SAP Ariba Tax Rules Training Material

SAP Ariba Supplier Configuration

The standard field is there for the company’s address in the case of SAP Ariba, provided by the system.

Still, in many organisations, the standard address regions are not sufficient. They need more terrains and their layouts to have features like street addresses, cities, and provinces that are separate.

We can assemble the said branches manually by following the given best drill standards.

Providing substantiation patterns for emails in SAP Ariba is also a highly sought-after feature.

How can regular expressions or regex patterns be defined? These ensure that the data entry is without mistakes and therefore increases the quality of the supplier submissions.

What is the requirement for supplier insight in SAP Ariba? These features include field substantiation and mapping. What kind of strict formatting rules can we explain employing regex patterns?

Regarding the establishment of the supplier, I verify the mappings and the correctness of the linked branches.

Through questionnaire formatting and substantiation checks, SAP Ariba streamlines the supplier registration process, eliminating much of the paperwork.

This form is now developed, so I also reorganised its structure. The moving of sections in the form safeguards that every section is in the proper sequence in SAP Ariba.

The modification of the visibility of particular specialities is also available in SAP Ariba.

If a supplier’s address is optional, we can create conditional visibility rules to display the relevant fields only when needed.

When it comes to preferred settings, SAP Ariba is the tool that helps us manage supplier insights.

Another critical component of the dock is the mapping system, which has been designed to connect with any supplier network easily.

Automating Supplier Tax Configuration

The SAP Ariba podium automates the Supplier Tax Configuration process, enabling the onboarding of suppliers to be accelerated to a minimum.

If you need help to modify tax terrains in some country or to enforce selection conditions, SAP Ariba will automate the process very well, said Boensch.

While operating automation, companies can simultaneously perform tasks more systematically and meet the guidelines in place.

Besides that, SAP Ariba is key to change in procurement tools, which supplies great features in taxation settings and supplier selection.

Country-clear-cut Tax Details in SAP Ariba

When dealing with suppliers, tax details carry significant weight.

Furthermore, SAP Ariba supports tax details configuration, enabling enterprises to populate tax zones based on the requirements of a particular country.

For example, in Belgium, a business enterprise’s number and VAT number are mandatory, while in India, every company is required to use a PAN and GST number.

SAP Ariba should manage all this with the help of the taxes that are selected according to the reports provided by the supplier from another country.

Tax and Banking Reports in SAP Ariba

The tax setup in the SAP Ariba system is very convenient for the users, who can validate a country statically.

That is, users in India must have their PAN verified, whereas suppliers from other regions may have different tax registration mandates.

By applying SAP Ariba, you can drive field visibility to a personalised level and ensure that they fully comply with local tax regulations. This enables a high level of skill when handling tax-required documents across various settings.

As the country-specific regulations require, the metadata of the tax in SAP Ariba is also used for specific tax configurations. With SAP Ariba, countries with particular conditions can dynamically select the relevant tax types.

SAP Ariba is a software that provides a straightforward tax compliance system spanning multiple countries.

The cooperation between the tax administrations of GST-related Indian businesses and VAT-related UK businesses ensures the practical application of tax configurations and their smooth operation.

Except for tax and banking, SAP Ariba encompasses the operation of digital and highly refined supplier processes that enable them to comply with regulations. Tax metadata, together with the comprehensive transactional structure, enables operating in a passive mode.

To set the tax settings in SAP Ariba, users must ensure that the correct authentication is used, e.g., the GST format of India, which the SAP Ariba system enables them to use.

One of the features of SAP Ariba is the rigorous condition-based visibility, which ensures that suppliers can see only the specialities relevant to the tax based on location mandates. No more confusion, and the input of the data is uncluttered as a result.

SAP Ariba Tax Tools

The next most important thing in Ariba is tax metadata. It is a file that shows tax structures that companies can define for alternative regions, thereby ensuring compliance with the regulations of a particular country.

SAP Ariba offers businesses a comprehensive global tax rule configuration. It enables the creation of metadata files and the automation of conditional visibility, making it easier for the company to comply with regulatory frameworks.

