.

Managing Employee Benefits:Workday Payroll’s Employee Benefit Management feature makes managing employee benefits, like health and retirement plans, simpler by deducting payments directly from paychecks.

Generating Payroll Reports: Workday Payroll generates payroll reports such as pay stubs, tax forms and payroll summaries that can be used for accounting, budgeting and tax reasons.

self-service portal access:Workday Payroll offers employees self-service portal access to pay stubs, tax forms and details related to payroll through its service platform.

In addition, Workday payments help ensure compliance with rules and laws surrounding fees such as wage-hour and tax laws.

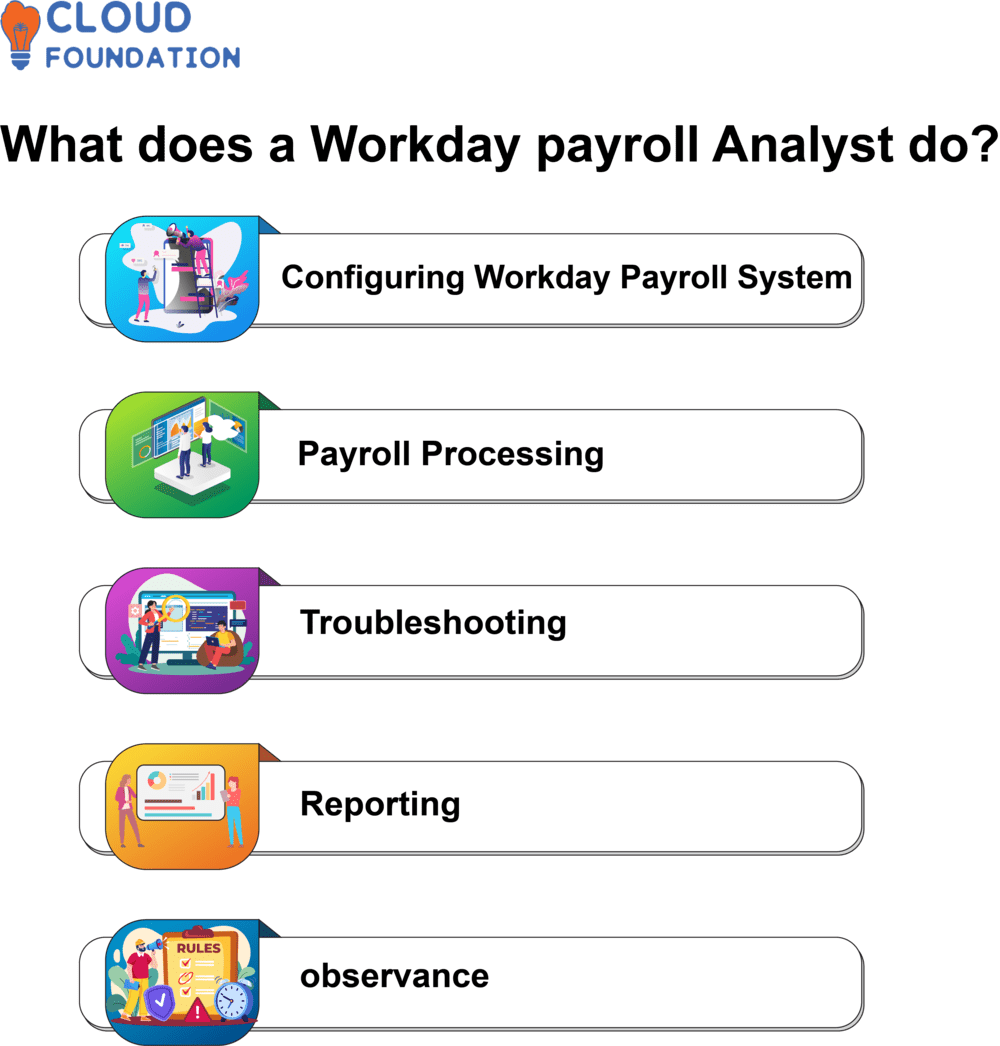

What does a Workday payroll analyst do?

A Workday Payroll Analyst’s specific responsibilities depend on their organization’s size and requirements; these typically include:

Configuring Workday Payroll System: Workday Payroll Analysts are charged with configuring their organization’s Workday Payroll System to meet all its payroll needs, which could involve creating processes, calendars, earnings deductions and taxes as required by their business.

Payroll Processing: Workday Payroll Analysts are charged with regularly processing payroll for employees to ensure it adheres to any and all tax laws or regulations that may impact it.

Troubleshooting: Workday Payroll Analysts are charged with troubleshooting issues related to Workday Payroll systems, such as pay errors for employees or incorrect tax withholding amounts.

Reporting: Finally, Workday Payroll Analysts also produce accounting, budgeting and tax reports from Workday Payroll systems for accounting departments or agencies.

