What is Oracle Fusion Financials?

Introduction to Oracle Fusion Financials

A complete set of financial management tools from Oracle is called Oracle Fusion Financials, the suite is made to assist businesses of all sizes in managing their financial operations across various ledgers, currencies, and linguistic systems.

Procedures for integrated payables, receivables, and cash management solutions, it offers strong and secure accounting and reporting capabilities. Users of this suite may quickly develop automated procedures for reconciling data from various corporate platforms.

It assists businesses in achieving maximum cost reductions, lowering financial risk, improving data visibility, and expanding their capacity for forecasting.

It assists businesses in achieving maximum cost reductions, lowering financial risk, improving data visibility, and expanding their capacity for forecasting.

Users are also able to simply develop automated reconciliation procedures across numerous business systems by utilising this suite’s capabilities.

Overview of Oracle Fusion Financials

Oracle Fusion Financials is a collection of cutting-edge features cloud financial services provided by Oracle Corporation.

It is a complete solution that helps organisations to optimise their financial performance while streamlining procedures, boosting operational efficiency, increasing agility, and more.

Depending on the size and complexity of the company, a variety of modules that make up Oracle Fusion Financials can be employed separately or in combination.

These modules cover General Ledger, Accounts Payable, Multi-Currency Accounting, Core Finance, Bank Reconciliation, Tax Management, Trade and Receivables Management, Fixed Assets, Capital Assets, and Financial Planning and Budgeting.

Organisations may improve their ability to make decisions and raise their financial efficiency with the aid of Oracle Fusion Financials.

By automating process, expanding reporting capabilities, and improving the quality of financial data, this solution’s cutting-edge features assist to maximise operational efficiency.

Additionally, it gives organisations better control over their accounting procedures and greater insight into their financials.

Oracle Fusion Financials offers extensive security and audit features to guarantee data protection and compliance.

By allowing compliance reporting and monitoring capabilities, it aids organisations in abiding by the pertinent rules and regulations.

Overall, Oracle Fusion Financials aids businesses in better managing their operations while lowering costs, boosting efficiency, and enhancing competitiveness.

What is Oracle Fusion Financials?

Organisations utilise Oracle Fusion Financials, a set of cloud-based financial applications and tools, to manage their financial operations.

Organisations utilise Oracle Fusion Financials, a set of cloud-based financial applications and tools, to manage their financial operations.

Accounting, ordering, procurement, budgeting, and corporate performance monitoring are just a few of the components that are integrated.

Self-service financials, mobility, multilingual support, compliance reporting, and module integration are just a few of the features that Oracle Fusion Financials has to offer.

Mobility capabilities will provide mobile access to financial data, facilitating user connectivity and mobile collaboration.

The module integration function enhances the accuracy of the financial data by enabling users to follow information across various modules and receive changes in close to real-time.

Additionally, Oracle Fusion Financials offers analytics capabilities for insights into financial performance, enabling businesses to spot trends and take appropriate action.

In conclusion, Oracle Fusion Financials is a potent cloud-based technology that supports compliance demands and streamlines financial processes for businesses.

The suite is made up of a number of modules that may be combined to fulfil the unique requirements of the organisation.

Definition of Oracle Fusion Financials

A comprehensive software package for companies of all sizes, Oracle Fusion Financials supports a wide range of financial management features. It offers the most complete and modern selection of financial tools for effectively managing and analysing financial data.

The Oracle Fusion Financials package offers real-time information, makes financial processes simpler, and enables swift responses to market developments. All of the financial data is integrated into a single database since it is designed on a single platform.

This integrated platform makes it possible to manage sales orders, receivables, account payable, and other things effectively, every stage removes manual data entry.

Oracle Fusion Financials enables better financial reporting and control, the suite offers features including real-time budgeting, monitoring, and pricing these functions guarantee that Oracle Fusion Financials will provide you the best possible control over your financial operations.

Additionally, Oracle Fusion Financials provides a cutting-edge security architecture for complete visibility, auditability, and adherence to institutional and commercial laws. To assist you in making better decisions more quickly, it also provides a comprehensive set of business analytics and reporting tools.

