Guidewire Claim Center Claims Management Training

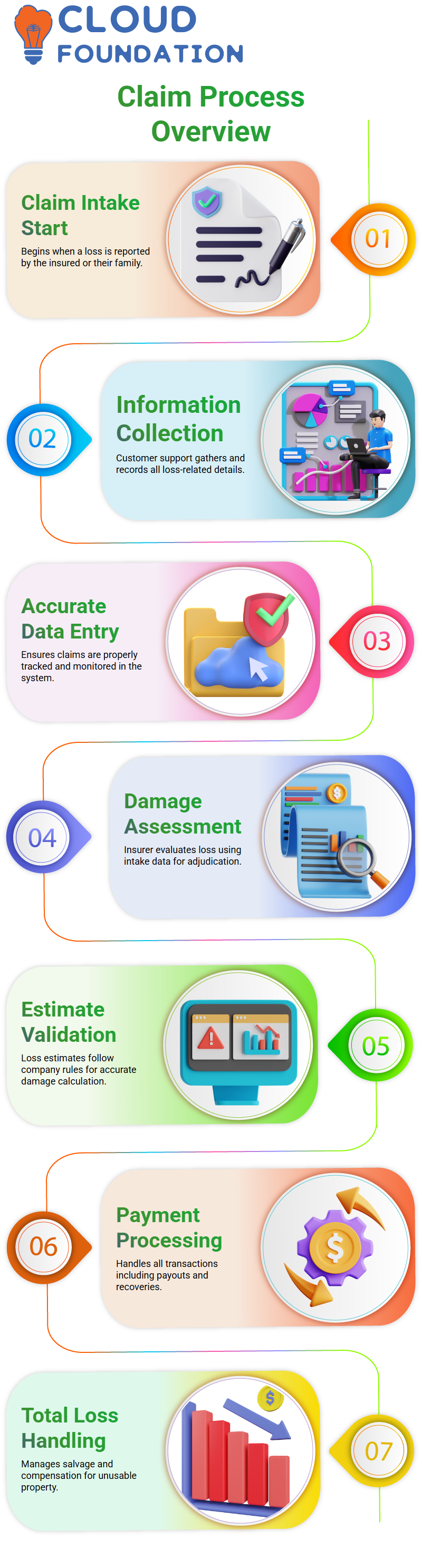

Understanding Guidewire Claim Center Claim Intake

The Guidewire Claim Center’s intake phase begins when a consumer files a loss. Here, the insured or a family member gets in touch with the customer support agent and gives them all the information about the loss.

The intake is important in the Guidewire Claim Center.

The information supplied will serve as the basis for the whole claim procedure, which starts here.

By entering the information into the system, the customer support agent makes sure the claim is accurately recorded and monitored.

Guidewire Claim Center Adjudication and Loss Estimation

The Guidewire Claim Center enters the claim into the adjudication step when the intake is finished. Here, the information supplied at intake is used by the insurance company to assess the damage.

Because it establishes the course for payments and recovery, this stage is crucial.

All loss estimates are guaranteed to adhere to certain company regulations by the Guidewire Claim Center.

The method assists in precisely calculating the damage when the adjuster evaluates the data.

This guarantees that the claim proceeds without hiccups and that everyone concerned receives accurate information.

Guidewire Claim Center Payment Handling

Payments are handled by the Guidewire Claim Center after adjudication. The system effectively handles every transaction, whether it involves paying the insured, a service provider, or collecting money from other parties.

This stage also includes complete loss scenarios, in which the insured gets compensated by the insurance provider when the car or property is rendered unusable.

All forms of payments, including recovery from other insurance providers, are supported by Guidewire Claim Center.

The technology guarantees accurate and timely payments, even in complicated instances with several parties or litigation.

Guidewire Claim Center Total Loss and Salvage

The Guidewire Claim Center keeps track of total loss and salvage activities in situations when the vehicle or property is totally ruined.

The system manages the transfer of property to the insurance company, keeps track of the procedure, and determines the amount owed to the insured.

This guarantees accuracy and openness in the handling of claims.

Guidewire Claim Center Litigation and Special Investigations

Claims may include court cases or disagreements between many parties. There are tools in the Guidewire Claim Center to handle these complex circumstances.

Fraud detection systems are activated, loss estimations are examined, and if necessary, specific investigations may be carried out.

In order to verify claims and identify any fraud, Guidewire Claim Center connects with other systems.

This guarantees that, even under difficult situations, the claim procedure will continue to be dependable and predictable.

The technology facilitates efficient communication between adjusters, investigators, and customer support agents.

Guidewire Training

Guidewire Claim Center Business and Functional Perspective

The Guidewire Claim Center offers a clear business roadmap for the whole claim lifecycle.

