SAP Revenue Accounting & Reporting Training

Introduction to SAP Revenue Accounting & Reporting

SAP Revenue Accounting & Reporting is a comprehensive solution developed to facilitate the effective management of revenue recognition processes inside enterprises. This may give companies insights into their revenue sources and timely data, enabling educated choices based on reliable analysis.

To ensure that the procedures associated with revenue recognition are as smooth as possible, SAP Revenue Accounting & Reporting uses advanced automation technologies to automate the calculations, adjustments, and disclosures connected to revenue recognition.

SAP income Accounting is a module that, when integrated with other SAP modules such as Sales and Distribution and Financial Accounting, provides businesses with a holistic picture of the income generated from contracts throughout the whole organization.

Today’s companies need a reliable revenue accounting and reporting method to compete successfully in the modern, constantly shifting global business landscape.

Today’s companies need a reliable revenue accounting and reporting method to compete successfully in the modern, constantly shifting global business landscape.

It helps simplify complicated revenue recognition procedures and boost financial statement transparency and control. Companies using it reduce the risk of noncompliance while providing an audit trail of transactions to satisfy regulatory mandates.

As more and more companies use subscription and usage-based pricing models as part of their digital transformation initiatives, it becomes ever more essential to the success of company operations.

The SAP Revenue Accounting Reconciliation module, makes handling various revenue sources and contracts simple, enabling businesses to adjust to changing business requirements more readily.

Definition of SAP Revenue Accounting & Reporting

It is intended to assist businesses in the management of their revenue processes as well as the reporting of those operations. It offers a complete accounting system for all forms of income, including sales, service revenue, and revenue based on subscriptions, among other sorts.

The primary objective of SAP Revenue Accounting & Reporting is to guarantee correct revenue recognition, assure compliance with accounting rules, and expedite the reporting of financial data.

This solution allows businesses to automate revenue recognition procedures, create thorough financial reports, monitor income across various goods and services, and manage revenue overall.

In addition, real-time visibilitymakes it possible to analyse and predict revenue patterns, providingvaluable insights that help strategic decision-making.

In addition, real-time visibilitymakes it possible to analyse and predict revenue patterns, providingvaluable insights that help strategic decision-making.

SAP Revenue Accounting & Reporting provides a consolidated platform for managing revenue operations, guaranteeing uniformity and transparency in financial reporting. These benefits may be realized by using the software.

It interfaces with third-party vendors’ other SAP modules and systems to simplify data flow and improve operational efficacy. In addition, it helps organisations conform to accounting standards such as IFRS 15 and ASC 606, amongst others, ensuring compliance with different regulatory obligations.

In general, SAP Revenue Accounting & Reporting enables organisations to keep their revenue records correct and in compliance while also giving essential insights that can be used to promote development and profitability.

