What is Workday Revenue ?

Welcome to Our Weblog! What Is Workday Revenue will provide an in-depth breakdown of Workday Revenue’s features and capabilities as well as how to begin using them.

Overview and Introduction of Workday Revenue?

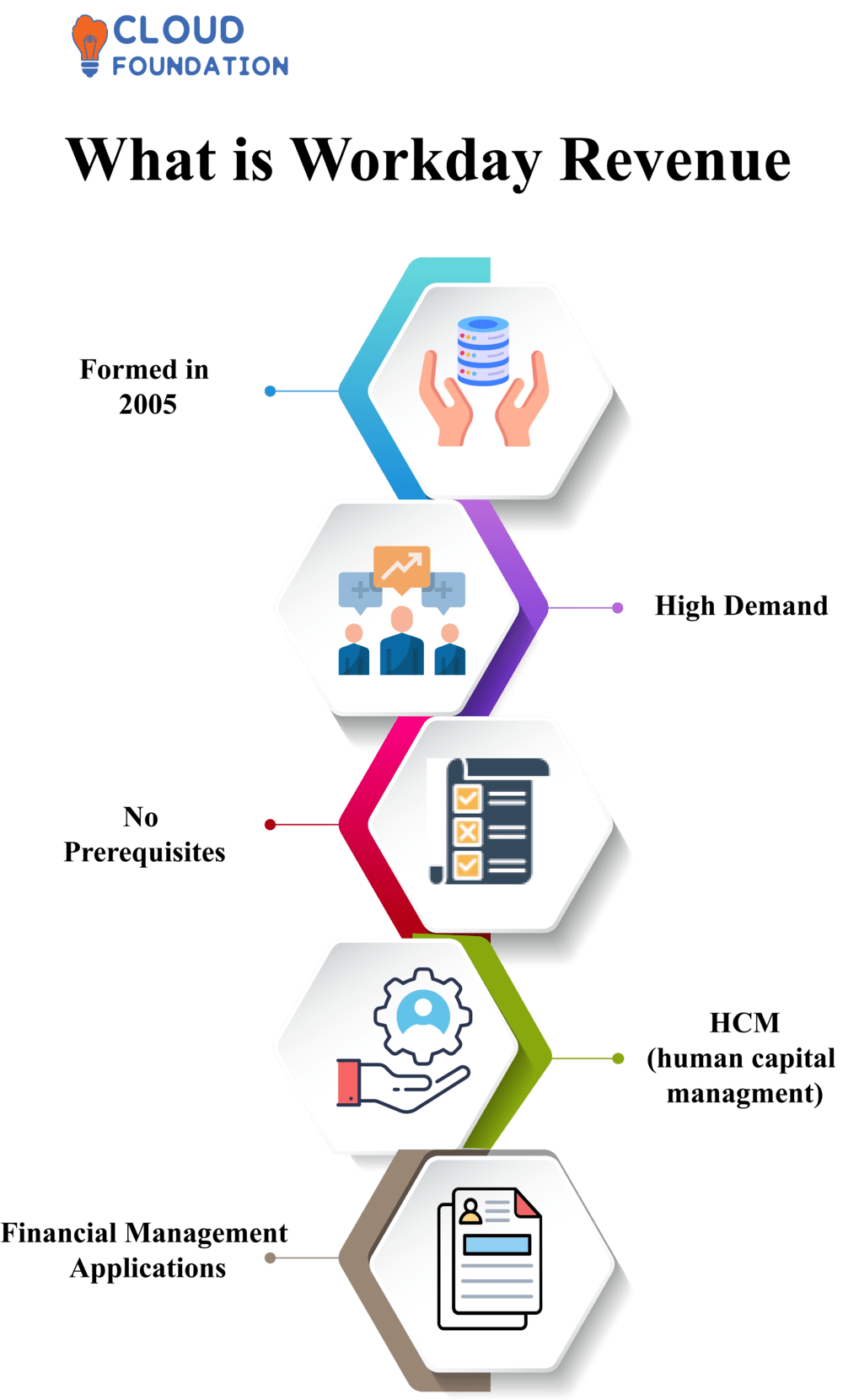

Workday Revenue is a cloud-based financial management application designed to simplify business finances.

