SAP FICO Customer and Vendor Master Data Training

SAP FICO Financial Configuration

To access and set financial settings in SAP FICO, we utilise the SPRO transaction to gain access to its Implementation Guide (IMG). From there, we navigate to Financial Accounting, followed by Accounts Receivable and Payable.

Here, we define customer and vendor settings, such as account groups, number ranges, and field status variants, for customers and vendors.

Before posting transactions to any GL accounts, they must first be assigned appropriately.

Establish reconciliation accounts between customers and vendors that link subledger transactions back into the general ledger.

SAP FICO allows us to define posting keys, which determine how transactions are recorded. For instance, debit postings to customer accounts might use key 01 while credits made out to vendors would use key 31.

These settings ensure that every transaction is accurately recorded, reflecting a precise financial position.

Document Types and Number Ranges in SAP FICO

SAP FICO records transactions using specific document types and number ranges that help define their nature and account involvement – for instance, vendor invoices might be assigned document type 19.

At the same time, payments might receive document type 15 treatment.

As with customer-related transactions, such as invoices and expenses, customer transactions utilise document types 14 and 18.

Document types play a crucial role in how transactions are processed and reported, ensuring an accurate record is easily retrievable during audits or reconciliation.

With SAP FICO, we can customise document types according to transaction processing or reporting needs and assign them directly to specific GL accounts, ensuring every transaction can be recorded accurately while being easily traced back during an audit or reconciliation review process.

SAP FICO helps us ensure clarity and consistency in financial reporting by assigning distinct document numbers for different transaction types.

Regardless of whether it is accounts payable (AP) or accounts receivable (AR), each has its own specific set of documents and number ranges to ensure optimal efficiency in administration.

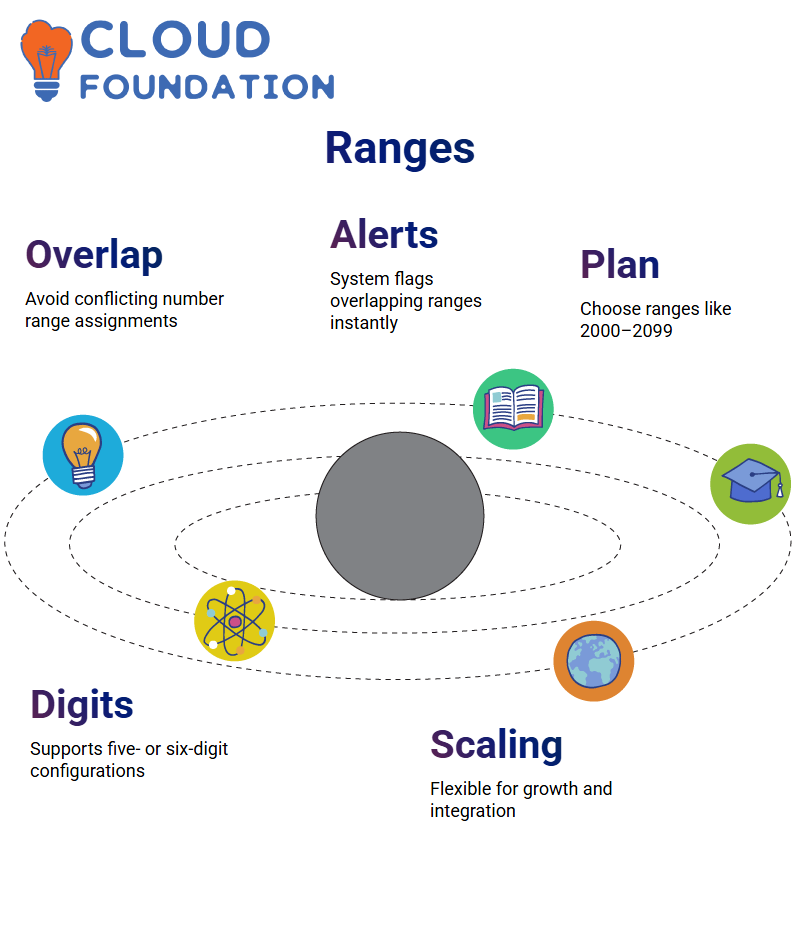

Number Ranges in SAP FICO

One thing I always look out for in SAP FICO is any overlapped number ranges. If I attempt to assign one that overlaps with an already established range, the system throws an error and reports my attempt as invalid.

