SAP FICO Tutorial | A Beginners SAP FICO Tutorial Pdf Guide

Good day there,

My purpose for being here today is to share my thoughts regarding the most important part of the SAP ERP system, which is the method that the vast majority of businesses use to maintain control over their financial data.

The SAP FICO looks like this. A comprehensive look at SAP FICO is provided for your perusal in this tutorial.

Thus, let’s begin with the fundamentals of it.

What is SAP FICO stand for?

According to what its name suggests, SAP Financial Accounting and Controlling, often known as SAP FICO, is designed to save, generate, and analyse financial accounts, as well as report on them.

Further, these reports can be put to use in the process of establishing corporate strategies and making decisions.

This is an On-premises system that is divided into two portions altogether.

In addition, these two divisions are the ones accountable for carrying out the various procedures that make up the company’s financial module. They represent the following:

SAP Financials (FI)

Controlling with SAP (CO).

Even though they are two distinct modules, with FI focusing on financial accounting and reporting and CO being limited to planning and cost monitoring, the majority of people refer to them as a single module because of their close association.

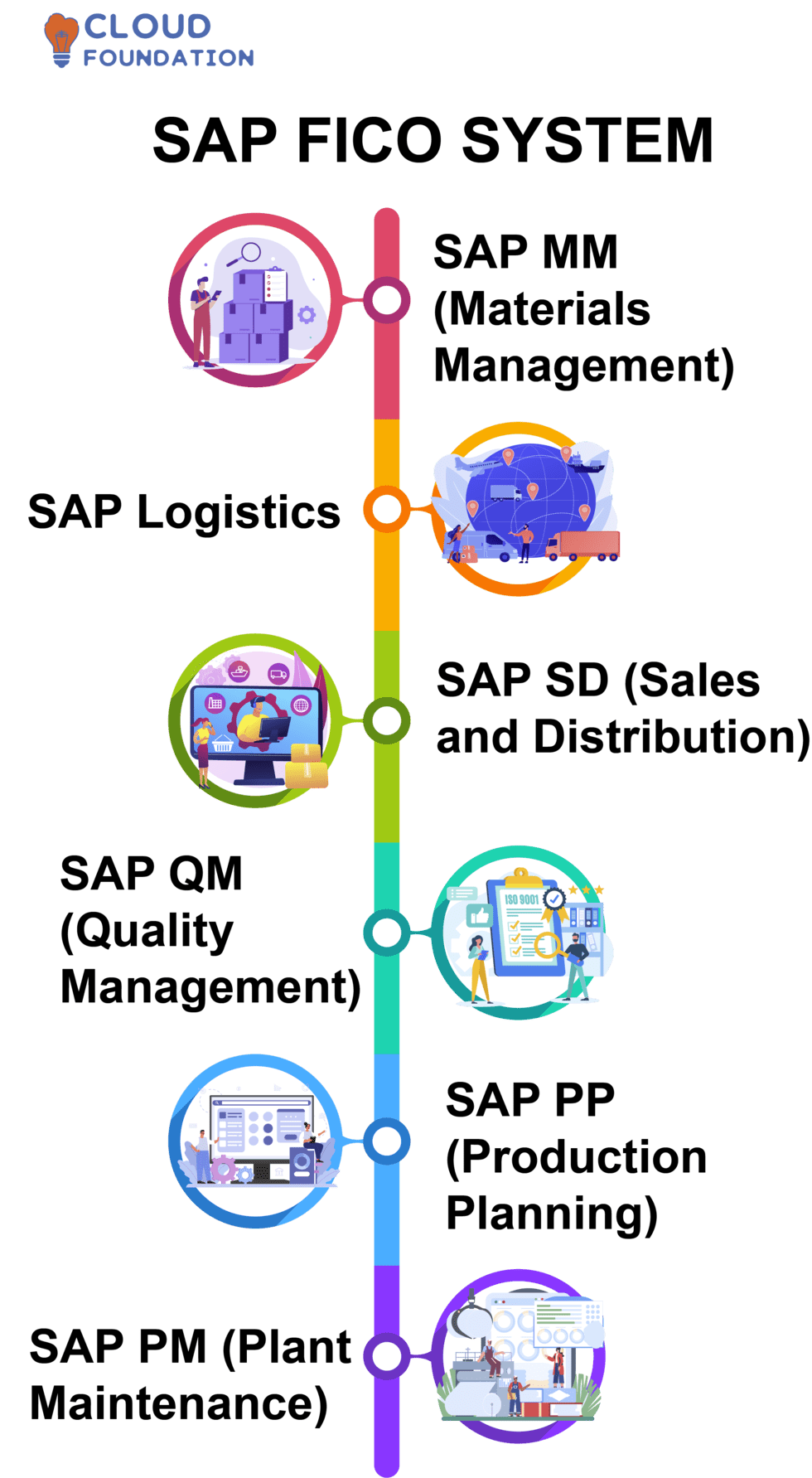

The following are some examples of other systems that SAP FICO can integrate with:

SAP MM (Materials Management)

SAP Logistics can be seen here.

SAP SD (Sales and Distribution)

SAP QM (Quality Management)

SAP PP (Production Planning)

SAP PM (Plant Maintenance)