Hence, obsequiousness is essential in the context of international business operations.

With SAP Ariba tools, not only can you operate taxes more efficiently, but you can also maintain the clarity of your financial transactions.

The way SAP Ariba organises tax and banking is key to the observance of companies that operate in diverse regions.

With the help of SAP Ariba, a company can perform tax work in one place while complying with the regulations of different countries simultaneously.

The process that SAP Ariba has laid out for adding tax-related evidence has been made easy to follow, thereby helping companies to adhere to regulatory demands as expediently as possible.

When you make use of SAP Ariba’s sturdy tax and banking settings, you will see how the business process gets faster, and at the same time, it stays in line with the regulatory framework.

As the leader in the world of conducting transactions and managing company finances, SAP Ariba has provided a straightforward framework for simplifying processes across all regions.

Capitalising on SAP Ariba, businesses can automate various tax conditions while ensuring that suppliers provide accurate data in conformance with country mandates.

Tax Metadata Import in SAP Ariba

The tax metadata import process is quite simple with SAP Ariba. For example, if you want to add new tax sectors for a country like Belgium or Bulgaria, the process is indeed easy.

One of the simplest ways to change tax zones is to enter new parameters and then upload the file back to the system.

After the import operation, SAP Ariba automatically embeds these stipulations into the supplier configurations, thus the system complies with the local tax regulations.

The flexibility of SAP Ariba enables enterprises to affirm details in tax configurations without manual interaction.

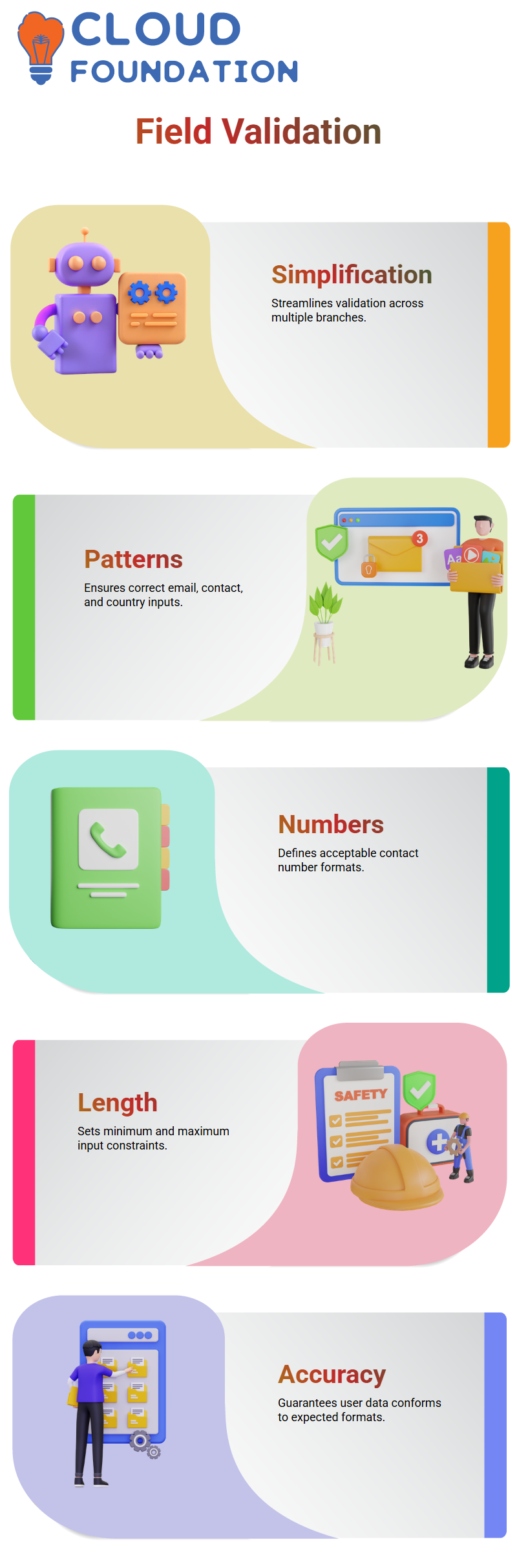

Setting Up Field Validations in SAP Ariba

With SAP Ariba, we simplify and accelerate the substantiation of multiple branches.