From purchase through payment, Oracle Fusion Financials simplifies the whole financial process. It speeds up manual procedures and facilitates multi-company/subsidiary financial transactions.

What does Oracle Fusion Financials do and what is Oracle Fusion Financials used for?

An ERP platform called Oracle Fusion Financials was created to offer organisations in several sectors integrated, cloud-based financial management solutions.

The programme is intended for multinational companies that want to improve productivity while addressing their accounting, planning, and budgeting difficulties.

A variety of financial modules particularly created for businesses across sectors are included in Oracle Fusion Financials, a component of Oracle’s Fusion Applications family.

Organisations may manage their finance and accounting activities on a single integrated platform inOracle Fusion Financials.

Users may create complete financial plans for organisations using this one-stop solution, and they can obtain visibility across many different aspects.

The platform’s ability to swiftly build and deploy financial models gives customers the ability to precisely predict financial landscapes and assess hedging tactics.

Additionally, Oracle Fusion Financials enables more customisation of financial procedures.

The system enables users to create flows and procedures that may initiate particular activities, and it also supports automated workflows.

Additionally, Oracle Fusion Financials facilitates regulatory compliance.

Oracle Fusion Financials Training

How does Oracle Fusion Financials work?

A robust enterprise resource planning (ERP) tool called Oracle Fusion Financials is made to assist businesses in streamlining their financial procedures and enhancing overall workflow management.

The programme focuses on giving users an effective way to handle financial data, including accounts payable (AP) and receivable (AR), transactional processing, analytics, and risk management.

The integrated business processes and solutions that come with Oracle Fusion Financials are made to work together to produce effective data mining, reporting, and analytics experiences.

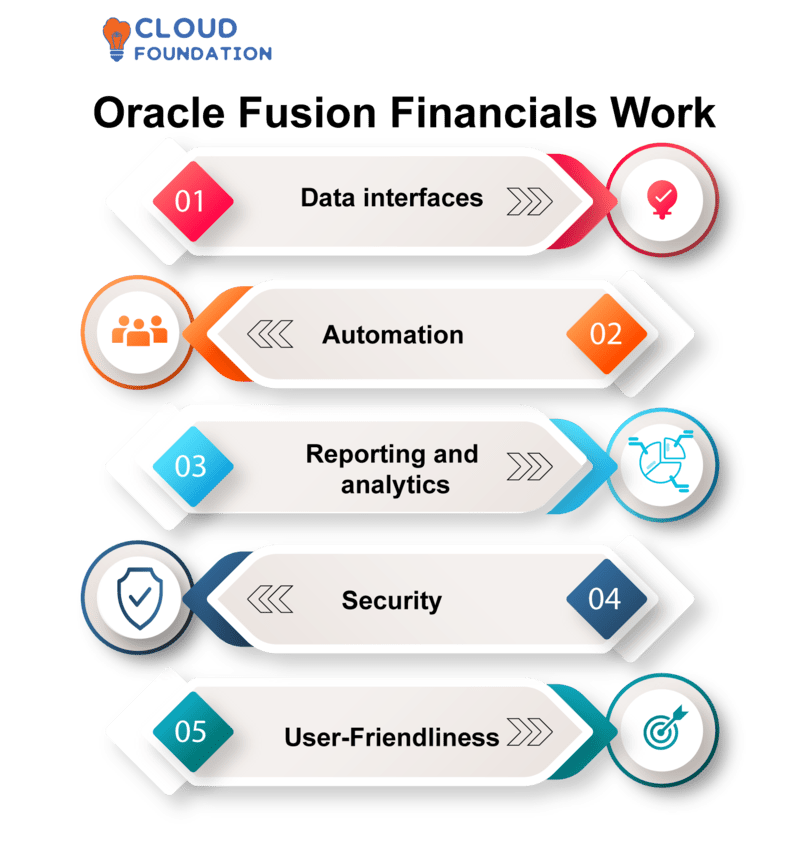

Data interfaces: Secure data interfaces are offered by Oracle Fusion Financials, enabling customers to quickly and efficiently combine their financial data with other systems. These connections aid in ensuring the accuracy of all financial data.