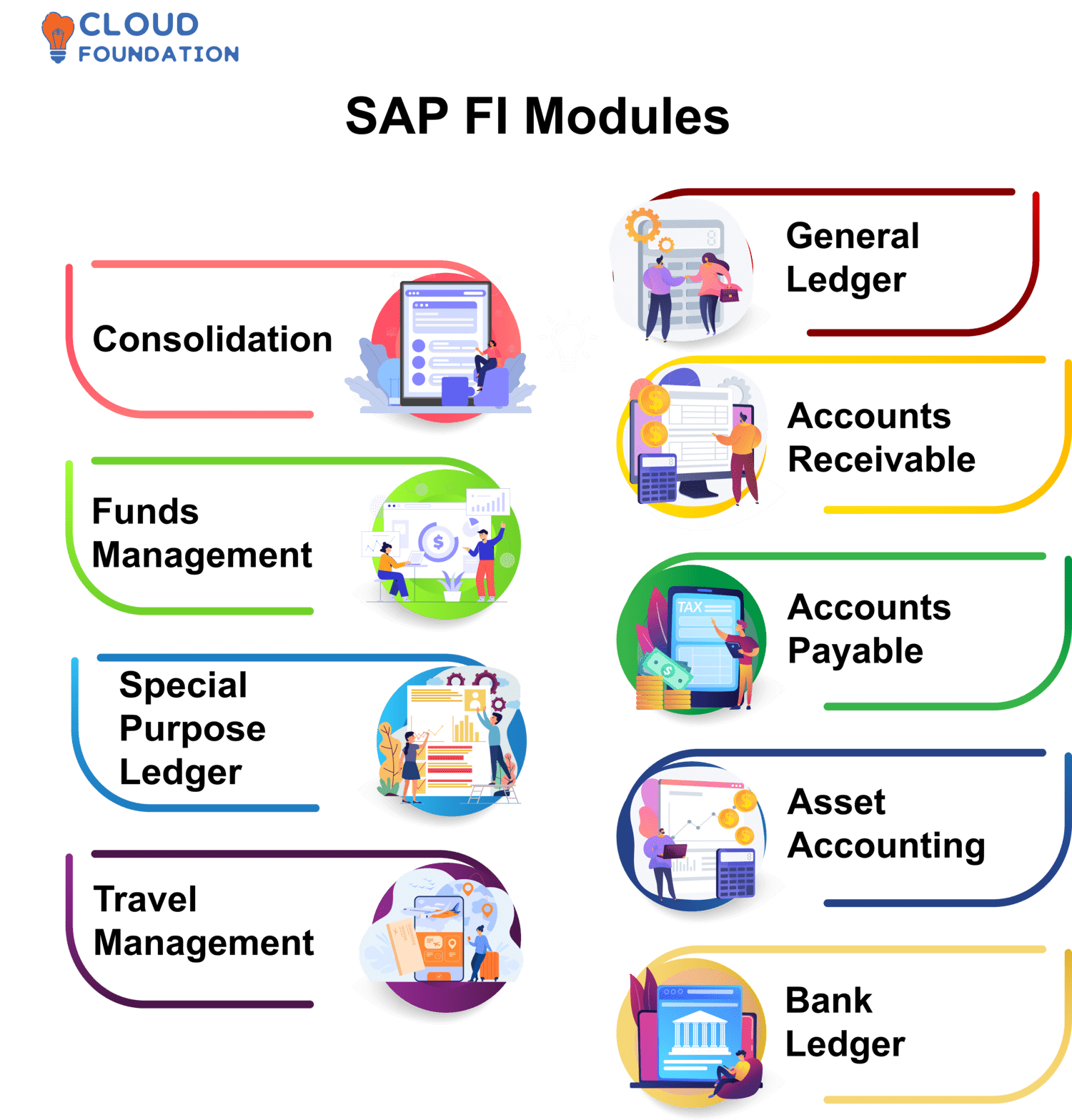

SAP FI Modules:

The following is a list of the submodules of FI that are liable for specific procedures in accounting, such as the generation of financial statements, which may include balance sheets, profit and loss statements, and other similar documents.

A company’s transactional data is recorded in the chart of accounts, which contains information on all charges made in the system.

General Ledger: The general ledger is where this data is compiled. The data from the general ledger is used to generate real-time transactions, which are then logged.

Accounts Receivable: It is responsible for the management of customer accounts and the recording of transactions, such as the posting of invoices, the execution of customer reports, the posting of credit memos, invoice payments, and down payments.

Accounts Payable: This function manages the accounts of the vendors and keeps a record of all the transactions that take place with the suppliers. These transactions include running vendor reports, posting invoices, making automated payments, posting credit memos, making down payments, and invoice payments.

Asset Accounting for assets is responsible for managing a company’s fixed asset transactions, which might involve the purchase of assets, their depreciation and revaluation, their retirement, transfer, and sale. The land, buildings, and other structures as well as the machinery are examples of fixed assets.

Bank Ledger: It is responsible for the management of all of a company’s transactional bank data. It does a comparison between the bank statements that have been reconciled and the transactions that have been logged on the system.

Consolidation is the process of integrating the financial accounts of multiple businesses into one to determine the current and future state of a company’s finances in the market.

Management of funds: This function is responsible for handling the revenue and cost budgets of a corporation.

Special Purpose Ledger: It defines SAP FI ledgers that are used for reporting reasons and are referred to as Special Purpose Ledgers.

Management of travel: This function maintains a record of the data associated with the various travel-related procedures. It makes it possible for a firm to keep track of travel spending and manage trip bookings.

