What is SAP FICO and What is SAP FICO Modules?

In this blog, you’ll gain an understanding of SAP Fico and its many features and benefits.

Overview: Introduction to SAP Fico: What is it?

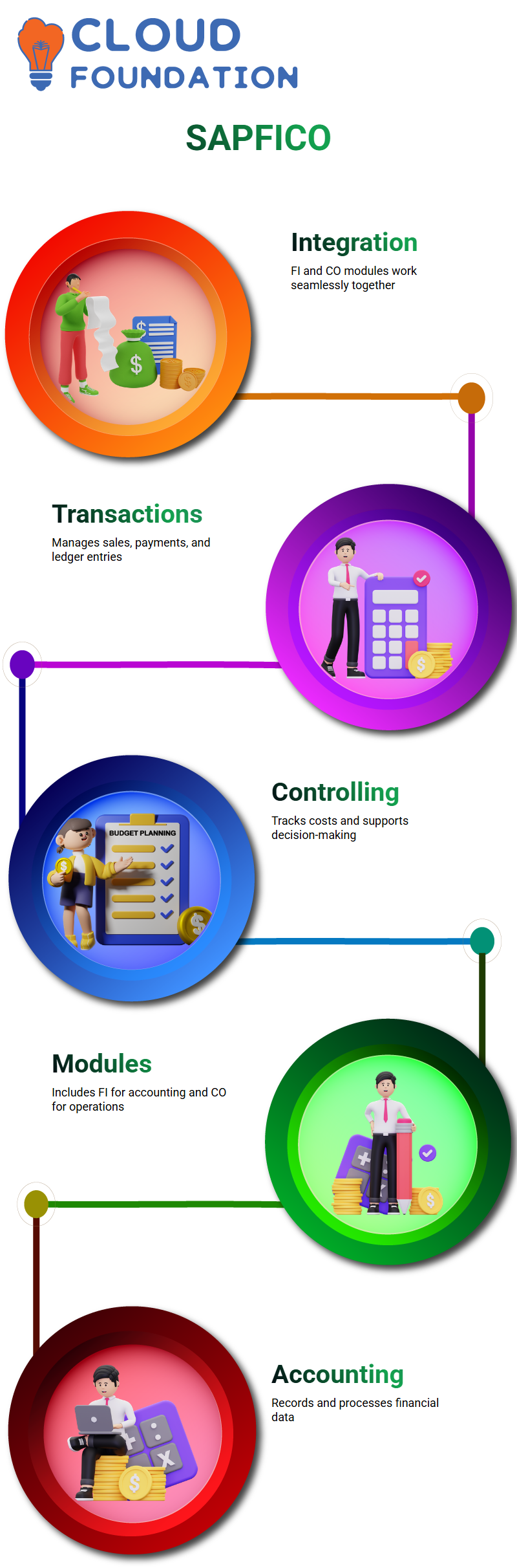

Each part has a specific function and role within it, plus there’s tight integration between SAP FI and CO.

SAP FICO allows businesses to manage all financial transactions, such as sales orders, customer orders, payments and general ledger entries.

SAP CO works together with the Controlling (CO) module to manage financial aspects, and Human Resources (HR) module for employee tracking. Companies may utilize SAP CO to maintain control over their cost accounting information.

SAP CO helps companies monitor expenses and generate reports that can be utilized for research. Furthermore, SAP CO has excellent integration with other SAP modules, particularly SAP SD.

SAP FICO, a powerful business management solution, makes managing a company’s finances and day-to-day operations a breeze.

With SAP FICO, businesses gain the capacity to make informed decisions that can significantly enhance their operations.

SAP FICO is a comprehensive financial management solution, giving businesses the power to effectively manage both their financial and operational activities.

Definition of SAP Fico

SAP FICO stands for Financial Accounting and Controlling. It is a business management software used to monitor the financial and operational activities of an organization, as well as store its data securely.

SAP FICO module serves as a financial accounting tool, aiding organizations in managing their accounting processes.

Included within SAP ERP, SAP FICO is available and ideal for archiving sensitive company data such as payroll and accounting records.

You may wish to break this function down into its two components–SAP FI (Financial Accounting) and SAP CO (Controlling)–to better comprehend its purpose (control).

SAP Financial Accounting and Controlling (SAP FI and SAP CO) can be implemented as standalone modules or part of an ERP system to store financial data.