Substantiation patterns should accompany the email ID, contact number, or country selection to prevent errors.

For demonstration, if you are going to add a contact number, you must set the acceptable numerical patterns, clarify the minimum length, and specify the maximum length. This will confirm that the user’s input conforms to the expected format.

Managing Data with SAP Ariba

One of the most common methods for managing data in SAP Ariba is through the use of Outperform imports.

You can save time by not entering items manually. The process becomes more approachable and faster by utilising Surpass sheets for structuring data and carrying out revisions collectively.

A good representation to consider is that when adding countries, we use ‘Be outstanding’ to create the list, and then we register the courses. SAP Ariba handles all tasks by operating the file and embedding the settings directly.

Repeatable Sections in SAP Ariba

One of the features in SAP Ariba that is highly organised due to its multiple functions is called repeatable sections, which allow for various field instances. For demonstration purposes, while collecting connectivity details, users can add multiple broadcasts in real-time.

Furthermore, the bank details can also be set up as repeatable sections, allowing only the necessary financial information to be entered while still providing flexibility to the user.

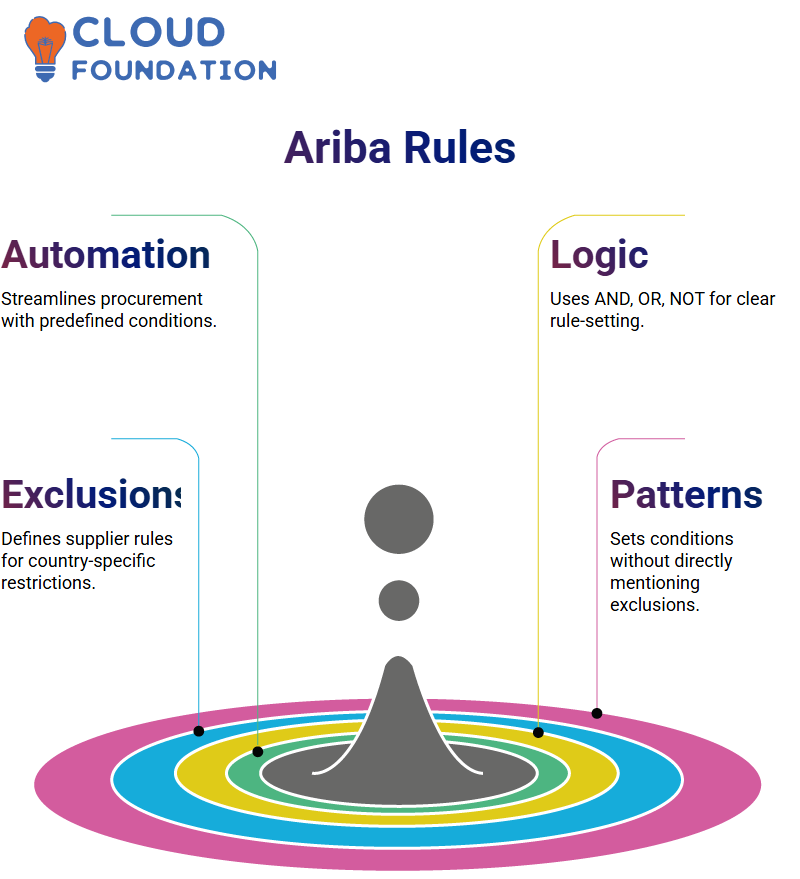

SAP Ariba Conditions and Configurations

SAP Ariba offers an opportunity for your business to derive advantage from creating thorough and involved conditions that automate the procurement process effectively.

When creating rules, consider arranging conditions using logical operators such as AND, OR, or NOT to make the selections unambiguously transparent.