SAP Revenue Accounting & Reporting Training

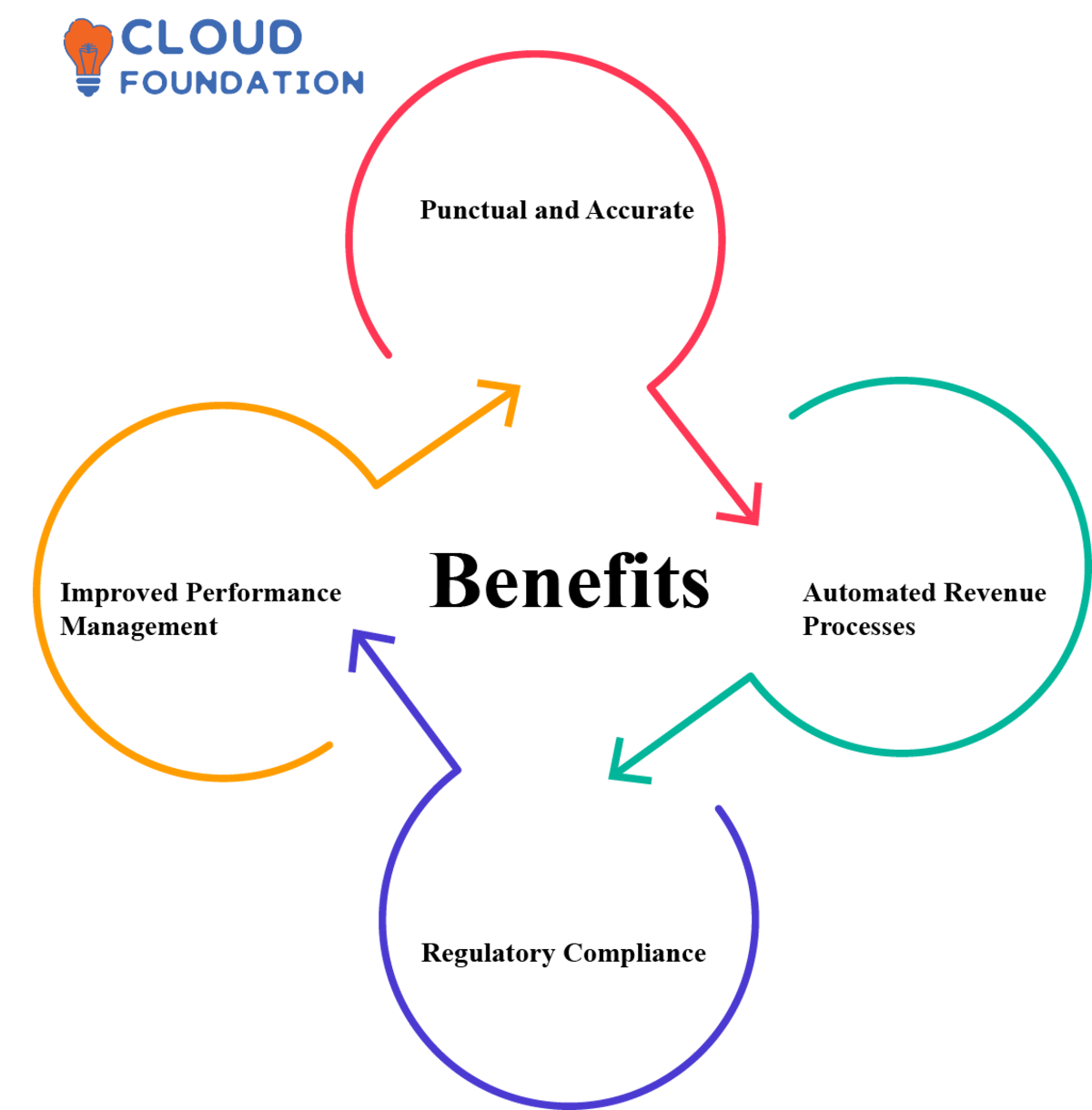

Benefits of SAP Revenue Accounting & Reporting

Punctual and Accurate:SAP Revenue Accounting & Reporting guarantees that the recognition of revenue conforms with applicable accounting regulations and processes, reducing oversights while also assuring accurate financial reporting.

Punctual and Accurate:SAP Revenue Accounting & Reporting guarantees that the recognition of revenue conforms with applicable accounting regulations and processes, reducing oversights while also assuring accurate financial reporting.

Automated Revenue Processes:It allows organisations to automate their revenue processes, eliminating manual data entry and human errors while making firms more efficient and freeing them up for other vital activities. It saves time, increases efficiency, and allows firms to focus on more pressing needs. Regulatory Compliance:Verifying that a company complies with various laws and accounting standards, such as ASC 606 and IFRS 15, may help guarantee that a company complies with all applicable legislation and does not suffer any penalties or fines.

Improved Performance Management:The real-time analytics and reporting capabilities allow firms to monitor revenue performance, identify bottlenecks, and make data-based decisions to promote rapid revenue growth. It provides accurate and transparent income data storage systems, offering one source of truth while increasing data accuracy and transparency, simplifying auditing efforts,and decreasing the chances of fraud occurrence. This makes auditing more straightforward while reducing potential cases of theft by outsiders.

Prerequisites of SAP Revenue Accounting & Reporting

The Core Concepts of Financial Accounting for the SAP Revenue Accounting & Reporting software must be used efficiently and effectively. A full grasp of accounting principles, including revenue recognition, accrual accounting, and matching codes, is essential for the program’s deployment.

This skill must also allow efficient use of software to report financial information, such as revenue correctly.

Candidates for the SAP Financial Supply Chain Management (FSCM) certification must show they are familiar with SAP Systems Revenue Accounting & Reporting. To use this application effectively for you mustthoroughly grasp all essential issues, particularly system processes like data flow.

Candidates for the SAP Financial Supply Chain Management (FSCM) certification must show they are familiar with SAP Systems Revenue Accounting & Reporting. To use this application effectively for you mustthoroughly grasp all essential issues, particularly system processes like data flow.

Discovering which SAP modules communicate with one another and which SAP features are accessed or used by each SAP module is of great use.

For those strategies that have something to do with money, it is essential to understand financial processes such as order-to-cash or procure-to-pay, notably the recording of transactions and the identification of income.