SAP FI is responsible for implementing the General Ledger, Accounts Payable/ Receiving, Bank Accounting and Asset Accounting modules.

SAP CO is in charge of implementing Sales & Distribution, Production Planning, Material Management, Cost Accounting and Quality Management modules within SAP.

Accounting serves as the foundation of all financial records and reports produced by a business. It assists with keeping tabs on finances and filing necessary reports. Furthermore, accounting helps oversee money management and machinery within an enterprise; ultimately enabling owners to run their company more efficiently.

Its primary function is to record and process financial transactions for a business. In other words, it manages the recording and processing of that company’s transactions. Other responsibilities include maintaining cash on hand across various accounts in the business.

These departments include Sales and Distribution, Production Planning, Material Management, Cost Accounting, and Quality Assurance. Any financial dealings of a company should be recorded there.

What does SAP Fico do and What can it be used for?

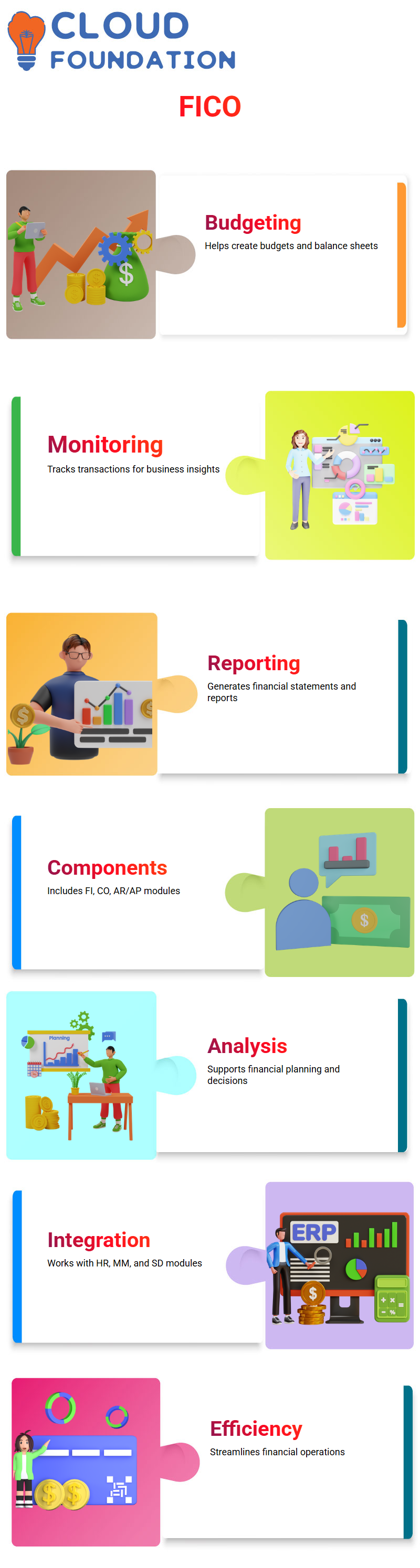

With SAP FI, companies can easily manage their financial data to produce budgets and balance sheets. With SAP FI, companies’ transactions may be efficiently monitored, giving the resulting information the insight, it needs to make informed business decisions.

Both Controlling (CO) and Accounts Receivable and Payable (AR/AP) modules are subparts of SAP’s Financial Accounting and Reporting module.

Instead of relying solely on SAP FI to create financial statements, businesses may choose to utilize SAP CO instead.

SAP Financial Accounting, Controlling, and Accounts Receivable and Payable are three primary components of SAP Financials (FI). Together they offer an efficient way for companies to manage their money and streamline financial operations.

SAP FI is used for financial data storage and statement generation, while SAP CO is utilized for real-time statement production.

Financial analysis, planning, and decision-making are other areas where SAP FI can be beneficial.

The FICO is an invaluable asset that can be employed to provide comprehensive financial reporting for an organization.

Financial transactions within an organization can be managed using SAP modules such as Material Management, Sales & Distribution and Human Resources to get a comprehensive overview of the organization’s financial position.

How Does SAP Fico Function?

SAP FICO allows companies to store and manage both financial and management accounting data, enabling them to produce reliable financial statements for use in making strategic decisions.