The program streamlines financial operations while expanding financial insight.

Workday Revenue includes accounting, budgeting and forecasting functionality along with cash flow/treasury management capabilities as well as human capital management/payroll/benefits administration/project accounting functionality and more – simplifying financial management for organisations of any size!

Finance teams rely on accounting-focused Workday Revenue for tracking and reporting revenue in real time, streamlining revenue recognition and financial closing with its intuitive user interface, while making revenue performance analytics simple for teams to view.

Workday Revenue helps teams quickly identify trends, opportunities and recognition requirements as they pertain to revenue tracking & reporting requirements – while saving them valuable time from manually inputting data for analysis or report creation.

What Is Workday Revenue?

Workday Revenue Management is a cloud-based enterprise resource planning (ERP) system designed to assist organizations in effectively managing their revenue processes.

It features revenue recognition, billing analytics, recurring revenue management and forecasting; as well as providing customer invoice management with automated processes for revenue recognition/billing as well as automated processes for tracking/reporting revenue.

Furthermore, Workday provides integrated tools which assist organizations accurately recognize revenues while streamlining billing procedures efficiently in managing customer relationships more effectively.

Workday Revenue Module is an innovative financial software system that empowers businesses to efficiently manage their revenue and expense cycles.

Users are able to monitor revenue recognition processes, automate revenue recognition rules and calculations, as well as produce financial reports with ease. Furthermore, Workday also features tools for forecasting, budgeting and tracking performance against plans.

Workday revenue includes both operational and non-operational business revenue sources; sales of goods and services provide operational revenue while investments and deposit interest account for non-operational revenue streams.

Financial experts use revenue figures to analyse

Workday Revenue Definition or Define Workday Revenue?

Workday Revenue provides automated revenue finance. Track sales, billings and revenue with this module to stay informed. Automate collection, analysis and reporting on revenue. Analyse client behaviour to enhance strategic decisions while increasing revenues with this automated revenue solution.

Workday Revenue manages client contracts and money streams accurately while accurately reporting revenue. Furthermore, integrated financial reporting and analytics optimize revenue sources so companies can improve revenue projections and judgements with this valuable insight.

Revenue transactions are calculated, analysed, and reported using Workday Revenue’s module, providing users with visibility of revenue information and company finances as well as advanced reporting functions that help improve business decisions.

What does workday revenue do and what is workday revenue used for?

Workday utilizes income for operations, research, product and service development as well as purchases and dividends.

Utilising revenue-based funding sources allows Workday to cover its salaries, overhead, R&D expenditure, marketing expenditure and software upgrades while opening new markets or funding new technology acquisition.

Workday revenue covers business expenses such as salaries and overhead expenses, it may also be used for purchasing equipment or entering new markets or supporting projects or paying dividends.

Workday Revenue automates revenue recognition for enterprises, with this tool, companies can track revenue under US GAAP, IFRS and others with ease, creating rules, planning estimated processes, managing customer contracts and creating reports with this module for better financial visibility and speedy billing cycles management.

How does workday revenue work ?

Workday Revenue provides order to cash tracking.

It accurately bills orders while automating revenue recognition, analysis and accurate revenue reports. Furthermore, Workday Revenue monitors customer payments, accounts receivable and revenue collection while EFM incorporates this tool.

Workday Revenue Management connects sales and billing.

Organizations can easily manage prospecting, sales orders, invoices, revenue recognition and reporting with one source of income – making financial statement creation much simpler.

Client data, contracts, revenue recognition and invoicing can all be managed centrally with this solution.

Real-time revenue information makes forecasting more accurate as well as decision making more swift.

Eventually this also contributes to improved strategic planning with accurate revenue predictions.

Workday Revenue Management analyses and reports performance. Trend detection and improvement become easier while keeping tabs on system changes with detailed audit trails.

Why Workday Revenue and what are the benefits of Workday Revenue?

Workday Revenue provides investors with a financial overview of an organization.

It reveals revenue generation figures which can be compared with similar businesses operating within an industry and also forecast growth and profits of any given firm.

The module helps uncover revenue possibilities and risks as well as managing according to GAAP reporting standards and other reporting guidelines.

Workday Revenue offers cloud-based revenue process management capabilities.