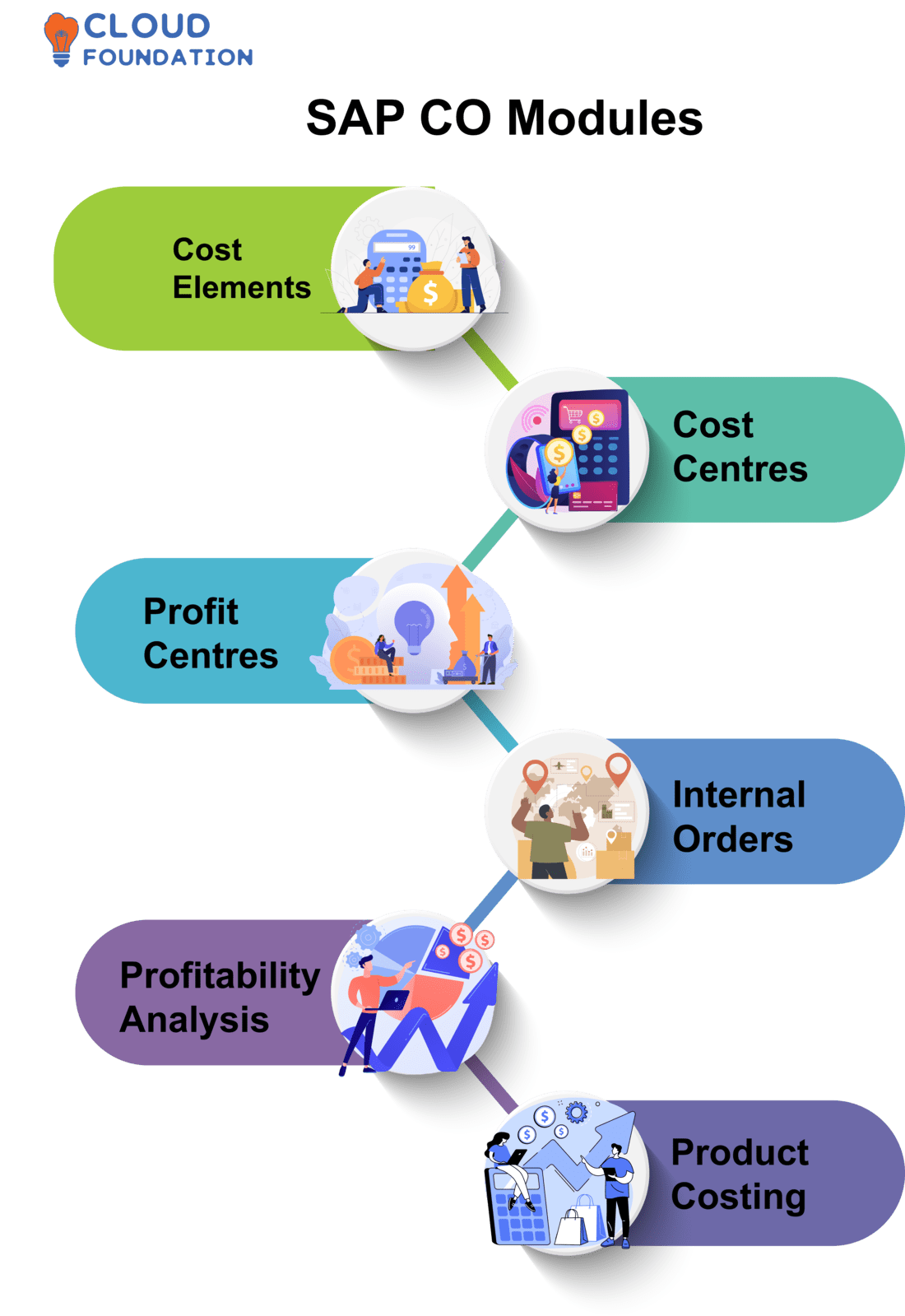

SAP CO Modules:

The SAP CO has the single most important bearing on the overall profitability of the organisation. Similar to SAP FI, SAP CO is composed of submodules that assist with the design of business processes, the creation of reports, and the monitoring of an organization’s operational costs.

The breakdown is as follows:

Cost Elements: When it comes to the profit and loss statements or income statements of a firm, the Cost Components section is responsible for maintaining accurate records of the company’s expenses and revenues.

It also illustrates specific expenses incurred by the company and describes the source of the costs.

Cost Centres: Cost Centres are responsible for handling the expenses, but not the revenues, that are connected to a company’s internal departments such as production, sales, and marketing.

Human Resources, for example, is one of these departments.

Profit Centres: In contrast to cost centres, profit centres are responsible for managing the information concerning a company’s revenue and expenditures related to its operations in the business world.

Internal Orders: These deal with costs connected to non-fixed assets and limited-time interior projects such as marketing campaigns that are run for a short period.

Examples of these types of projects include renovations and new furniture.

Profitability Analysis: Profitability Analysis is a tool that gives a company the capacity to evaluate the profitability of its goods.

For example, conducting a Profitability Analysis before deciding on product pricing, distribution networks, or target market groups can be helpful.

In addition to this, it offers other levels of analysis, such as determining profitability according to country or region, product types, distribution channels, or individual customers.

Product Costing: The process of product costing analyses how much money a company spends to produce its items.

A company’s ability to estimate its manufacturing costs and its level of efficiency can both be improved by conducting a product costing study.

Where may one make use of SAP FICO?

As technology advances in a variety of fields, businesses have been searching for ways to build workforces that are both more extensive and more efficient.

But, despite this, financial accounting appears to be the only department in any firm that appears to be able to hold its own when automation is used.

This is because even people have their limits. SAP Financial Accounting (FI) is consistently ranked as one of the most widely used modules in businesses of all sizes.

