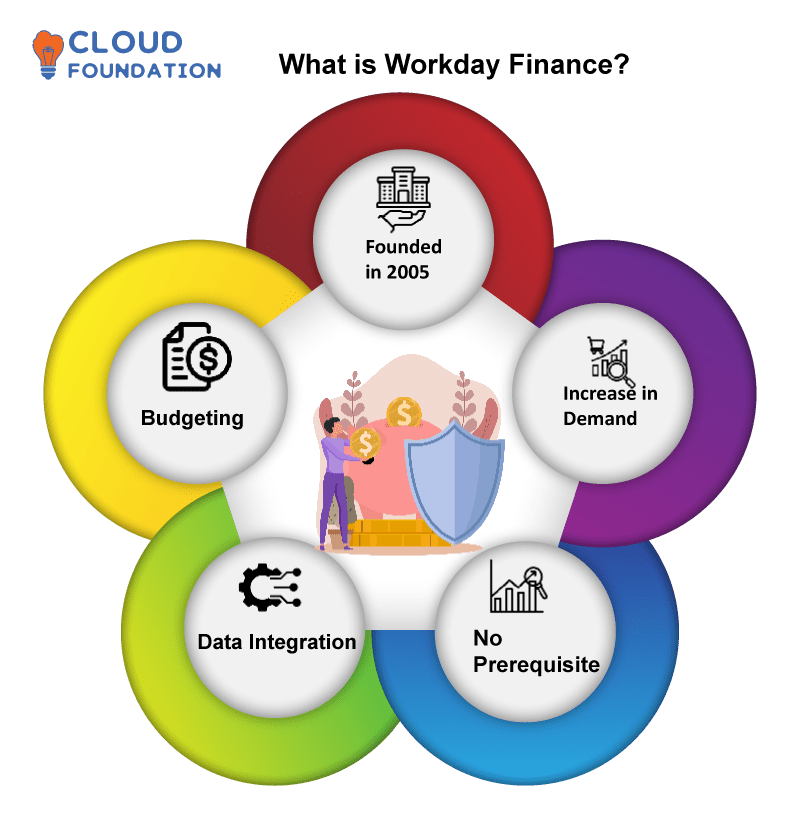

What is Workday Finance & Workday Financial Management?

I hope all is fine with you people. Even though I am aware that you may already be familiar with Workday Finance, let’s still take some time to learn about it in greater depth, including its features, advantages, and benefits and tools.

Overview, Introduction to Workday Finance

Workday Finance, an enterprise resource planning (ERP) solution available online, integrates financial and Human Capital Management(HCM). It assists business with their organization and financial administration needs by streamlining processes related to organisation and finance administration.

Revenue recognition encompasses reporting, planning and forecasting financial matters.

Workday is also a leading provider of Human Capital Management(HCM), helping companies better oversee employees from recruitment through retirement and beyond.

Workday provides an in-depth view of employees and the entire company through its centralised platform for human capital management and accounting.

Workday Finance is an innovative cloud-based financial and management system developed specifically to aid businesses in streamlining accounting and finance tasks within one system.

Workday Finance is part of Workday, an all-in-one financial and management solution tailored specifically for today’s Millennial workforce.

Workday Finance makes life simpler for businesses by equipping them with cutting-edge apps built for cloud technology, making accounting and financial responsibility much simpler for any operation.

Workday Finance offers businesses an effective solution for effectively overseeing the Financial Managementof their operations. Businesses may more efficiently track financial records with this financial solution in hand.

Assume full control of both billing and invoicing. They’re capable of monitoring spending habits and payment procedures as well as overseeing their own budgets.

Companies searching for an advanced financial management system will discover Workday Finance to be their ideal solution. Built around cloud computing technology and featuring access to cutting-edge apps, Workday Finance is an all-in-one financial management package with all these features and more!

Workday Finance definition OR Workday Finance definition

Workday Finance, a cloud-based corporate software solution, allows companies to enhance their financial processes and operations with its cloud technology.

Financial management information systems (FMISs) offer organizations a complete system for overseeing finances in an integrated, uniform fashion while simultaneously offering real-time insights and visibility across their organization.

Workday Finance features an assortment of financial features such as accounts payable/receivable management, General Ledger Functions, budgeting forecasting, and reporting capabilities.

As well as this, this system features automatic payment processing, audit trails and real-time Data Integration– among its many other capabilities. Users are able to gain access financial insights anytime from any device irrespective of location via its mobile capabilities.