The system tracks and manages each phase, including intake, adjudication, payment, total loss, and litigation.

The Guidewire Claim Center’s functionalities include comprehensive validations, claim maturity levels, and interfaces that guarantee seamless operations.

Every day, adjusters and customer support agents depend on the system to correctly and effectively handle claims.

These procedures will be set up in the system if your company decides to switch from a legacy system to the Guidewire Claim Center, guaranteeing that all functional needs and business standards are satisfied.

Guidewire Claim Center Understanding Claim and Exposure Handling

Every claim we make is properly labeled when we collaborate with the Guidewire Claim Center.

Entering loss estimates, adjudication, and adjuster activity is the first thing you do when you establish a claim.

These actions, which are sometimes referred to as “new loss completion,” are administered inside the Guidewire Claim Center together with exposure generation.

The Guidewire Claim Center is where the majority of the adjudication takes place. You modify claims, change activities, and generate exposures.

When you first call, the system only gives you a portion of the information. As further damages are found, you may submit more information later.

We proceed to payouts when all adjudication is completed in the Guidewire Claim Center. Services provided or claims resolved are reflected in payments.

This is also where recovery stages take place. From adjudication to payment, every module in Guidewire Claim Center makes sure that claims are processed effectively.

The FNOL procedure is represented by the draft state in the Guidewire Claim Center. The ‘capacity to pay’ stage is when a claim is prepared for settlement.

In Guidewire Claim Center, every intermediate level—including exposures and claim updates—is closely monitored.

Numerous claims and exposures are managed by Guidewire Claim Center. Drafts are stored throughout the claim creation process, and new loss completion levels are used.

While most procedures adhere to conventional Guidewire Claim Center flows, business rules may generate intermediate levels in cases when numerous cars or events are involved.

An essential component of Guidewire Claim Center is exposures. They stand for losses associated with a claim.

For instance, you use coverage information retrieved from the Policy Center to establish an exposure in Guidewire Claim Center if the glass in your car breaks.

Deductibles, limitations, and premium amounts are examples of coverage specifics.

In the Guidewire Claim Center, every exposure is linked to a particular occurrence and coverage. Without choosing the appropriate coverage and linking it to an occurrence, you cannot generate an exposure.

This guarantees precise processing of payments.

All insurance information is retrieved from insurance Center via Guidewire Claim Center.

Guidewire Claim Center utilizes these facts to manage exposures and payments once the underwriter reviews them and determines premiums and deductibles. The creation and processing of exposures are impacted by each coverage choice made at the policy level.

The coverage must be present in Policy Center in order to create a tire damage exposure or a glass damage exposure in Guidewire Claim Center.

The exposure cannot be processed by Guidewire Claim Center without the coverage.

This guarantees that the handling of claims is in line with the insurance plans that have been obtained.

The Guidewire Claim Center manages a number of intermediary levels for exposures and claims.

A final ‘ability to pay’ stage is reached by claims before payment processing starts, thanks to each step.

The system keeps a close eye on every exposure to ensure accuracy and adherence.

In Guidewire Claim Center, an exposure is always created and associated with an occurrence and a coverage.

For example, the glass, engine, or tires will be exposed in a thorough car damage claim.

To guarantee the accuracy of the payment process, Guidewire Claim Center keeps track of reserves for every exposure, such as a $3,000 reserve for comprehensive coverage.

Every step of the claim process, from initial reporting to adjudication, exposure management, and payment, can be tracked using Guidewire Claim Center.

The solution helps you handle claims properly and effectively by integrating with Policy Center to get coverage data.

The user interface (UI) of Guidewire Claim Center displays all levels, exposures, and claim information. You may monitor maturity levels, add exposures, and edit occurrences.

The system guarantees that every claim proceeds appropriately, only going to the “ability to pay” stage if all required procedures have been completed.

In Guidewire Claim Center, every claim is made up of a mix of coverage information, exposures, and occurrences.

The technology makes guarantee that no exposure occurs if occurrences and insurance coverage are not properly linked.

Accurate payment and exact claims processing are ensured by this framework.