SAP FICO gives business leaders comprehensive insight into their organization’s current and historical financial performance, giving them the power to plan for the company’s future.

Why Use SAP Fico and What are its Advantages?

SAP FICO simplifies creating comprehensive financial reports for any study, making it ideal for businesses that prioritize their financial health. As an integral component of SAP ERP’s Central Component, Sap FICO offers unparalleled versatility.

What Are the Advantages of Utilizing SAP Fico?

SAP Fico promises numerous advantages.

SAP FICO provides numerous advantages. Here are a few:

Reduced time-to-market. With SAP FICO, it is possible to speed up the production of reports by streamlining processes and creating them instantly.

Faster decision-making. SAP FICO allows for the quick creation of reports to assist with quick decision-making.

Reduction in errors. With consistency across all business transaction systems, there is no chance for mistakes.

Cost reduction potential. Saving money with SAP FICO is now even easier thanks to its cost saving features.

Centralized Data. SAP FICO allows for centralized data management, making it easier to manage all information effectively.

Greater Stability. Having more stability with SAP FICO makes the business more profitable overall.

SAP Global Trade Services Training

SAP Fico

Offering Improved Financial Control: SAP FICO provides organizations with an advanced financial control system, enabling them to maintain accurate and up-to-date records on their finances.

Simplified Reporting: SAP FICO makes reporting easier by providing a centralized location for all pertinent data. As a result, compiling financial reports that are timely, accurate and comprehensive has never been simpler.

Automated Productivity: SAP FICO’s automation of repetitive processes and simplified workflows leads to productivity gains, making it simpler for companies to handle vast amounts of data with fewer mistakes due to human intervention. This not only reduces errors caused by human error but also simplifies data handling overall.

Cost Reductions: SAP FICO reduces the need for organizations to perform manual interventions, helping these businesses save on labor costs. Furthermore, it eliminates the requirement for multiple software systems, leading to significant cost savings across various departments.

Risk-Free Environment: SAP FICO creates an entirely risk-free environment for the administration of financial information, which plays a major role in providing increased data security measures the firm offers.

What is Sap Fico Software and How to Use It?

SAP FICO is used to manage all financial transactions, record them and create financial statements for reporting.

It stores financial data, produces financial statements and plans future business scenarios.

SAP Fico (System Accounting Function), CO (Process Operationalness), and M (Management Module). Offering financial consolidation and helping companies assess their position financially, this module offers effective tools for management of a company’s operations in the financial realm.

An ideal example is SAP FICO – its FICO module providing effective assistance with financial aspects management.

Financial operations refer to all activities within a company’s organization, such as cost accounting, revenue management, managing, and any other related financial activities that may be undertaken.

It can be used to manage the company’s financial transactions, document them, and produce the company’s financial statements so that further analysis may be conducted.

SAP Fico tool has applications in a wide range of fields, such as manufacturing, retail, real estate, healthcare and technology.

Controlling (CO) and Financial Accounting (FA) in SAP are often seen as two essential components (FI).

It also acts as an internal audit tool with great precision.

It is an adaptable system that can be employed for many business challenges.

It makes managing financial transactions and analyzing financial data incredibly simple with its use. Furthermore, this platform is highly adaptable and can be tailored to fit the exact requirements of an organization.

It is fully compatible with various SAP applications, such as SAP Material Management, Sales & Distribution, Controlling and more.

In doing so, the organization gains a centralized data management system which also helps meet their business needs.

If you plan to utilize SAP FICO, then it is essential that you are aware of its various components and how they can be applied in real-world scenarios. After these sections, you should have a much better understanding of SAP FICO and its many uses.

SAP Global Trade Services Online Training

What Is SAP Fico Module?

Modules of SAP Fico

Organization of SAP Financial Information can be achieved using modules, which are specialized SAP programs that perform certain functions.