It displays revenue pipelines, client contracts and revenue recognition processes; compliance operations may be automated for improved visibility, efficiency and accuracy.

Benefits of workday revenue are:

Increased Visibility: Workday Revenue provides enterprises with real-time financial visibility that facilitates quicker decision-making and accurate forecasting.

Efficiency: Automated processes and data integration facilitate speedy billing, payment and collection processes that enhance productivity and profit potential.

Simplified Planning: Workday Revenue simplifies sales, pricing and promotion planning to drive maximum revenue growth.

Improved Compliance: With Workday Revenue’s help firms can easily comply with industry standards and best practices for compliance management.

Better Customer Experience: Workday Revenue streamlines and simplifies billing for an improved customer experience that allows fast payment of invoices without error or payment issues.

Improved Financial Planning: Accurate financial information helps businesses manage resources effectively while planning ahead for a bright future.

Real-time Data Sharing and Collaboration: Workday Revenue provides real-time access to relevant financial data that allows organizations to quickly make strategic decisions.

Better Decision Making: Accurate financial data provides organizations with valuable tools for strategic decision-making processes.

What is Workday Revenue software and how to use Workday Revenue?

Workday Revenue Software, a cloud-based financial management solution, simplifies accounting processes by automating accounting functions such as accounting and budgeting/forecasting/revenue recognition for organizations of any size.

Users can track income, manage compliance obligations and gain company insight using this solution which integrates seamlessly with Workday applications as well as third-party apps while offering flexible deployment options and built-in analytics features.

Workday Sales Software is an innovative cloud-based system designed to bring customer and financial data together during the sales cycle, automating revenue recognition while managing financial data efficiently, decreasing manual complexity and providing real-time visibility of performance for optimal revenue and profitability maximization.

How to use workday revenue?

Workday Revenue’s first step for organizations using Workday Revenue should be creating their revenue streams with codes, descriptions and other income stream details such as codes or descriptions to use Workday Revenue more effectively.

Set Revenue Stream Rules: Once revenue streams have been created, configure their rules – such as revenue kind and due date settings – accordingly.

Enter Revenue: After setting up streams and rules, manually or use integration to enter revenue data (integrations can help streamline this step).

Track revenue with Workday Revenue by creating budgets and revenue forecasts.

Generate Reports: Workday Revenue allows users to generate reports about revenue stream performance that can help optimize decisions regarding revenue optimization decisions.

Workday Revenue services & Workday Revenue Features:

In terms of services & features for Workday Revenue; these include:

Revenue Management: Automate ASC 606 revenue recognition and reporting.

Revenue Forecasting: Utilize predictive analytics and machine learning techniques.

Revenue Optimization:Smart pricing methods to optimize timing & mix.

Revenue Protection:Protection against Revenue Leakage or Fraud.

Customer Behaviour Insights: Unlock Income Opportunities.

Measure, Monitor and Optimize Revenue Performance across All Channels.