Observance: Workday Payroll Analysts ensure that an organization’s payroll processes to do fast for all relevant regulations and laws, such as wage-hour laws or taxes.

How does Workday Payroll Work?

Workday Payroll, a cloud-based system, simplifies payroll for companies of any size and connects seamlessly to other Workday apps (HR and time tracking) for an unified payroll experience.

Workday Payroll simplifies employee earnings and salaries calculations, payroll tax filing, compliance monitoringwith local and federal legislation and audit readiness with its user-friendly user interface and comprehensive reporting features.

Workday Payroll offers employees self-service options to obtain pay stubs, update personal information and manage direct deposit accounts – giving them more control of payroll data than ever before.

Why Workday Payroll, and what are the benefits of Workday Payroll?

Workday Payroll, a cloud-based payroll solution, simplifies payroll operations while cutting expenses and improving employee experiences.

Workday Payroll offers an intuitive user interface and real-time reporting to manage payroll efficiently and compliantly, along with top-grade security, scalability and compliance support. Furthermore, Workday Payroll integrates easily with other Workday applications like Human Capital Management and Financial Management for seamless operation and user convenience.

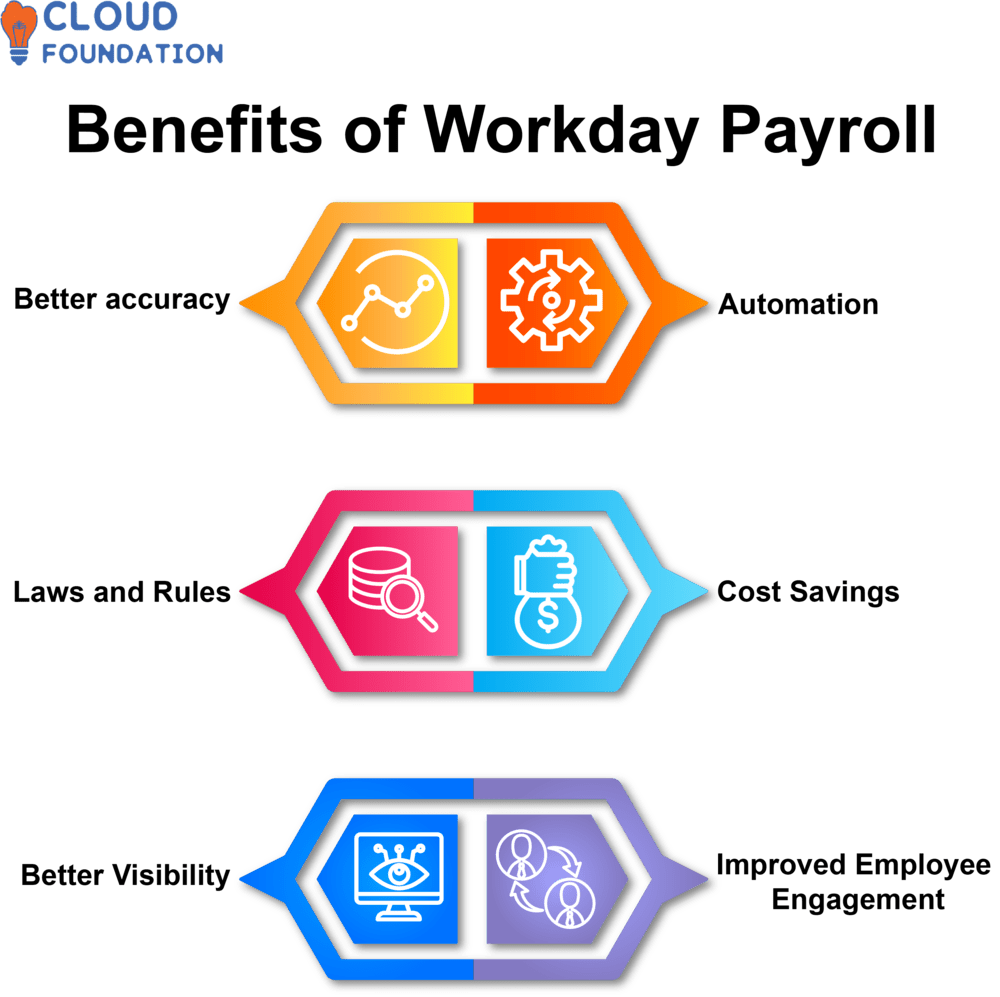

Here are the benefits of Workday payroll:

Better accuracy:Workday Payroll was developed to assist organizations in minimizing mistakes and increasing accuracy when conducting payroll operations, by simplifying operations for user.

Automation: Workday Payment automates many payment processes so people don’t need to enter data manually and errors become less likely.