Data interfaces: Secure data interfaces are offered by Oracle Fusion Financials, enabling customers to quickly and efficiently combine their financial data with other systems. These connections aid in ensuring the accuracy of all financial data.

This enables businesses to quickly understand their finances and aids in improved decision-making.

Automation: Integrated automation features, Oracle Fusion Financials enables businesses to automate their financial procedures.

For instance, businesses might programme automatic recurring tasks like processing invoices and payments. The financials are constantly up to date and more effective in this automation.

Reporting and Analytics: Oracle Fusion Financials provides in-depth reporting and analytics, enabling customers to get insight into the health of their financial situation. The reporting and analytics software enables businesses to examine their financial accounts, make financial projections, and obtain insights into their financial performance.

Security: Oracle Fusion Financials places a high premium on security since the system allows users to impose access restrictions and stop unauthorised access to financial data.

Users may safely restrict who has access to certain data using different degrees of permission control, preventing unauthorised persons from accessing it.

User-Friendliness: Oracle Fusion Financials is intended to be simple to use, enabling users to set up and manage financial entries and transactions with ease.

Users can easily navigate the programme and manage their finances to its easy user interface.

Overall, Oracle Fusion Financials offers businesses a whole financial management solution that is intended to improve workflow and assist organisations’ financial operations become more efficient.

Oracle Fusion Financials may assist organisations in improving their operations and gaining a better knowledge of their financials capabilities like automation, reporting, and analytics, as well as secure data interfaces.

Why Oracle Fusion Financials and what are the benefits of Oracle Fusion Financials?

An integrated set of financial cloud services called Oracle Fusion Financials aids organisations in streamlining and automating their financial operations.

These cloud-based services give businesses complete, real-time access into financial data and aid in decision-making.

Deeper visibility into financial performance is provided by Oracle Fusion Financials, which also offers increased agility, scalability.