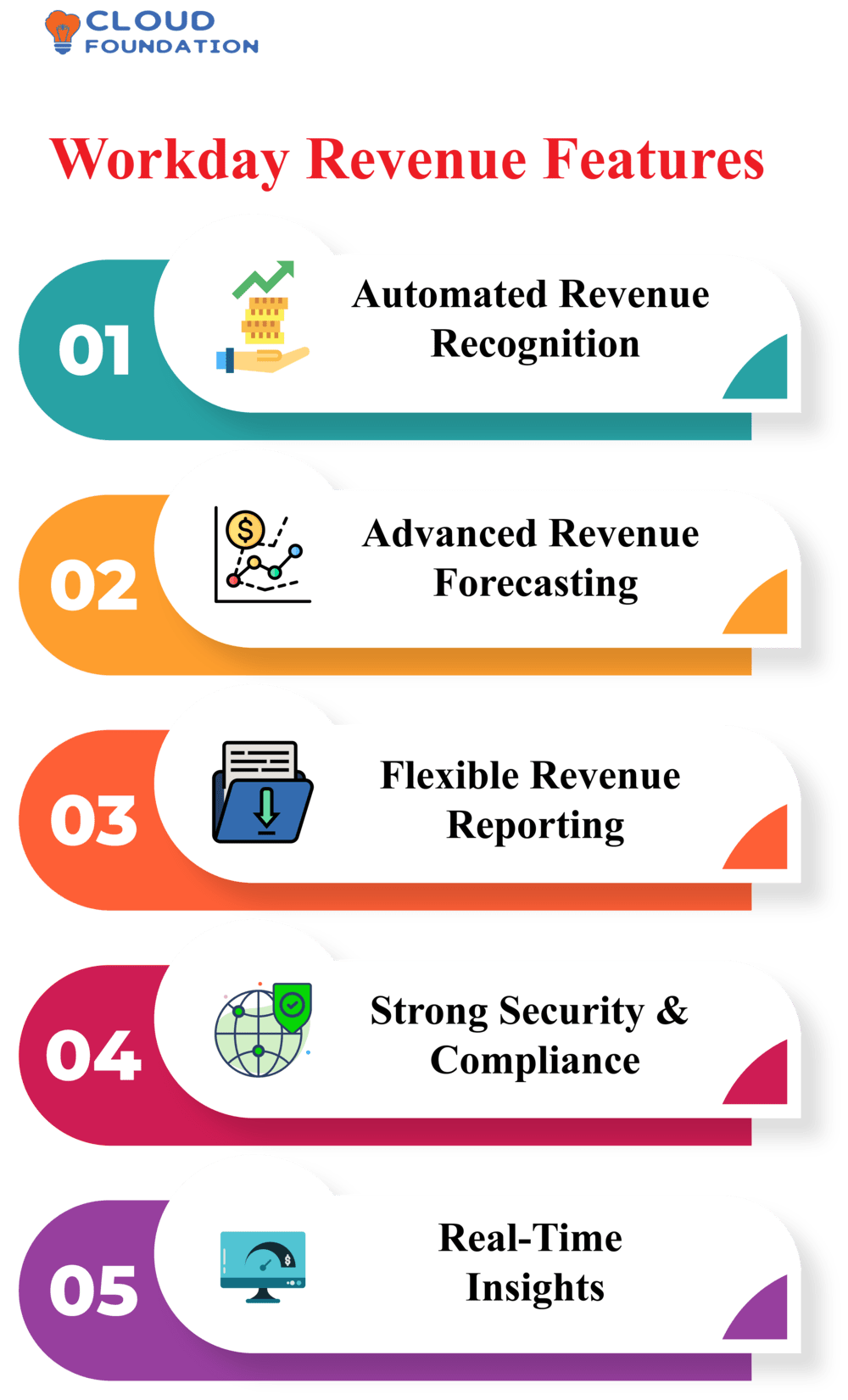

Workday Revenue Features Include

Automated Revenue Recognition:Workday Revenue automates revenue recognition calculations and processes according to GAAP and IFRS compliance.

Advanced Revenue Forecasting:While advanced forecasting tools help enterprises predict revenues streams and manage cash flows with accurate predictions of cashflow in advance.

Flexible Revenue Reporting: Workday Revenue’s flexible revenue reporting enables firms to collect and analyse revenue data from many sources and formats, as well as analyse it using business rules-driven revenue management strategy for accurate, compliant revenue recognition. To guarantee accurate, compliant recognition of revenues.

Strong Security and Compliance:Workday Revenue provides firm with strong security and compliance features that help ensure they comply with industry rules while protecting data. Plus,

Real-Time Insights:Workday gives enterprises real-time insight into revenue performance!

What are the best ways to learn Workday Revenue?

Take an online course: There are various online courses dedicated to Workday Revenue basics available from Workday, third parties or universities.

Read Workday documentation: For an in-depth knowledge of Workday Revenue the website contains material and resources designed specifically to teach this system.

Attend webinars or conferences related to Workday Revenue for further education. Check out official or third-party presentations hosted by either Workday or third parties.

Speak to Workday Revenue experts: Workday offers several experts that can advise you; you can connect via LinkedIn, Twitter or any other means available on social media such as these platforms.

Experience Workday Revenue first-hand through its 10-day demo.

Beginners to Workday Revenue may find CloudFoundation online learning materials helpful as these provide quality training via Workday Revenue courses, Workday revenue blogs and Workday Revenue videos in an accessible format.

Prasanna

Author

Never give up; Determination is key to success. If you don’t try, you’ll never go anywhere.