To correctly install and take advantage of SAP revenue accounting &and reporting, financial reporting must first be developed.

It is necessary to have this level of knowledge to install and successfully run sap revenue accounting & reporting.

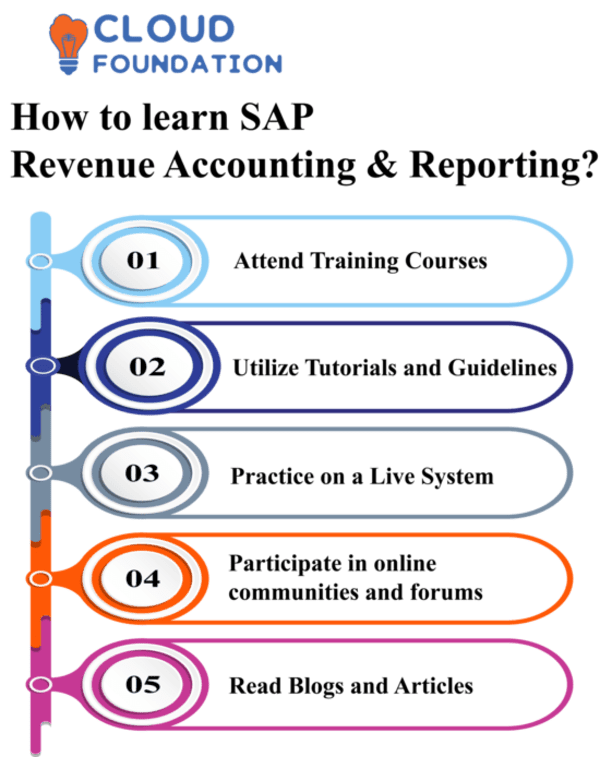

How to learn SAP Revenue Accounting & Reporting?

Attend Training Courses: SAP provides in-person and online training programsto give the students a comprehensive introduction to the features and functions of the software, including how the features and functions are used. If you attend these lectures, you will have a solid foundation in the CloudFoundation subject matter because you participated in them.

Attend Training Courses: SAP provides in-person and online training programsto give the students a comprehensive introduction to the features and functions of the software, including how the features and functions are used. If you attend these lectures, you will have a solid foundation in the CloudFoundation subject matter because you participated in them.

Utilize Tutorials and Guidelines: offers many tutorials and guidelines online that can assist in your study of modules step-by-step, presenting an organised study approach and helping to ensure you better comprehend concepts. These materials offer an organised way of approaching each subject area.

Practice on a Live System: For optimal learning, hands-on experience with it is ideal. A demo system or trial version is anexcellent method of doing just this. It lets you get your hands dirty with its features and functions, which helps you better understand how those features and capabilities are used in the real world.

Participate in online communities and forums:SAP Revenue Accounting & Reporting experts and users have numerous forums dedicated to their industry; by joining one, these communities provide you with a chance to connect with professionals and learners alike, pose queries, exchange knowledge and experiences, and network.

Read Blogs and Articles: Many SAP consultants use blogs and articles as resources to share knowledge. By staying abreast of SAP Revenue Accounting & Reporting developments and trends using these resources and benefitting from experts’ experiences, these can help keep you abreast of products and trends while CloudFoundation offering valuable knowledge from experienced practitioners.

SAP Revenue Accounting & Reporting Online Training

Modes of learning SAP Revenue Accounting & Reporting

Instructor-Led Training (ILT): Instructor-led training is a classroom-based method whereby an experienced trainer gives classes physically and instructs learners in basic principles while the CloudFoundation is outlining processes with diagrams; they then provide opportunities for hands-on practice sessions with trainees. This type of learning method is sometimes called traditional or “classroom”.

Instructor-Led Training (ILT): Instructor-led training is a classroom-based method whereby an experienced trainer gives classes physically and instructs learners in basic principles while the CloudFoundation is outlining processes with diagrams; they then provide opportunities for hands-on practice sessions with trainees. This type of learning method is sometimes called traditional or “classroom”.

Corporate Training:This is done inside an organisation for its personnel, and it may take place in-person or online, depending on the employer’s preference. CloudFoundation has been modified to fulfil the prerequisites set out by the firm, and employees can schedule their training sessions at the most convenient time.

Certification Programs: SAP offers various certifications for professionals who want to enhance their Revenue Accounting and reporting skills and knowledge. These programs usually involve a combination of classroom training and self-study with an exam at the end to assess the understanding of the subject.

