SAP FSCM Training & Its Importance

I’m excited to share with you today an application of software that may be put to good use in the business of finance and accounting.

This blog provides an in-depth introduction to SAP FSCM training, from which readers may get a career path map.

Let’s get into it without a minute’s delay.

Overview of SAP FSCM

SAP Financial Supply Chain Management (FSCM) integrates solutions optimising financial processes, increasing transparency, and mitigating risk.

SAP ERP’s FSCM can effectively manage cash flows, credit lines, collections accounts and disputes.

FSCM gives organisations real-time financial data that enhances decision-making and cash flow management, saving time and money while decreasing errors through automation and optimisation capabilities.

FSCM’s Cash and Liquidity Management service provides real-time visibility of cash levels, inflows/outflows, and projections to help firms manage cash flow and increase liquidity, reducing external borrowing and financing costs.

FSCM also assists organisations in setting and monitoring consumer credit limits, assessing creditworthiness and managing risks through credit management; this allows organisations to improve credit management practices,decrease harmful debt levels and boost profits.

SAP FSCM provides integrated solutions that simplify financial processes, increase liquidity and minimise risk while increasing productivity for companies to improveeconomic security and success.

Companies using FSCM as part of their finance management solution may experience more excellent stability and success by managing their finances better with this tool.

Define SAP FSCM

SAP Financial Supply Chain Management (FSCM) refers to an umbrella collection of solutions provided by SAP that help companies optimise both financial processes and supply chain operations efficiently.

SAP FSCM provides essential financial management topics like cash and liquidity, credit and collections, invoices and payables, and dispute resolution.

Moreover,FSCM helps firms improve their financial processes, reduce manual effort and errors, and gain more significant insights into overall financial performance to enhance efficiency while simultaneously cutting costs.

SAP FSCM helps firms improve cash flow, lower operating expenses, and maximise overall financial performance.

What is SAP FSCM?

Financial Supply Chain Management (FSCM) software from SAP helps companies effectively oversee all financial activities across their supply chains, optimising cash flow, mitigating risks and increasing performance through modern technologies, best practices and corporate procedures.

SAP FSCM allows firms to coordinate information from procurement to payment.

SAP FSCM centralises financial data across your enterprise for real-time cash flow and liquidity insight, helping businesses better manage working capital, reduce expenses, make evidence-based decisions and take data-driven approaches.

“Accounting is the language of business, and business is the art of making money.”

SAP FSCM’s credit rating and restrictions capabilities help assess customer and supplier credit worthiness and minimise risks.

SAP FSCM streamlines vendor invoice management to accelerate and ensure timely vendor payments – helping firms strengthen supplier connections and payment terms.

It also provides analytical tools and reports on cash flow, working capital management and risk exposure – helping companies proactively oversee finances while making strategic decisions to increase performance.

Overall, SAP FSCM enhances supply chain financial management and control. Companies use it to streamline procedures, optimise cash flow management and minimise risks, thereby increasing financial results and business success.

SAP FSCM Training

Modes of SAP FSCM

SAP Treasury and Risk Management (FIN-FSCM-TRM),

SAP Biller Direct (FIN-FSCM-BD),

SAP Cash and Liquidity Management (FIN-FSCM-CLM),

SAP Collections Management (FIN-FSCM-COL),

SAP Credit Management (FIN-FSCM-CR),

SAP Dispute Management (FIN-FSCM-DM)

SAP In-House Cash (FIN-FSCM-IHC).