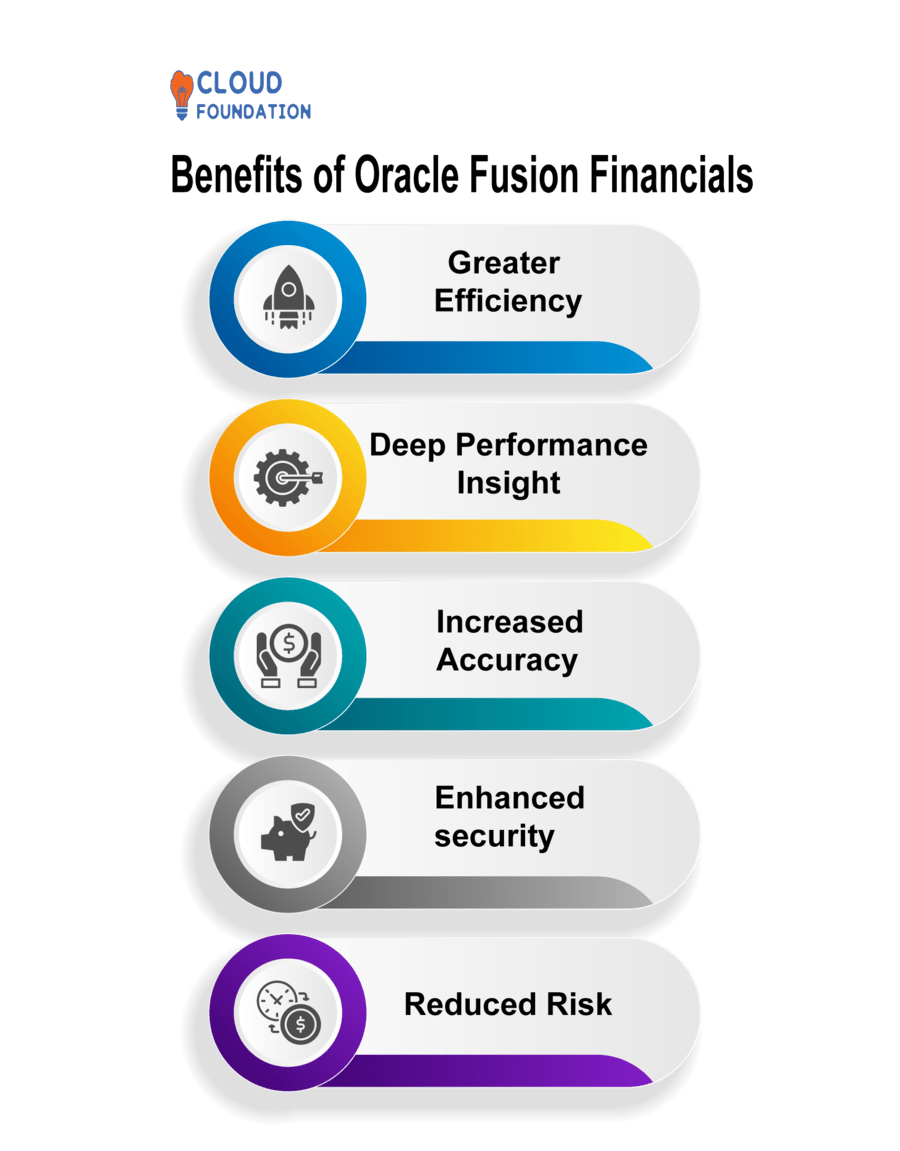

Greater Efficiency: The budgeting, accounts payable, accounts receivable, and order-to-cash operations are all streamlined and automated using Oracle Fusion Financials. Your company will save time and money because of the increased efficiency and decreased chance of manual error.

Greater Efficiency: The budgeting, accounts payable, accounts receivable, and order-to-cash operations are all streamlined and automated using Oracle Fusion Financials. Your company will save time and money because of the increased efficiency and decreased chance of manual error.

Deep Performance Insight: Oracle Fusion Financials gives users real-time access to financial data and trends, you may better comprehend, manage, and put your financial strategies into action with improved understanding.

Increased Accuracy: Organisations can assure financial reporting, planning, and forecasting accuracy with the aid of Oracle Fusion Financials, you are able to generate financial statements that are more accurate and timelier by using automated procedures and integrated source data.

Enhanced Security:Oracle Fusion Financials offers improved security features to shield your financial information from outside dangers.

Reduced Risk: The integrated technological structure and policies of Oracle Fusion Financials assist to lower financial, operational, and compliance risks.

Finally, Oracle Fusion Financials provides a full range of integrated financial cloud services that accelerate and automate financial activities.

Oracle Fusion Financials may increase productivity, provide users better access to financial data, guarantee the accuracy of financial reporting, and support the reduction of operational and regulatory risks.

What are the advantages of Oracle Fusion Financials?

A complete, contemporary finance suite from Oracle, Oracle Fusion Financials delivers integrated applications that promote productivity, visibility, and control over your financial operations. Here are a few of Oracle Fusion Financials’ main.

Greater visibility:Oracle Fusion Financials provides a 360-degree view of all operational and financial data, allowing operational and financial teams to quickly access the same data.

Greater visibility:Oracle Fusion Financials provides a 360-degree view of all operational and financial data, allowing operational and financial teams to quickly access the same data.

Organisations have greater access to information about the financial performance to this increased visibility, which can be utilised to make wise decisions.

Automated Financial activities: Oracle Fusion offers the automation of a number of financial activities, including the processing of invoices, payments, and computations, which reduces human error and boosts productivity.

Organisations can speed up the closing process, lower accounting mistakes, and boost financial reporting accuracy by automating financial procedures.

Improved User Experience:Oracle Fusion Financials offers consumers a user-friendly interface that is simple to operate, explore, and comprehend.

Users may operate the system more quickly and easily without requiring lengthy Oracle Fusion Financials training with straightforward interface.

Simplified Information Production: Oracle Fusion enables businesses to monitor, manage, and analyse data in real-time, enabling the quick creation of reports, dashboards, and personalised analytics, organisations are able to make better judgements to the increased output and quality of information.

Consolidated Financial Data: Businesses can combine financial data from several sources into a single repository that all employees can access.

As a result, businesses are able to conduct more stringent audits and gain better insight into their financial performance. Financial data is also always up to date.