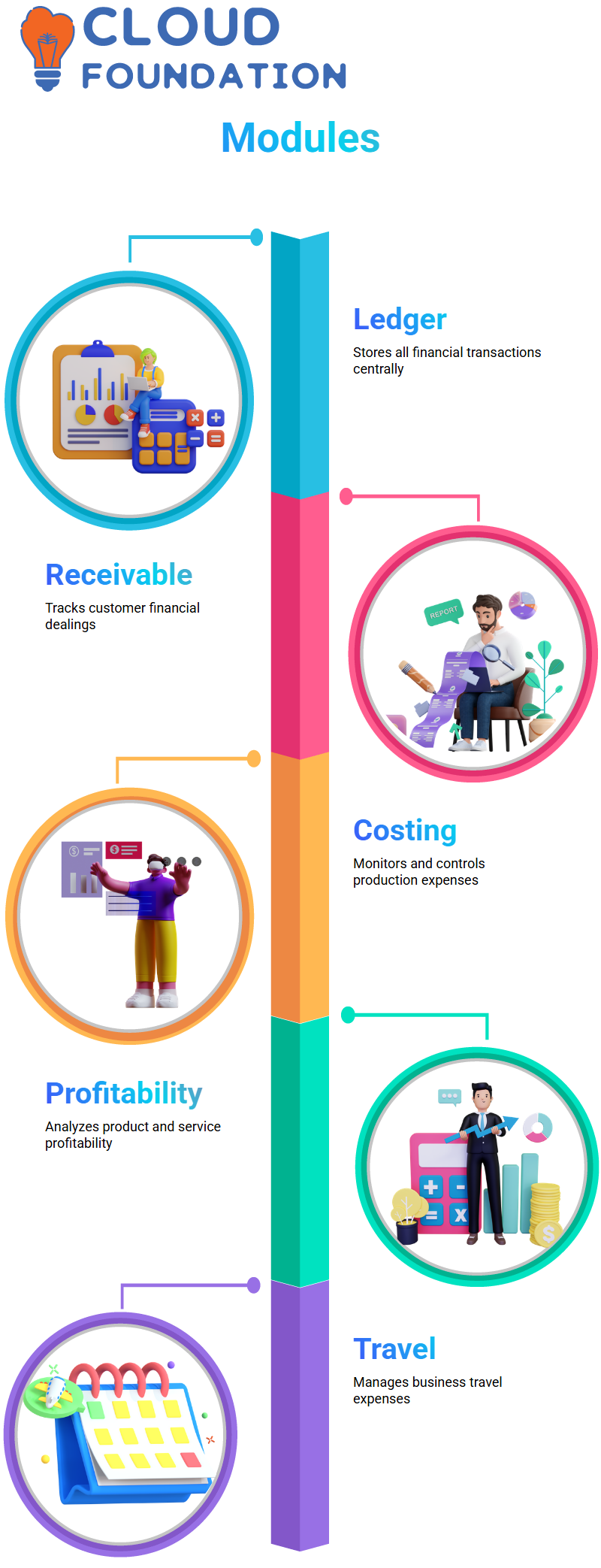

SAP FI submodules include:

General Ledger Accounting – This central database stores all financial transactions conducted by your firm.

Accounts Receivable -Your company’s entire history of financial dealings are recorded and kept conveniently with this feature.

Accounts Payable -Accounts payable oversees any business operations with suppliers for your company.

Bank Accounting – It oversees all financial transactions between a company and its various partners.

Asset Travel Management – Manages all costs associated with trips taken by the business.

Parallel Accounting – Manages a company’s financial reporting and tax filing needs.

Consolidation – Compiles all the separate financial reports generated by various divisions within an organization.

Funds Management -This function is accountable for overseeing and managing all internal financial accounts within the organization.

Special Purpose Ledger – Special purpose ledgers are ledgers used solely for a particular purpose; it’s the bookkeeper’s responsibility to monitor transactions within them.

Specialties – Manages all the company’s specialties.

SAP CO modules enable organizations to record both financial and non-financial activities. SAP CO provides support in the preparation of financial statements as well as other analyses.

Two major SAP CO modules are Chart of Accounts and Financial Accounting.

Other important modules include Cost Accounting, Profitability Analysis, Product Costing, Internal Orders, and Travel Management. Let’s take a closer look at each one individually.

Chart of Accounts (COA) – The COA module is responsible for managing the accounts for an organization.

Accounting terms refer to “accounts,” which are records of individual transactions like purchases and sales made. These records are stored in a general ledger within the business.

SAP CO provides the Chart of Accounts feature, enabling you to generate trial balances and produce financial statements such as Profit & Loss statements and Balance sheets.

Cost Accounting – The Cost Accounting module is used to monitor production costs for an organization.