SAP FICO alerts me immediately if range A1 overlaps with 01; therefore, I carefully choose ranges like 2000-2099 or 2100-2199 to avoid conflicts.

Furthermore, SAP FICO allows flexibility when choosing the number of digits; whether I prefer five- or six-digit figures, the system accommodates both types.

Flexibility can be especially advantageous when scaling operations or integrating with other systems, and maintaining clear number ranges allows SAP FICO to run seamlessly; all it requires is planning and understanding how the system interprets this configuration data.

Assigning Number Ranges to SAP FICO Groups

Once all number ranges are defined in SAP FICO, they must be assigned to their respective customer groups.

I assigned customer groups, such as A001 and A002, with designations A1 and A2, assigning domestic customers numbers from 2000 to 2099, while service customers received numbers between 2100 and 2199.

SAP FICO manages these assignments efficiently, making sure each new entry follows a prescribed structure.

Domestic vendors receive numbers between 3000 and 3099, while service vendors get numbers 3100 and 3199.

SAP FICO relies heavily on an assignment process for accurate financial reporting and data management.

It connects group definitions and ranges, creating an organised system that facilitates efficient financial data reporting and administration.

Configuring GL Accounts and Accounting Groups in SAP FICO

One of the cornerstones of SAP FICO is creating General Ledger (GL) accounts and categorising them by accounting groups.

These help us categorise accounts according to their nature: assets, liabilities, revenues, and expenses.

Asset accounts typically range in numbers between 1000 and 1999, and liabilities from 2000 to 2999. When creating a General Ledger Account in SAP FICO, we assign it to a group that best matches its characteristics.

This facilitates financial reporting while ensuring that similar accounts are treated consistently.

Bank accounts may be classified as assets, while vendor payables are classified as liabilities.

SAP FICO also provides the flexibility and control needed to customise accounting groups based on individual needs, whether for internal reporting or compliance reporting requirements.

With such groups, we gain ultimate control of how financial information is structured and presented.

SAP FICO: Field Status Groups and Data Consistency

Field status groups in SAP FICO allow data entry users to specify which fields are mandatory, optional, or hidden during data entry.

When working with customer master data, you may encounter general fields, such as address and contact details, as well as company code data, including account management details and payment terms.

Consistency among field status groups in SAP FICO is of critical importance, particularly for reconciliation accounts, which should be either mandatory or optional, regardless of their nature. To do this properly.

Without a compelling reconciliation account in place, data won’t transfer correctly between customer master data and General Ledger accounts, potentially disrupting financial reporting processes and overall reporting efforts.

Tolerance Limits in SAP FICO

Once master data has been imported into SAP FICO, the next step involves setting tolerance limits, which determine the acceptable variance in financial transactions.

SAP FICO utilises tolerance limits as a filtering mechanism in cases where payments fall just outside their invoice amounts, and these thresholds are used to determine whether to accept or deny transactions.

I set specific tolerance levels for general ledger accounts, customers, and vendors to maintain consistency across financial operations.

SAP FICO offers an intuitive user interface for setting tolerance limits, making the enforcement of financial controls simpler than ever. By setting and adhering to clear tolerance levels, I ensure that SAP FICO supports accurate and compliant financial reporting. It’s an effort that pays big dividends when it comes to data integrity.