Integration of ERP and CRM Systems: By integrating ERP and CRM data with financial operations, Oracle Fusion enables businesses to have a better understanding of their customers’ preferences, performance, and behaviours, this aids businesses in making wiser selections.

Lower Operating expenses: Oracle Fusion assists businesses in lowering operating expenses, enhancing financial reporting accuracy, and decreasing human mistakes.

Improvements in financial visibility and operating cost reductions can encourage strategic development and higher profitability.

Organisations may gain from an integrated system that offers better visibility, automated financial operations, and simplified information creation with Oracle Fusion Financials. Organisations may use Oracle Fusion to acquire the insights required to boost competitive advantage, boost productivity, and boost profitability.

Oracle Fusion Financials Online Training

What is Oracle Fusion Financial software and how to use Oracle Fusion Financials?

An integrated set of enterprise resource planning (ERP) solutions called Oracle Fusion Financials is intended to assist businesses manage their finances.

Reporting, budgeting, forecasting, accounting, and compliance are just a few of the duties that the programme is intended to assist organisations with.

The software is very scalable and gives businesses the option to customise it to meet their own requirements.

Oracle Fusion Financials is a complete enterprise resource planning (ERP) tool that was made by Oracle. It helps companies see what’s going on, make the best use of their resources, run their global business, and meet legal requirements.

Oracle Fusion Financials is a complete enterprise resource planning (ERP) tool that was made by Oracle. It helps companies see what’s going on, make the best use of their resources, run their global business, and meet legal requirements.

Oracle Fusion Financials gives a full view of all financial processes, including accounts payable, accounts receivable, planning, and the general ledger. Dummies makes it possible to start and run both front office and back-office processes with a single system.

This lets organisations quickly set up systems that work the same way everywhere and can grow as needed.

Enterprise marketing, customer relationship management (CRM), supply chain management (SCM), enterprise planning, business process management (BPM), and Human Capital Management (HCM) are a few examples of the industry-specific solutions that organisations may use.

Additionally, Oracle Fusion Financials gives customers the option to link with pre-existing corporate applications to improve operational efficiency and optimise procedures.

Oracle Fusion Financials Products

Oracle General Ledger: For all of an organization’s financial management requirements, including general ledger, account receivable, account payable, fixed assets, cost management, and more, it offers an integrated, worldwide Enterprise Resource Planning (ERP) solution.

Oracle Accounts Payable: With the help of this module, organisations may efficiently manage their accounts payables, along with the payments and invoices that go along with it. It helps businesses to fully automate the accounts payment process, minimise human work, and increase supplier discounts.

Oracle Accounts Receivable: This programme automates every step of managing accounts receivables (AR), from taking client orders to generating invoices and collecting payments.

Additionally, it offers a variety of methods for controlling consumer receivables and lowering late payments.

Oracle Fixed Assets: This module aids in the correct and effective tracking and management of a company’s fixed assets, including real estate, buildings, and other physical fixed assets

Oracle Cash administration: automates the administration of bank accounts and cash, allowing businesses to better manage their worldwide cash position, cut costs by automating banking operations, and improve insight into cash flows.

Oracle eBusiness Tax: This instrument aids businesses in managing the difficulties of tax compliance across several countries. It uses an automated procedure to process invoices and credit cards, takes care of tax filing and payment, and generates analysis and reports that make process monitoring and auditing simple.

Oracle Project Financial Management: This module ties with Oracle’s planning, tracking, and accounting tools to enable cost storage for project-related expenditures, expense management, and budget management.

Oracle Financial Data Quality Management: With the use of this tool, businesses can make sure that financial data is accurate and comprehensive. In addition to reporting tools for locating and resolving data quality problems, it offers configuration tools to validate, convert, and enrich financial data across the company.

Oracle Receivables: With the help of this module, businesses may collect and handle payments and invoices from clients centrally. Additionally, automated cash application services and dispute resolution

What are the best ways to learn Oracle Fusion Financials?

Learning Oracle Fusion Financials is essential for organizations, as it provides the tools and functionalities needed to run financial operations.