On-Job Training: By choosing this instructional method, learners will experience SAP Revenue Accounting and Reporting while working on actual projects in real life. During this learning experience, more experienced coworkers or mentors advise by sharing their theoretical knowledge and practical experience.

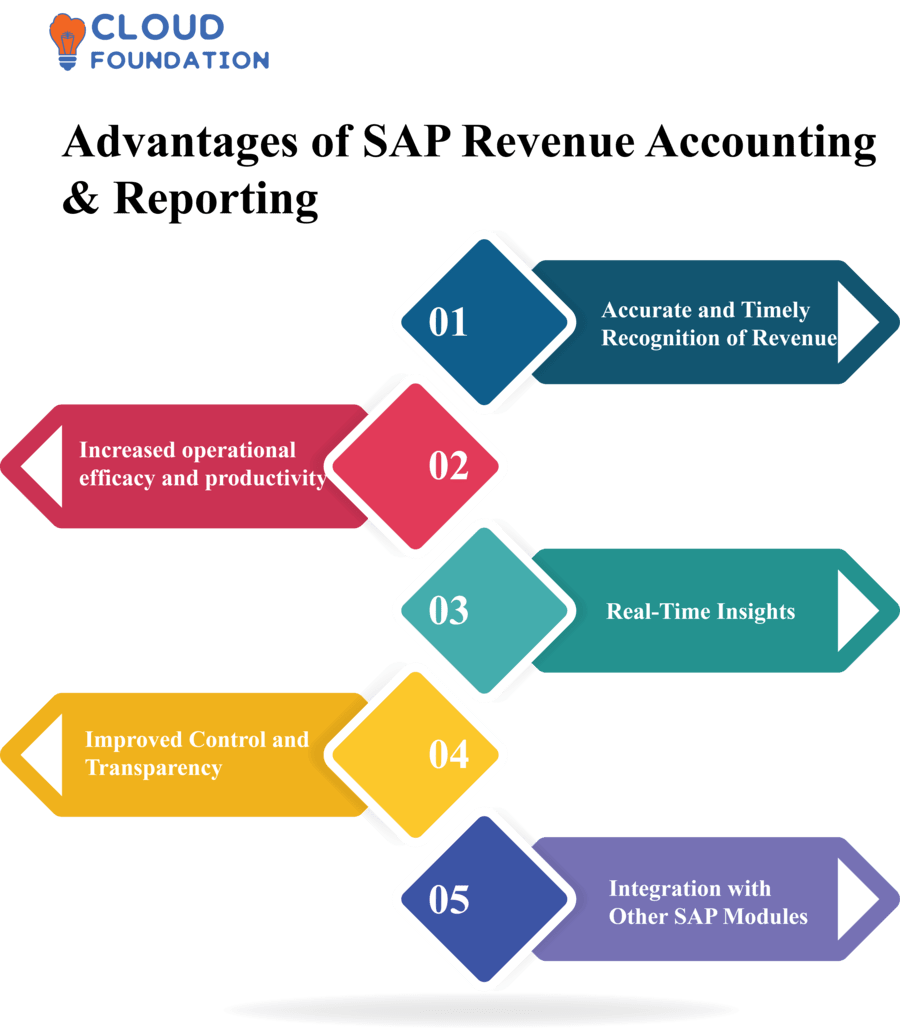

Advantages of SAP Revenue Accounting & Reporting

Accurate and Timely Recognition of Revenue: When utilised correctly, SAP Revenue Accounting & Reporting ensures accurate revenue recording, resulting in timely and precise recognition.

Accurate and Timely Recognition of Revenue: When utilised correctly, SAP Revenue Accounting & Reporting ensures accurate revenue recording, resulting in timely and precise recognition.

By automating revenue recognition processes with precision and consistency in recording revenue figures, firms can better comply with accounting regulations while mitigating risks related to legal or financial repercussions of accounting regulations and requirements more efficiently and safely.

Increased operational efficacy and productivity:Using SAP Revenue Accounting & Reporting, firms can reduce the amount of manual labour required for accounting operations while streamlining those processes. Employees are released from the responsibility of repeatedly doing data entry duties, allowing them to focus more intently on strategic concerns, enhancing both productivity and efficiency.

Real-Time Insights: Businesses using this solution gain real-time insights into their revenue data, giving them real-time insight to inform decisions and more efficiently manage income. Recognising trends, patterns, and outliers makes it easier to take appropriate actions toward improving revenue performance.

Improved Control and Transparency: SAP Revenue Accounting & Reporting provides businesses with one platform for revenue management that offers enhanced control and transparency at every point in the revenue life cycle, from revenue collection from different sources through insights into revenue streams to watching how money affects financial statements.