Suppose you want to devise conditions for suppliers that will exclude India from a particular setting; in this case, SAP Ariba is the solution.

One way to help you set up the rule quickly and correctly is to specify the pattern without mentioning India.

Through the condition settings, it is also possible to delimit exclusions, such as ‘none of’ to exclude a specific country or ‘any of’ to cover multiple countries.

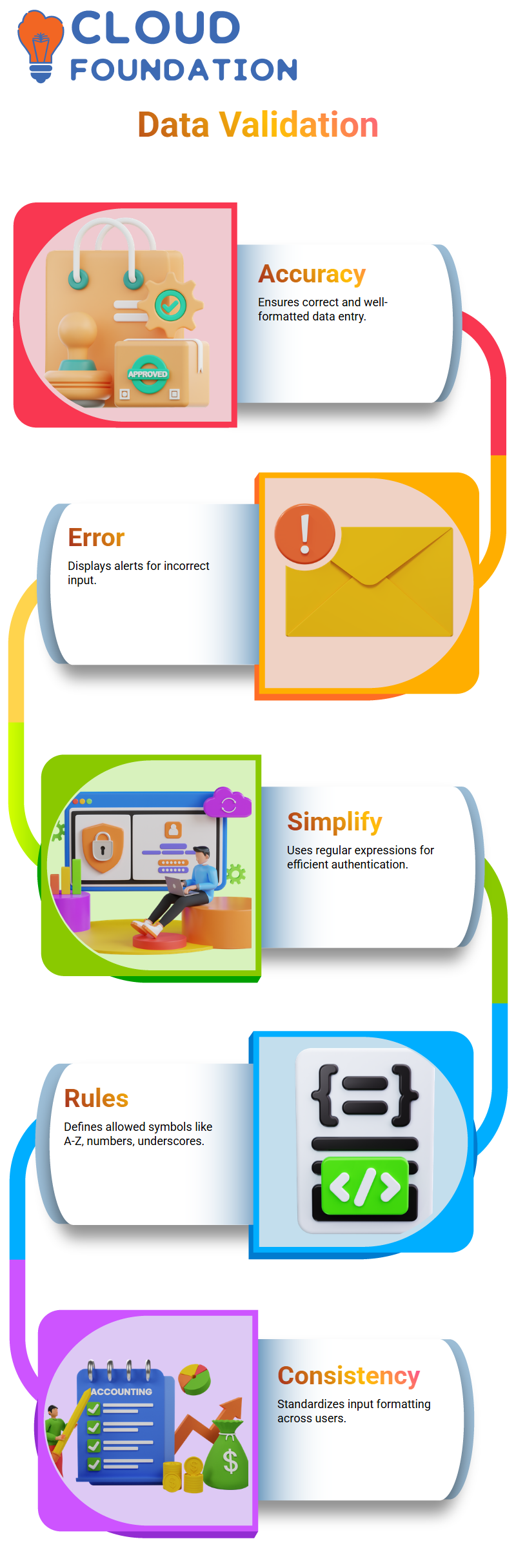

Awareness Substantiation in SAP Ariba

If we complete the authentication process correctly in SAP Ariba, we can enter only correct and well-formatted data.

Imagine you’re entering your email, but the input falls short of the expected standards—SAP Ariba will display an error message alerting you to the issue, and thus comp… 226 characters so far.

Instead of applying complicated authentication rules, we systematise them by capitalising on regular expressions.

We select allowed characters, such as A-Z, numbers, and underscores, to ensure the email is in the correct format when entered.

Refining the User Experience in SAP Ariba

The primary purpose of setting up these validations and configurations in SAP Ariba is to create a more efficient and user-friendly system, resulting in a better user experience.

Among the examples are modifications created by users themselves, such as those that add active fields, which provide the simplest way to run data in SAP Ariba.

Energising users to be in control by doing pattern substantiation, applying repeatable sections, and importing from Achieve Excellence.

With this, one can effectively pilot SAP Ariba, minimising mistakes and streamlining the system.

Navya Chandrika

Author