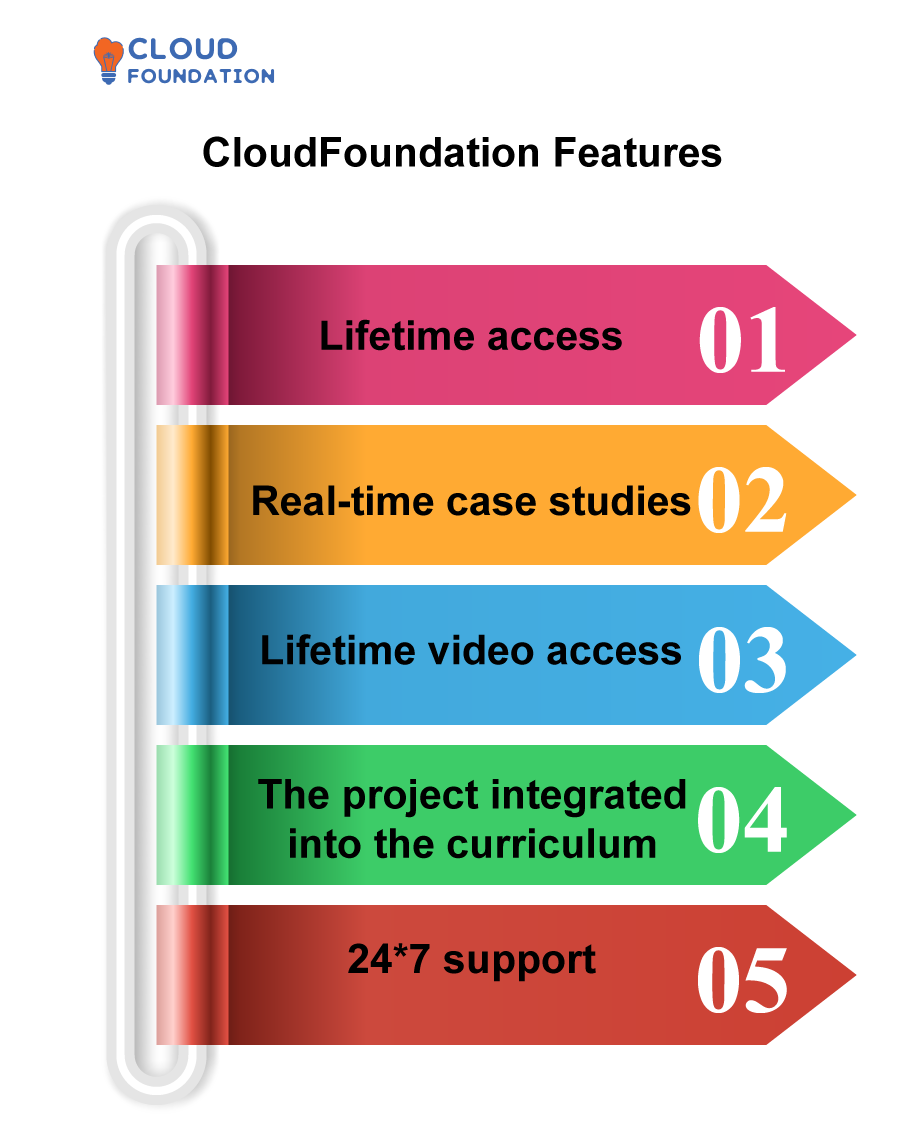

It’s crucial to sign up for an online training platform since it gives you the chance to use excellent learning resources.

Enrolling in Oracle Fusion Financials courses enables you to access Oracle Fusion Financials learning resources such as Oracle Fusion Financials Pdfs, materials, Course contents and networking with professionals, and assists you to master new skills here.

Oracle Fusion Financialsonline classes andOracle Fusion Financials training videos provide a quick overview of the financial management system in use. Without an effective and competitive financial management system in place, business potential and profitability may be restricted.

Keeping up with Oracle Fusion Financials blog updates is the key goal. Ultimately, it demonstrates how to streamline financial procedures and beat out the competitors.

CloudFoundation is one of the major platforms that provides online training for Oracle Fusion Financials.

Additionally, online education gives you the flexibility to learn whenever and wherever you choose, which is crucial in the very digitalized society we live in today.

Oracle Fusion Financials Course Price

Sindhuja

Author