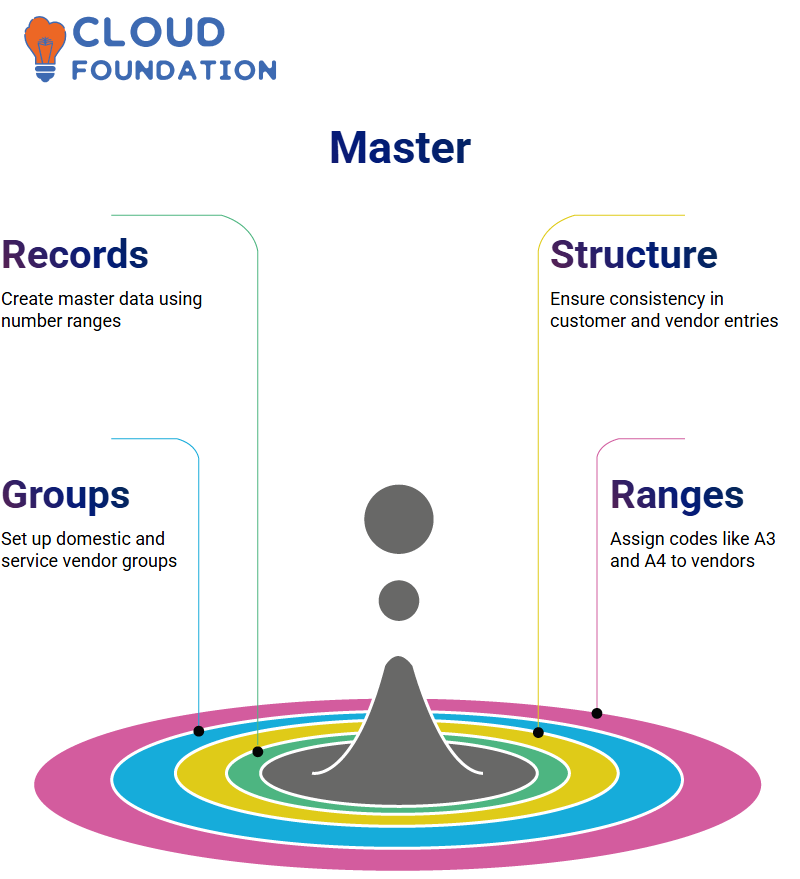

Preparing Master Data in SAP FICO

With my groups and number ranges mapped out, it was time to prepare my master data in SAP FICO.

This process involved creating customer and vendor records using assigned number ranges—a straightforward task, but one that required my complete attention and meticulousness.

SAP FICO ensures that each new master record adheres to our predetermined structure, whether it’s for domestic customer records or service vendor accounts, assigning numbers that link directly to its grouping and category.

As the preparation phase comes to fruition, all your hard work pays off. SAP FICO makes managing large volumes of data easy while simultaneously keeping an eye on individual records; that is one reason I rely on SAP FICO as part of financial data management solutions.

Vendor Groups in SAP FICO

SAP FICO enables us to set up vendor groups, similar to customer accounts. I created two groups: one for domestic vendors (A003) and another for service vendors (A004). These help differentiate vendors based on what services or goods they provide.

Next, I established vendor ranges. For domestic vendors, I used A3 starting at 3000; for service vendors, I used A4, beginning at 3100-3199.

SAP FICO makes managing these ranges effortless, so each vendor is uniquely identified and tracked accordingly.

Assigning number ranges to vendor groups was the last step. SAP FICO automates this assignment, ensuring that when I create new vendors, their appropriate number range is assigned based on their group membership.

This provides an efficient yet powerful method to keep financial data organised and orderly.