Integration with Other SAP Modules: Our solution seamlessly connects to other SAP modules like Financial Accounting, Sales and Distribution, and Project Systems to provide an organization-wide view of revenue data – effectively eliminating data silos while increasing data accuracy at once.

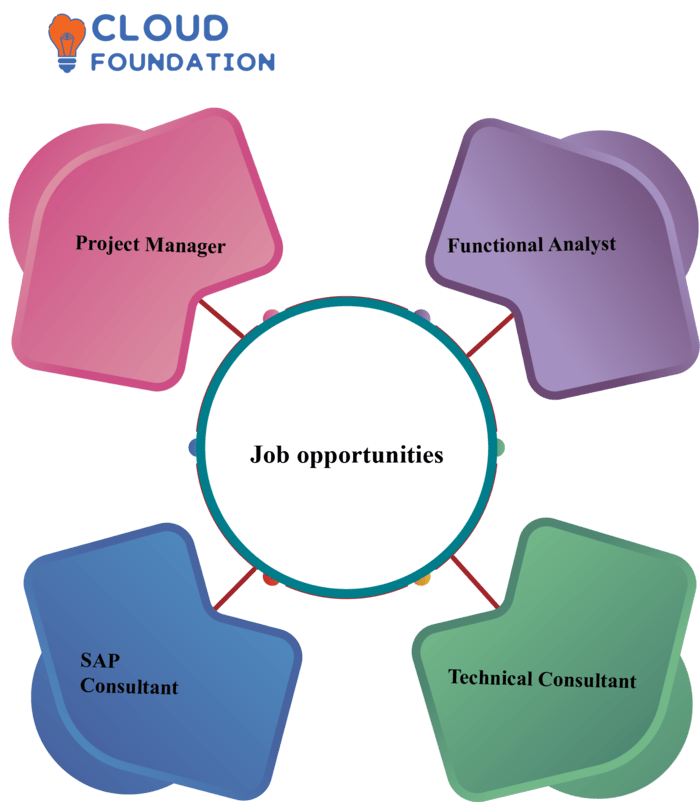

Job opportunities in SAP Revenue Accounting &and Reporting

SAP Consultant: SAP Revenue Accounting & Reporting consultant advises clients on how to install and get the most out of SAP products so that customers may be served more effectively by the customers’ businesses.

SAP Consultant: SAP Revenue Accounting & Reporting consultant advises clients on how to install and get the most out of SAP products so that customers may be served more effectively by the customers’ businesses.

This position provides chances in SAP Revenue Accounting & Reporting, one of your responsibilities. Other responsibilities include understanding client needs to configure systems according to thoserequirements, completing quality assurance testing processes as required, and teaching end users about them.

Project Manager: The primary task that falls on your shoulders is to oversee and supervise the client deployment of the SAP Revenue Accounting & Reporting software CloudFoundation this includes everything from scheduling, budgeting, and resource allocation to monitoring success indicators for team members working on projects.

You will oversee every part of the deployment to ensure it runs according to plan, including providing advice and instructions when required.

Functional Analyst: for SAP Revenue Accounting & Reporting, your primary responsibility will be to collaborate closely with clients to get a deeper comprehension of the business processes they use before transforming the resulting needs into specifications for the information technology infrastructure that will be used to support SAP Revenue Accounting & Reporting. After that, it is up to you to develop additional features while simultaneously configuring it and making adjustments so that it can fulfil your customers’ requirements.

Technical Consultant for SAP Revenue Accounting & Reporting:Responsibilities include Planning, developing, and implementing technical solutions will be at the forefront of your responsibilities as a technical consultant for SAP Revenue Accounting & Reporting. In many cases, this necessitates the creation of bespoke reports, interfaces, and updates that are expressly geared toward fulfilling the organisation’s needs.

Conclusion to the SAP Revenue Accounting Reporting

In the entire blog of CloudFoundation, we have given some clarity about it, and here, once again, we recall all the information from top to bottom. We first learned an introduction to the SAP Revenue Accounting Report, which is flexible support to all businesses.

We can define it as offering a complete accounting system for all forms of income, including sales, service revenue, and revenue based on subscriptions, among other sorts.

Then we learnt how much the technology provides benefits like automated revenue processes. We got the information on Prerequisites, how to know the SAP revenue accounting reporting through the certification programs, reading the books and blogs, and guidelines. And we got the information about the modes, advantages and job opportunities of different kinds.

SAP Revenue Accounting & Reporting Course Price

Shekar

Author