Workday Finance was developed with one goal in mind helping businesses optimize their operational efficiencies and enhance financial processes more precisely.

Scalable and secure system designed to make it simple for businesses to adapt operations according to shifting market requirements.

Additionally, Workday Finance includes automated processes and compliance controls which ensure accuracy, consistency and compliance with regulations across your organisation.

What does Workday Finance do and what is Workday Finance used for?

Workday Finance is an innovative financial management system used to oversee company funds in the cloud. Also referred to as Workday, its main advantage lies in being hosted remotely on secure servers rather than being installed locally on company machines.

Workday Finance includes accounting, budgeting, forecasting, cash management, accounts receivable/payable management/reporting as well as advanced tools for analytics/auditing/compliance management.

Furthermore, Workday Finance may be combined with other Workday modules like Human Capital Management for seamless financial administration.

Budgeting, Forecasting, Ar/Ap Accounting, Cash Management, Auditing Compliance Reporting are just a few financial activities managed with Workday Finance.

Workday Finance allows businesses to automate repetitive tasks, reduce human error and boost productivity within their finance department.

With Workday Finance businesses have instant insight into their financial performance allowing for swift response time in response to changing market circumstances.

How does Workday Finance work?

Workday Finance is an online financial management solution which assists companies with streamlining and optimizing their financial operations.

Workday Finance also features reporting and analytics capabilities that give businesses more in-depth understanding of their financial condition.

Workday Finance may help organizations automate and optimize their financial processes, gain better insight into their data analysis capabilities, and gain better control of their money.

Workday Finance includes more complex capabilities like Budgeting, forecasting and cost analysis in its software package. It integrates seamlessly with several other Workday apps – like Human Capital Management – for an all-encompassing view of an organisation’s operations.

Workday Finance empowers organizations to more easily oversee global operations, comply with global accounting standards, and reduce expenses related to information technology expenses.

Why Workday Finance and what are the benefits of Workday Finance?

Budgeting, forecasting and reporting can all be automated with Workday Finance’s cloud finance and accounting solution.

Users gain a comprehensive view of their financial data which allows for improved decision-making and improved performance.

It integrates seamlessly with other Workday solutions for an improved experience as well as clear visibility into an organization’s finances to make sure resources are being maximized while making informed decisions that increase efficiency.