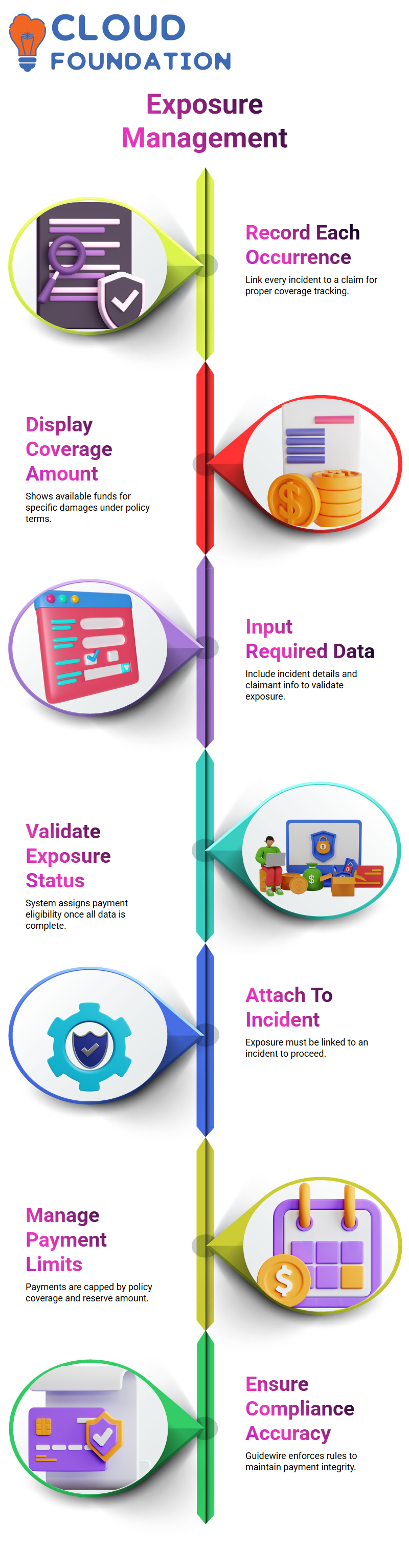

Guidewire Claim Center Exposure

The process of exposing the harm to your insurance coverage is referred to as exposure in Guidewire Claim Center. You record each occurrence in the system, and the exposure is linked to your claim.

This guarantees that the occurrence is appropriately covered by the coverage provided by your insurance.

For instance, the exposure will display the available cash for that particular damage if a windshield crack happens and you have comprehensive coverage.

Guidewire Claim Center makes sure that any payments are made under the $1,000 limit of your windshield policy.

Guidewire Online Training

Creating and Validating Exposures in Guidewire Claim Center

You must input some required data, such incident facts and claimant information, while establishing an exposure in Guidewire Claim Center.

This is enforced by the system using validation levels. The exposure gets the “ability to pay” status and becomes eligible for payments if all necessary information is provided.

An exposure stays in ‘new loss completion’ state if it does not have the required information.

For instance, in order to go to the next step while generating a collision exposure, you need to attach it to an incident, complete the required information, and update it.

After the necessary data is submitted, Guidewire Claim Center immediately adjusts the validation level.

Handling Payments Within Guidewire Claim Center Exposures

You may handle payments within the exposure reserves using Guidewire Claim Center. Depending on the coverage and the available reserve amount, you may pay covered parties or suppliers.

Payments are never made in excess of policy limitations because to the exposure principle.

For example, you may only process payment up to the $1,000 limit if the windshield damage is $1,000 and the policy’s total coverage is $3,000. Within Guidewire Claim Center, accuracy and compliance are guaranteed by this regulated procedure.

Guidewire Claim Center Incident and Exposure Workflow

Incidents are essential to generating exposures in Guidewire Claim Center. Every exposure has to be connected to an event.

When dealing with a third-party collision, for instance, you first establish the incident and then connect it to the exposure.

Exposure cannot progress if incident information are missing.

According to validation standards, exposures go from “new loss completion” to “ability to pay” via a straightforward procedure offered by Guidewire Claim Center.

The approach offers a strong, unconventional foundation for effectively controlling risks, but these principles may be tailored to meet specific company needs.

Customizing and Extending Guidewire Claim Center

The Guidewire Claim Center is very adaptable. Existing displays may be copied, settings can be changed, and data processing can be handled using reusable Java code.

Because of its adaptability, you may modify the platform to meet specific business requirements while maintaining its essential features.

Guidewire Claim Center takes great care in handling requests and answers when interacting with other systems.

The workflow for exposure and claims is still strong, guaranteeing precision and traceability all along the way.

Because of this, Guidewire Claim Center is a trustworthy platform for handling exposures and claims.

Claim and Exposure Maturity Levels in Guidewire Claim Center

Levels of claim and exposure maturity are monitored by Guidewire Claim Center. The system links a user’s claim to a policy and recognizes both insured and third-party claims.

To guarantee appropriate claim management, incidents, exposures, and validations all adhere to a defined protocol.

Insurance firms can effectively classify claims thanks to Guidewire Claim Center’s segmentation.

The system controls and validates every step, from creating exposures to collecting payments.

This guarantees that consumers are constantly aware of the finances and coverage that are available at every stage.

Vanitha

Author

The capacity to learn is a gift; the ability to learn is a skill; the willingness to learn is a choice