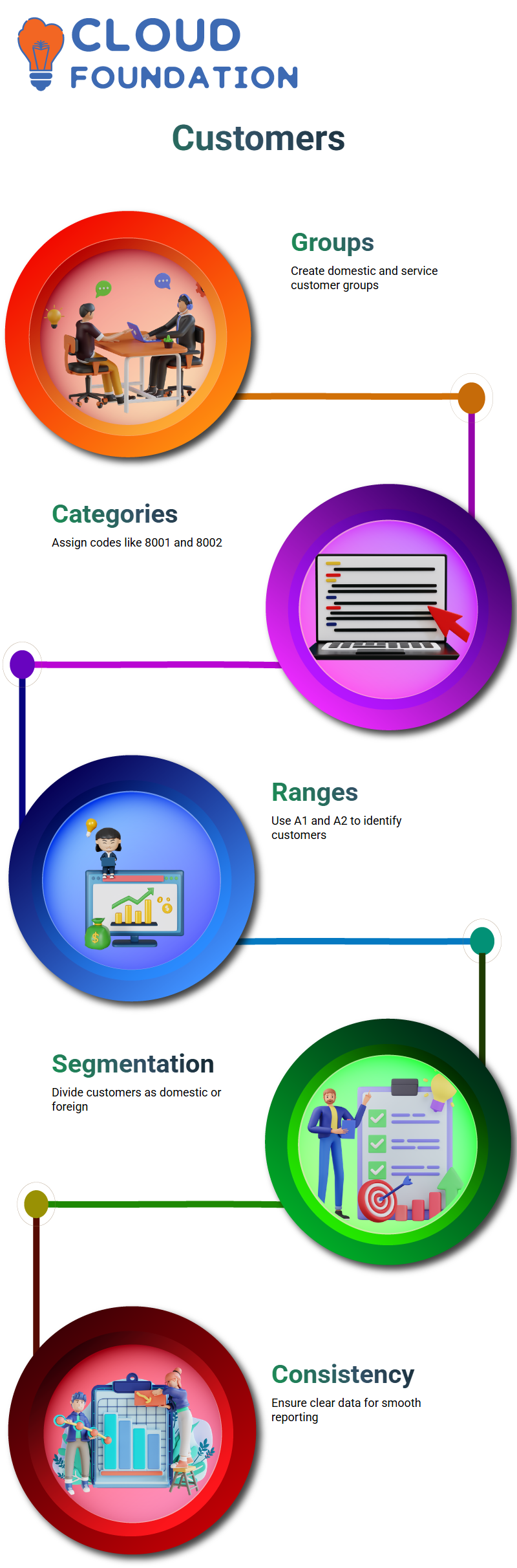

Creating Customer Groups in SAP FICO

Starting in SAP FICO, I created two customer groups: one for domestic customers and another for service customers.

Domestic customers fall under category 8001, while service customers fall into category 8002.

To accurately categorise customers based on the nature of their relationship with your business.

Once I created groups, the next step in SAP FICO is defining number ranges. This step is essential.

I devised two numerical ranges – A1 for domestic customers between 2000 and 2099, and A2 for service customers from 2100 to 2199 – to assign each group its identification number. These will ensure that each customer has their distinct ID within each group.

After I defined number ranges, I assigned them to customer groups within SAP FICO. This step connected the structure to data entry; when creating new customers through SAP FICO, the system automatically selected from an assigned range when allocating numbers, making the entire process seamless and error-proof.

SAP FICO: Domestic and Foreign Customer Segmentation

SAP FICO users need to establish customer groups, both domestic and foreign. One of their core tasks involves segmenting customers based on their national or foreign origin.

Example: If your company operates outside the U.S. with customers from India, their account would fall under the foreign category. Conversely, any U.S. customers would fall into the domestic category.

Utilising SAP FICO’s classification capabilities facilitates financial reporting and reconciliation processes with greater ease.

SAP FICO customers are typically divided into two main groups, domestic and foreign customers.

Although General Ledger (GL) permits more granular segmentation, our two-group system of segmenting accounts payable (APs) and accounts receivable (ARs) serves our needs adequately.

This approach simplifies customer data management while assuring consistency across financial transactions.

SAP FICO: Managing One-Time and Regular Customers

SAP FICO allows you to differentiate between one-time customers and regular ones. One-time customers refer to those with whom you conduct a single transaction, eliminating the need for keeping detailed master records for these individuals.

Regular customers require ongoing data maintenance and are typically part of your domestic or foreign customer groups.

With SAP FICO’s one-time customer setup functionality, however, you can use an account group that removes unnecessary fields.

By automating data entry processes, you ensure your system remains efficient and uncluttered.

Managing Accounts Payable and Receivable in SAP FICO

SAP FICO provides powerful tools for overseeing both accounts payable (AP) and accounts receivable (AR).

At Accounts Payable (AP), we handle transactions related to vendors, including recording invoices, making payments, and managing credit terms. In Accounts Receivable (AR), however, customer transactions such as billing collections or adjustments fall under their purview.

Each process encompasses multiple steps and document types; for instance, in AR, we might start with a customer invoice (document type DR), then payment (document type DZ).

SAP FICO ensures each transaction links back to its respective GL account and follows defined accounting rules, making for smooth accounting operations in accounts payable (AP).

SAP FICO stands out as an invaluable financial management solution due to its integration of Accounts Payable (AP), Accounts Receivable (AR), and General Ledger (GL). This makes SAP FICO such a robust solution.

SAP FICO Integration with Vendors and Customers

Integrity between different modules, particularly between vendors and customers, is of the utmost importance when working with SAP FICO.

At SAP FICO, we manage comprehensive business cycles, from purchasing goods from vendors through payment to accounting entries, including those related to financing and advances or down payments.

For instance, when making our initial purchases, we might make advance or down payments for those goods.

SAP FICO streamlines transaction management by efficiently applying discounts and setting payment terms, transitioning from manual to automatic payments.

SAP FICO offers robust tools to handle each of these processes efficiently.

Manual payments tend to be processed individually for vendors, whereas an Automatic Payment Program (APP) enables simultaneous payment processing across multiple vendors.

As consultants, we configure this APP, while end users use it regularly to manage overdue payments.

SAP FICO also features various document types for every transaction, whether that means invoices, payments, or reversals.

Each type is defined by its unique document type. For example, customer invoices typically use document type DR, while vendor invoices use KR.

These document types enable us to track and manage financial transactions within SAP FICO efficiently.

Navya Chandrika

Author