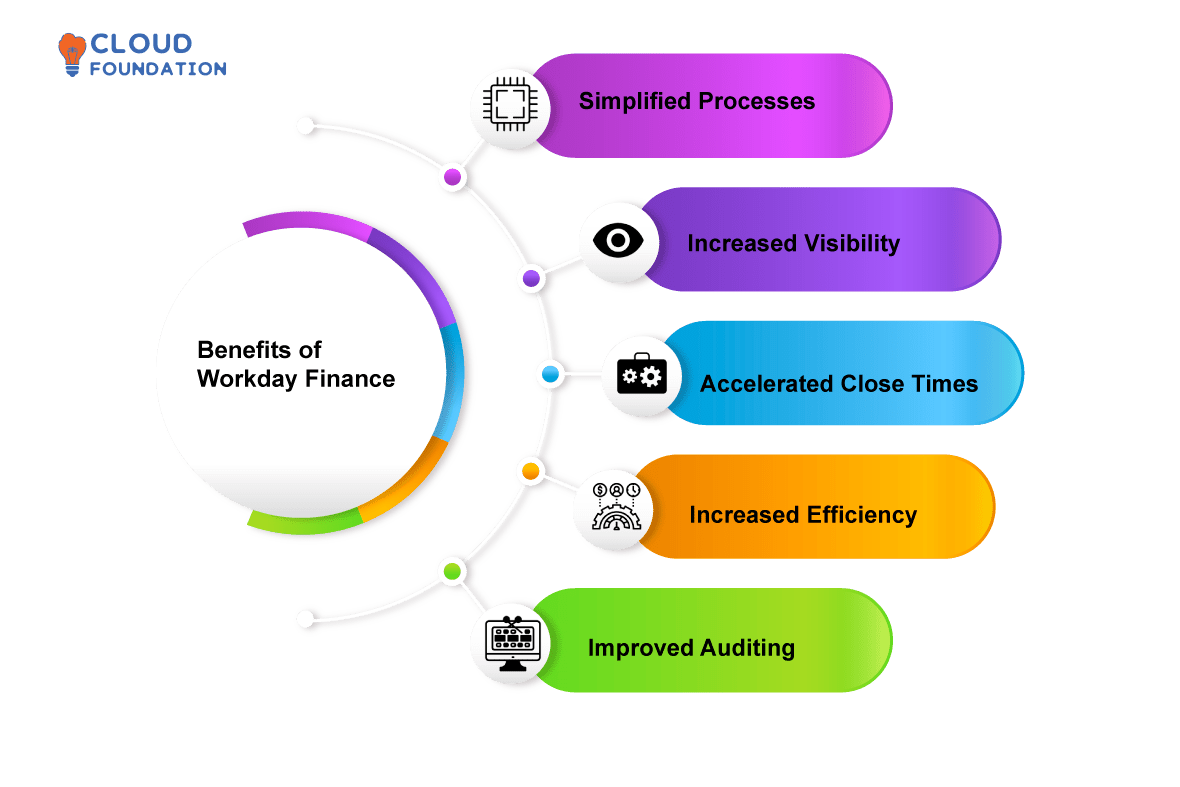

Benefits of Workday Finance

Simplified Processes: With its increased automation and streamlined processes, Workday Finance makes data entry less time consuming and reduces errors for more accurate, timely information that helps organizations make smarter decisions.

Increased Visibility: Workday Finance offers increased visibility of their financial data, helping organizations make more informed decisions and making their business operations run smoother and more efficiently.

Accelerated Close Times: With its efficient processes, Workday Finance helps organizations meet reporting deadlines more easily.

Increased Efficiency: Workday Finance helps organizations be more cost-efficient with their resources by decreasing time and money spent on manual processes, thus increasing efficiency with resources.

Improved Auditing: Workday Finance offers powerful auditing tools that ensure data accuracy and compliance with regulations.