Laws and Rules: Workday Payroll provides an effective means of upholding local laws and rules by tracking employees’ time and attendance, calculating taxes, and creating thorough reports.

Cost Savings: Workday Payroll’s cost-cutting capabilities allow businesses to save money on paper checks, postage costs and staff time associated with manual payroll processes.

Better Visibility: Having comprehensive reports and real-time analytics capability, Workday Payroll gives employers better insight into payroll data.

Improved Employee Engagement: Workday Payroll’s easy access and management of payroll data for workers, its streamlining processes makes employees happier with their jobs as it streamlines accessing payroll info more smoothly – thus increasing employee satisfaction with workday Payroll Reporting

Workday Payroll Reporting

Workday Payroll Reporting is an intuitive reporting solution designed for analyzing payroll data in Workday, an all-in-one cloud HR and payroll management solution. Users are able to generate real-time reports, inspect discrepancies in payroll processing and discover trends or patterns within data.

This tool assists HR and payroll personnel in recognizing potential problems, improving accuracy, and complying with labour laws and regulations. Furthermore, this application enables personnel to review employee salaries, compare budget data with performance measurements, as well as track staff attrition.

Workday Payroll Analyst

Workday Payroll Analysts oversee payroll for companies using Workday software. In doing so, they create and uphold relevant policies, methods, and procedures regarding employee payroll management.

An analyst must possess an in-depth knowledge of payroll taxes, deductions and related subjects; be knowledgeable with Workday; be adept in fixing problems; communicate well with personnel, executives and stakeholders alike. They must also possess organizational and problem-solving abilities for accurate payroll processing.

Advantages of Workday Payroll

Increased Efficiency: Workday Payroll’s primary purpose is to boost efficiency of payroll operations by offering an automated, streamlined design which eliminates manual tasks and shortening processing times, helping businesses save both time and money when processing payrolls. This system will ultimately lead to savings both time and money for them.

Enhanced Accuracy: Workday Payroll offers organizations peace of mind by guaranteeing payroll data is accurate and current. The system automatically updates data as entered, recording changes for auditing purposes ensuring accurate payroll data. This ensures an effective audit trail that keeps information current.

Improved Compliance: Workday Payroll provides organizations with enhanced compliance, helping them meet all applicable payroll laws and regulations while protecting from costly fines or audits.

Increased Visibility: Workday Payroll provides greater insight into an organization’s payroll processes, helping companies manage operations more effectively while gathering insights from payroll data.

Customizable Features: Workday Payroll offers customizable features tailored specifically to the requirements of an organization, which helps maximize both its payroll processes and its payroll system. This enables organizations to increase efficacy.

What is Workday Payroll software, and how to use Workday Payroll?

Workday Payroll streamlines payroll for businesses of any size by automating payroll, taxes, employee self-service portal and compliance reporting processes.

Installation and adaptation of Workday Payroll should meet your payroll needs. Create pay groups, schedules, earnings and deduction codes before adding employee data such as hours worked, compensation or bonuses into its database.

Workday Payroll’s self-service site gives employees access to pay stubs, direct deposit information and tax withholding settings; managers can review payroll checks, approve time off requests and monitor compliance using this system.

Workday simplifies payroll management while improving accuracy and efficiency for businesses of any kind.

How to process payroll in workday?

Payroll processing in Workday requires numerous steps:

The payroll process begins with employee data collection. This includes employee names, residences, personal details, work titles, salary, and benefits. After gathering employee data, compute salary. This entails calculating employee pay based on job title, salary, and other parameters.

Generating paychecks is the final step after computations. Employee paychecks should be printed or distributed promptly.

Finally, record all payroll transactions in Workday. Employee hours, wages, and benefits are tracked.

Why is Workday Payroll important for a business?

Workday Payroll provides many advantages to companies by simplifying and streamlining its payroll process. Automated payroll computations eliminate manual data entry while offering real-time visibility into expenditures for better financial control.

Additionally, this system streamlines employee data administration and Workday Payroll Processing Guide while offering powerful analytics to assist organizations in making smarter decisions.

Workday Payroll provides an integrated suite of payroll services, from time and attendance monitoring and benefits administration, tax filing and filing API integration with Workday to real time tax payment capabilities for both employees and employers alike.