The software and the SAP FI suite collaborate to offer a robust solution that can meet the requirements of any company’s accounting and financial processes.

Each corporation can benefit from having better oversight, evaluation, and planning of their commercial transactions by utilising the CO module.

This module is connected to financial accounting, and it is used to consolidate all of the associated costs.

In addition to this, it is used to monitor and compile master data, which includes things like cost centres, internal orders, profit centres, cost factors, and so on.

Planning, pursuing, putting the plan into action, and reporting are the processes involved in the process.

With the help of this module, we will be able to monitor the various heads of expense and plan accordingly.

The SAP CO module strengthens activity-based costing throughout the process. It keeps a record of the modifications that have been made to the items, spending, and budgets.

How does SAP FICO work?

Within an SAP environment, the CO and FI modules of SAP operate independently of one another. Data is passed back and forth between these many components consistently.

The data flows that occur between financial accounting and controlling affect the cost flows.

Cost centres, business processes, projects, and orders are just some of the CO account assignment objects that the system will use to divvy up expenses and earnings.

The Benefits Obtained by Using SAP FICO

Because of the increasingly intricate nature of managing business processes, companies require software to run their operations efficiently and successfully.

A suitable piece of software can assist a company in running its operations while also keeping both the present and the future in mind.

It is generally accepted that SAP FICO is software that assists businesses in centralising their financial and controlling procedures.

The mechanisms found in SAP FICO can provide businesses with assistance in designing modifications that are far-reaching and comprehensive in every facet of their operations, allowing those businesses to acquire benefits.

When it comes to learning SAP FICO, what are the prerequisites?

You will be able to master SAP FICO no matter what your educational background was like when you graduated.

A background in commerce and an emphasis on finance during one’s time at university would be beneficial additions to a resume for a job in this industry.

Do you want to learn more about the future capabilities of SAP FICO?

The majority of businesses like SAP FICO because it makes financial operations easier to understand. In this industry, there is an abundance of job openings to choose from.

There is a significant shortage of certified SAP professionals around the world, particularly among MNCs.

A comprehensive understanding of relevant financial topics along with an SAP FICO certification can help you land a position as an analyst.

Skilled in financial management.

Functional analyst for SAP FICO and consultant for SAP FICO.

In numerous industries:

Marketing, advertising, banking, telecommunications, consumer goods, and many other areas also fall under this category.

What many kinds of training are there to choose from?

The execution of SAP is a multifaceted endeavour that calls for superior skill. Learning at one’s speed or receiving instruction from experts are both viable paths to accomplishing this goal.

An excellent course of action to take if you want to be successful is to enrol in an integrated SAP FICO training programme offered by a reputable educational institution and complete the programme.

Which is the Most Effective Learning Platform for SAP FICO?

To further my profession, I was resolved to become proficient in Sap Fico Tutorial for Beginners. After conducting extensive research on the various locations that offer training, I came across an advertisement for CloudFoundation, which is an online corporate training platform that offers both self-paced learning and instructor-led training as alternatives.

Even though I went into the process of selecting a training option with some scepticism, their technical support team has been really helpful in pointing me in the correct direction by taking into account the needs I had.

In addition to that, I went to their website and signed up for an instructor-led training session.

The subject knowledge of their professors astounded me, and how they taught made even the most difficult aspects of FICO easy for me to comprehend.

Even though I do not come from a family with a history of financial education, I was able to pass my certification exam on the very first try thanks to their reference materials.

It would not be an exaggeration to state that I received my education from the most prestigious institute in the history of the world.

To Conclude:

SAP FICO is an integrated module of SAP that assists companies in the storage of financial information.

Submodules are used within SAP Financial Accounting and SAP Controlling to manage the company’s financial transactions.

Businesses can improve the decisions they make to attain higher levels of efficiency and profitability by using the reports that are created by the SAP FICO modules.

The labour market has a significant need for certified SAP FICO specialists because there are not enough of them, and if you want to get work in this field, earning certification can help.

Those who are interested in pursuing a career in the financial industry would be well to consider obtaining training and certification in SAP because of the software’s notoriously difficult implementations before embarking on that path.

Shreshtha

Author

Life is a long lesson in humility – Life is either a daring adventure or nothing at all.