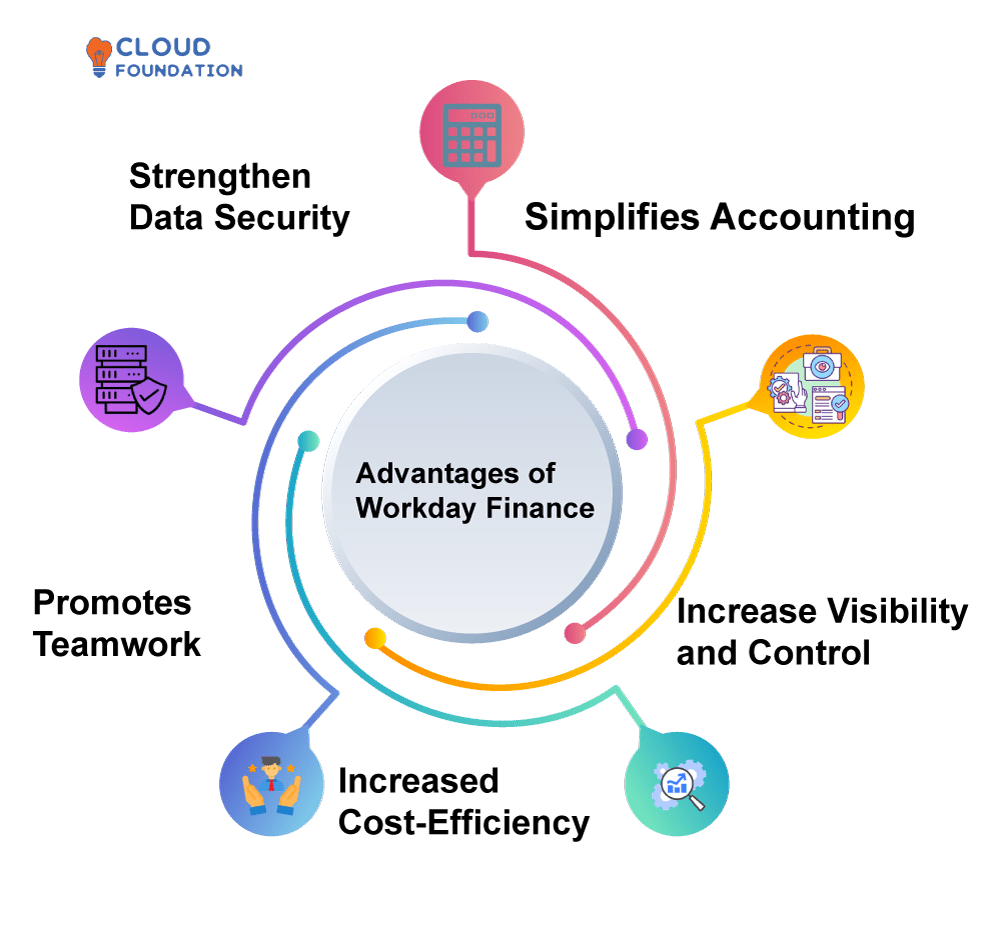

Advantages of Workday Finance

Simplifies Accounting: Workday Finance provides firms with simplified accounting procedures, making financial reporting, planning and forecasting, accounts payable/receivable operations more quickly and accurately – decreasing errors caused by manual labour in turn improving accuracy and decreasing errors that arise as a result of manual processes.

Increase Visibility and Control: Workday Finance provides businesses with a clearer view of their finances, helping them make informed decisions and take corrective action when necessary. Furthermore, Workday Finance strengthens internal controls by making it simpler to identify potential hazards quickly and manage them as soon as they arise.

Increased Cost-Efficiency: Workday Finance’s automation and streamlining features make for time and cost savings for businesses, as they gain the chance to refocus more resources into other areas.

Promotes Teamwork: Workday Finance contains several features designed to foster better teamwork and collaboration between members of an organisation, making sure everyone stays on the same page quickly while information can be easily accessed and distributed promptly.

This feature helps ensure everyone remains aligned and that information can be delivered efficiently across teams.

Strengthen Data Security and Prevent Unauthorized Access: Workday Finance’s state-of-the-art security features provide enhanced data protection while stopping illegal access, making more likely that sensitive financial information remains safe and private.

What are the Workday Finance Modules and how to use Workday Financials Modules

Let’s get deep understanding of Workday Finance Modules List

Accounts Payable

Asset Management

Grants Management

Tax Management

Reimbursement

General Ledger

Procurement

Financial Reporting

Budgeting

Cash Management

Workday Finance is an online financial management solution provided in the cloud that assists businesses in streamlining their financial operations and procedures. The main aim is to simplify budgeting, financial reporting, accounts payable/receivable/cash management/procurement procedures while being adaptable, secure, user friendly to maximize overall financial performance and visibility within organizations.

How To Use Workday Finance?

Log into Workday by inputting your username and password. For this step, visit the login page on Workday’s website and fill out your information there.

Navigating to Finance Module Once logged into, navigate directly to it via its menu on the left.

Explore Your Financial Reports: Within the workday financials modules, you have access to various financial reports including General Ledger, Accounts Payable and Receivable statements.

Develop and Administer Budgets Leverage the Budgeting tool in order to create and administer budgets for your organization.

Manage Expenses: With this module, you are able to keep tabs on employee expenses while managing and authorizing them for approval.

Manage Resources: With this workday financials modules titled Resources, you are given the power to manage resources across your entire organization while tracking associated costs.

Conduct an Analysis on Your Data Use the analytics tools to run analyses on your data, create reports and gain insight into its financial performance of your firm.