Costs are recorded in cost centers, which represent various cost centers within an organization such as Sales, Production, Marketing and Distribution.

SAP CO allows you to generate cost sheets, which detail production costs. It also produces cost statements like Cost of Goods Sold (COGS) and Profit & Loss statements.

Profitability Analysis -The Profitability Analysis module allows for the evaluation of either the manufacturing or sales profitability for a product or service.

Profitability Analysis will provide you with insightful data on the profitability of goods or services offered by a firm.

With this knowledge, you can make informed decisions regarding pricing, sales, and product development.

Product Costing -Organizational production costs can be controlled and monitored with the Product Costing module. Cost elements represent different cost components within an organization, such as Materials, Direct Labour, and Overhead.

With SAP CO, you can generate cost sheets that detail production expenses; additionally, the module generates statements such as Cost of Goods Sold (COGS) and Profit & Loss accounts.

Internal Orders – Organizations can manage internal orders with the Internal Orders module of SAP CO.

This helps manage costs associated with services provided by the organization and generate cost sheets for internal orders that provide details of expenses associated with those orders.

Travel Management: Travel management is responsible for keeping track of an organization’s expenses, both business and personal.

In SAP CO, you can generate travel reports that detail all expenses related to traveling.

What are the Best Ways to Learn SAP Fico?

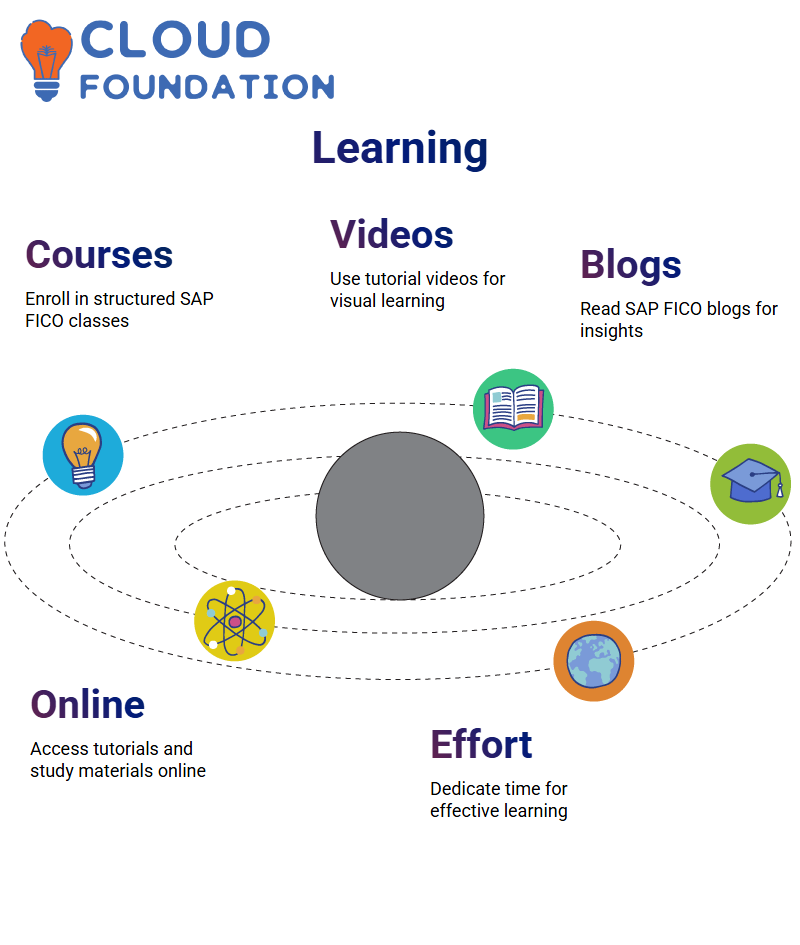

To maximize your efficiency on this platform, it’s essential that you learn everything possible about it and stay current on SAP Fico developments. The most effective way to learn Sap Fico Tutorial Video is either enroll in a class or purchase some high-quality training videos.

SAP Fico blogs are one of many online resources that could be beneficial in learning more about this system.

CloudFoundation’s training courses will ensure you maximize the power of your projects with SAP Fico.

SAP Fico Online Tutorial

If you are dedicating the necessary effort and time to studying for the exam, this is an invaluable resource.

SAP FICO Course Price

Shreshtha

Author