Workday Payroll API

Workday Payroll API offers access to employee, salary, deduction and benefit data that businesses can use for payroll management processes like starting, stopping, amending runs of payroll runs. Automating payroll using this safe, flexible, and accessible API offers secure yet accessible automation of payroll runs

Workday Payroll modules

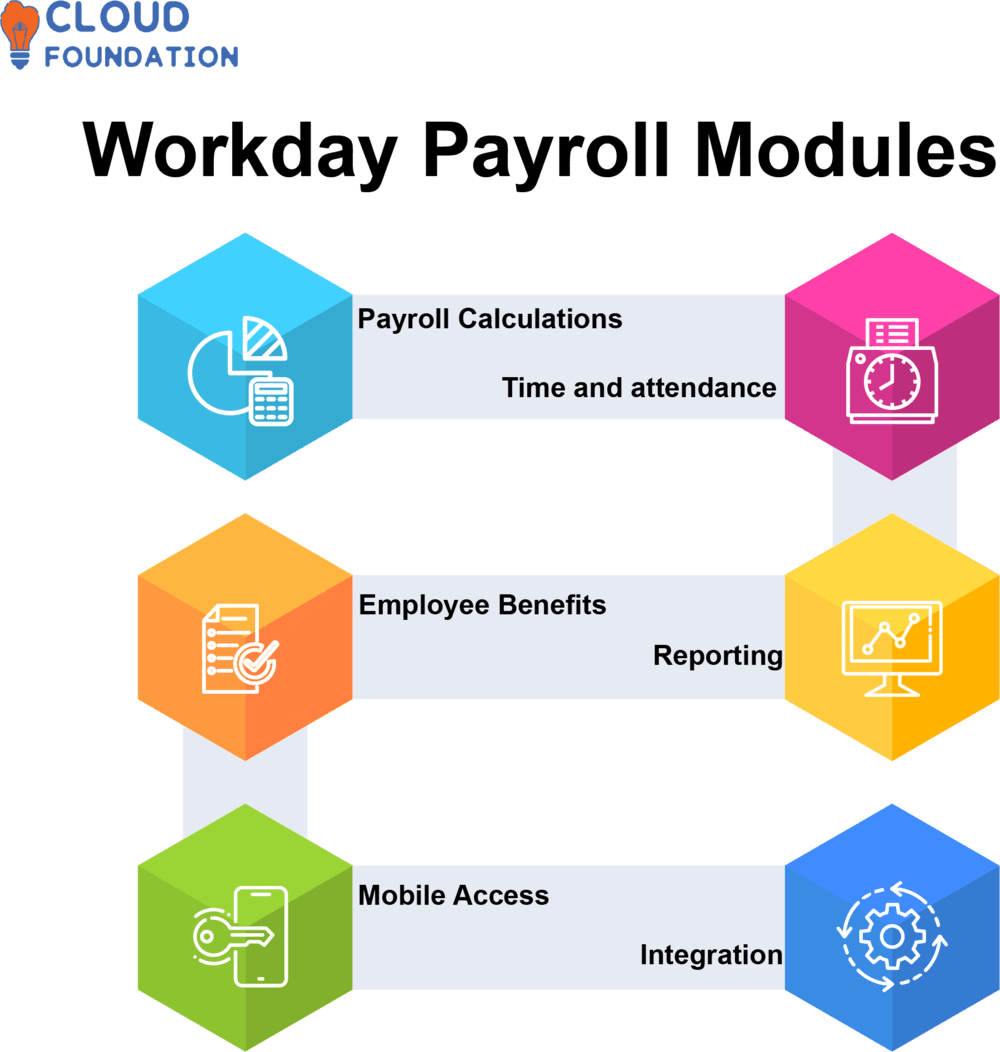

Here are some of the module’s most important features and capabilities:

Payroll Calculations: Workday Payroll’s automated payroll calculation capabilities, tax, benefits and deduction calculations can be completed automatically based on your organization’s payroll policies.

Time and attendance: Integrates seamlessly with Workday Time Tracking to enable accurate payroll calculation based on employee time and attendance data.

Employee Benefits: This gives administrators the ability to handle employee benefits, such as retirement and health insurance programmes.

Reporting: Workday Payroll’s reporting module offers real-time analytics and reports on payroll data such as payment receipts, tax statements and financial reports.

Mobile Access: Workday Payroll accessible on mobile devices allowing employees to review and administer payroll information anytime from any place at anytime.

Integration: Integrates seamlessly with other Workday modules such as HR, finance and benefits for an all-inclusive payroll and related administration solution.

What are the best ways to learn Workday Payroll?

Enroll and Learn HCM in CloudFoundation Online Workday Payroll Courses for an in-depth knowledge of this software’s fundamentals and effective use. These courses provide training on workday basics from professionals.

An exceptional training can provide detailed instructions for using Workday Payroll blogs as well as helpful strategies and recommendations to optimize its use.

Watching Workday payroll training videos is an effective way of learning the ropes of Workday Payroll software. They offer visual examples on how best to utilize its features and functions.

CloudFoundation can give you hands-on experience and allow for queries about Workday Payroll software, plus networking with professionals who use Workday Payroll.

Workday Payroll blogs provide valuable advice and useful hints for using this software, while informing their followers on all of its most recent updates and news.

Saniya

Author