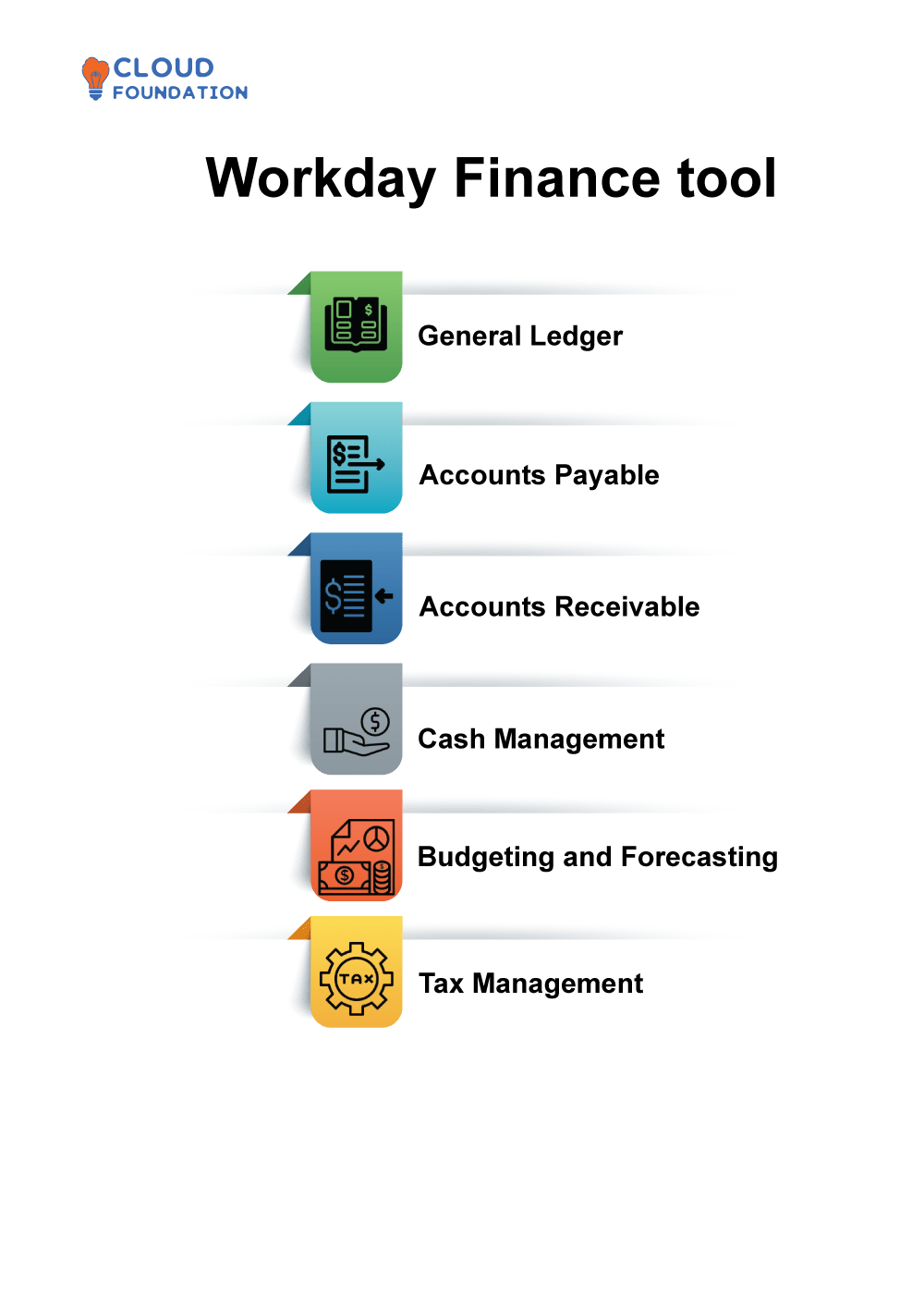

Workday Finance tool

General Ledger: Users can keep accurate financial records using this instrument, providing full visibility into data. Furthermore, this assists budget planning and forecasting while upholding accounting standards.

Accounts Payable: With Accounts Payable, users have the power to manage payments to vendors, record invoice data and monitor payment status – simplifying payment procedures while saving both time and money in the process.

Accounts Receivable: With this tool, users are able to more efficiently handle customer invoices and payments as well as track credit/debit balances more closely – also creating detailed customer reports using this software tool.

Cash Management: This app gives users the power to monitor real-time their cash flows and increase liquidity, as well as manage bank accounts, investments and transfers money between accounts seamlessly.

Budgeting and Forecasting: This application guides users through the steps necessary for creating, monitoring, and altering budgets as well as projecting future financial performance. Users may monitor expenditure in order to reach desired financial outcomes.

Tax Management: This app assists users in keeping on top of their tax responsibilities such as filing tax returns and making payments, while staying compliant with ever-evolving laws and regulations regarding their finances.

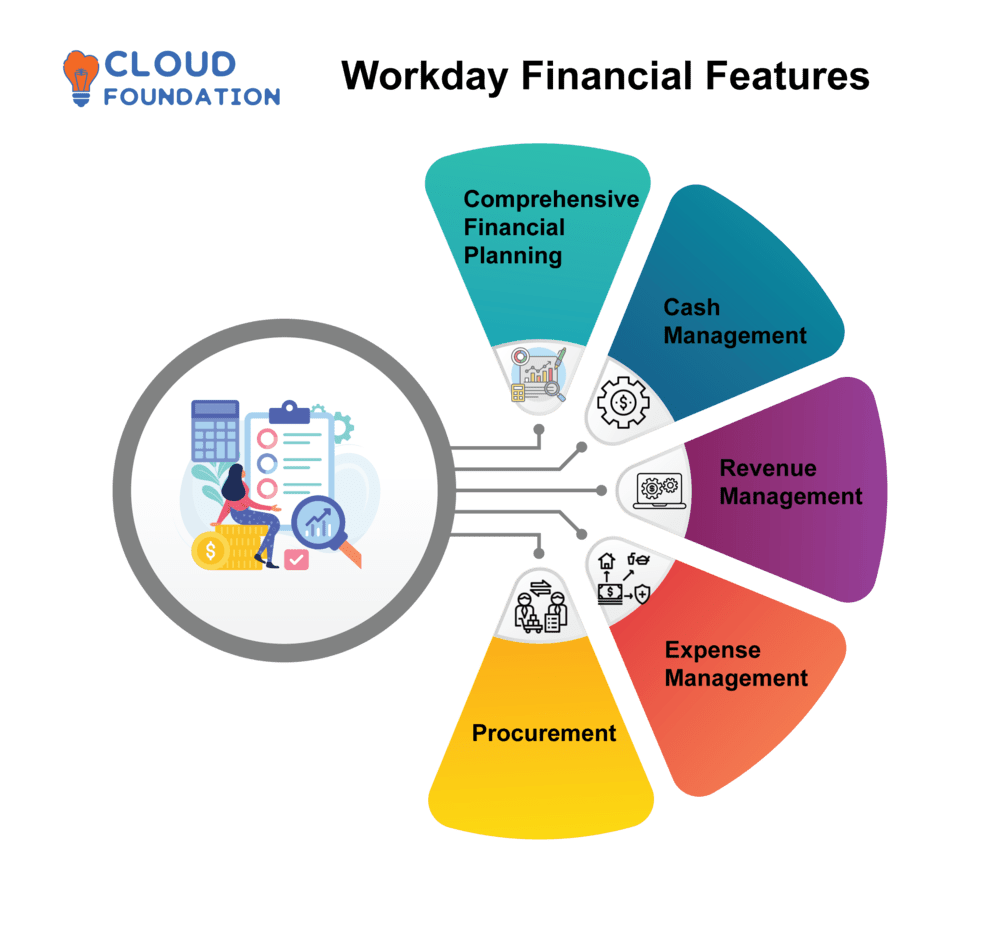

Workday Financial Features or Workday Financial Modules

Comprehensive Financial Planning: Workday Financial Planning provides its clients with an all-encompassing collection of applications to aid in every facet of financial planning, from budgeting and forecasting through reporting capabilities. An all-in-one view is offered via its capabilities for budgeting, forecasting, and reporting capabilities.

Cash Management: Workday Cash Management allows businesses to better control their cash flows, optimize balances and provide more accurate forecasts of upcoming cash needs. In addition, its tools help manage banking relationships, track investments and automate cash management procedures for optimal efficiency.

Revenue Management: Revenue Management provides businesses with an effective solution for effectively overseeing multiple revenue streams as well as related customer contracts and relationships. From one central location, information regarding customers’ relationships, billing histories and contracts may all be easily seen together.

Expense Management: Workday’s Expense Management helps businesses run more effectively by more closely overseeing spending. It offers a centralized view of expenses data as well as tools designed to facilitate cost management activities more easily and automatically.

Procurement: Workday Procurement provides businesses with a centralized view into the organization’s procure-to-pay processes. It features capabilities to aid supplier relationship management while improving purchasing and billing procedures.

What are the best ways to learn Workday Finance?

Enroll in online courses: For in-depth instruction on any aspect of Workday Finance, there is a selection of online courses tailored for users at different skill levels – each providing step-by-step directions on how best to utilize this particular software program being taught during its duration.

Earning a Certification: Earning a certification in Workday Finance can help demonstrate that you possess the necessary knowledge, and to show prospective employers your value as an employee.

It illustrates not only a solid grasp of its use but also how effectively implemented into professional environments.

Participate in Conferences There are an abundance of Workday Finance-oriented conferences and workshops, providing excellent opportunities to gain new knowledge from industry professionals as well as to network with fellow users.

Read Books There are various books and courses available both offline and online that provide in-depth knowledge about Workday Finance software, making reading one an ideal way of familiarizing oneself with its features and functionalities.

Seek help: If there’s anything about Workday Finance that you are having difficulty grasping, seeking assistance from more seasoned users or the support team could prove extremely valuable in making sure you make use of what has been purchased by maximising its capabilities.

Shreshtha

Author

Life is a long lesson in humility – Life is either a daring adventure or nothing at all.