SAP Bank Communication Manager (FIN-FSCM-BCM)

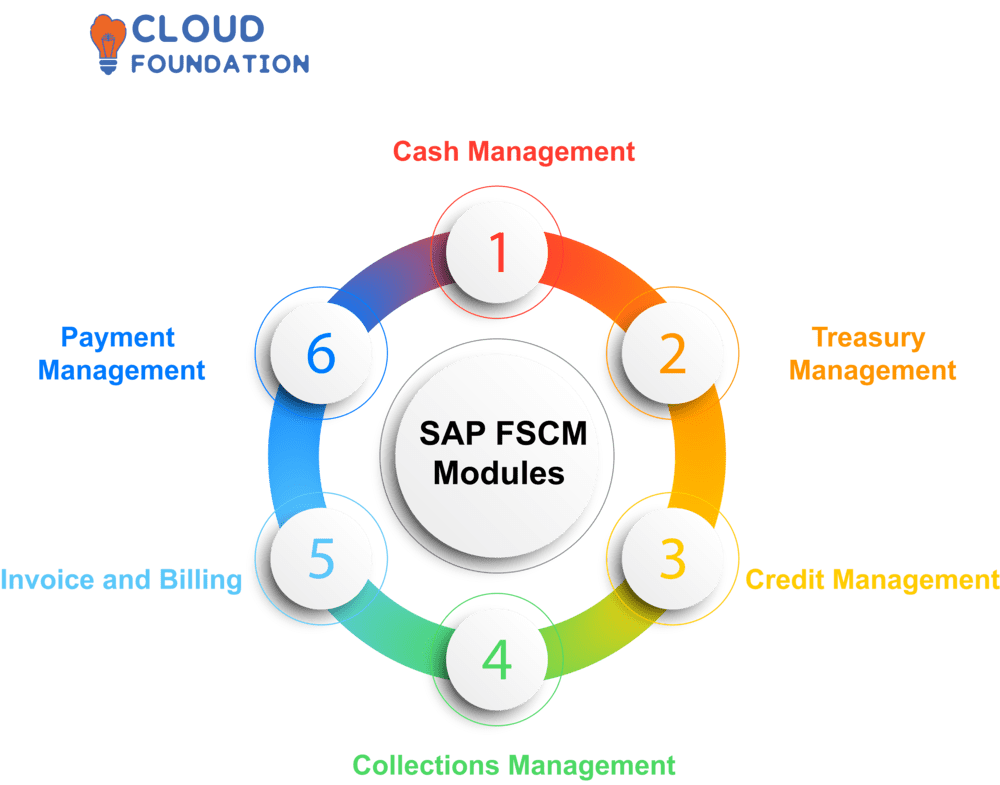

What are the modules of SAP FSCM?

SAP Financial Supply Chain Management (FSCM) provides an integrated solution for financial supply chain management. Comprised of various modules working together as one comprehensive system to control cash, liquidity and risk issues across your supply chains – these modules include the following.

Cash Management: With this module, you can efficiently oversee all aspects of cash, liquidity and bank relationships in real-time – providing real visibility into cash positions to optimize cash flow and make sound decisions.

Treasury Management: With this module, you can effectively oversee your liquidity, risk and investments. Featuring cash forecasting tools as well as liquidity planning and risk mitigation techniques that assist in optimizing financial resources to optimize returns for investments and optimize cash flows.

Credit Management: With this module, you can effectively oversee credit risk and customer relations while improving satisfaction by investigating, monitoring, and controlling credit more efficiently. It offers solutions for credit investigation, monitoring and management that enable you to reduce credit risks while increasing customer satisfaction.

Collections Management: With this module, you can effectively oversee all stages of the collection process including dunning, dispute resolution and payment processing. With tools designed to automate and optimize collection procedures allowing for increased cash flow while decreasing days sales outstanding (DSO).

Invoice and Billing: This module handles the invoicing and billing processes from creation of invoices through customer account administration to processing payments. With its tools for automating and optimizing invoicing processes, allowing cash flows to improve while decreasing administrative expenses.

Payment Management: With this module, you can control every stage of the payments process: authorisation, execution and reconciliation. With automated and optimized solutions available for automating or optimizing this payment procedure allowing for better cash flow while decreasing administrative expenses.

SAP FSCM features several essential modules. Each contributes towards creating a comprehensive solution for financial supply chain management, helping optimize cash flow, reduce risks and enhance customer satisfaction.

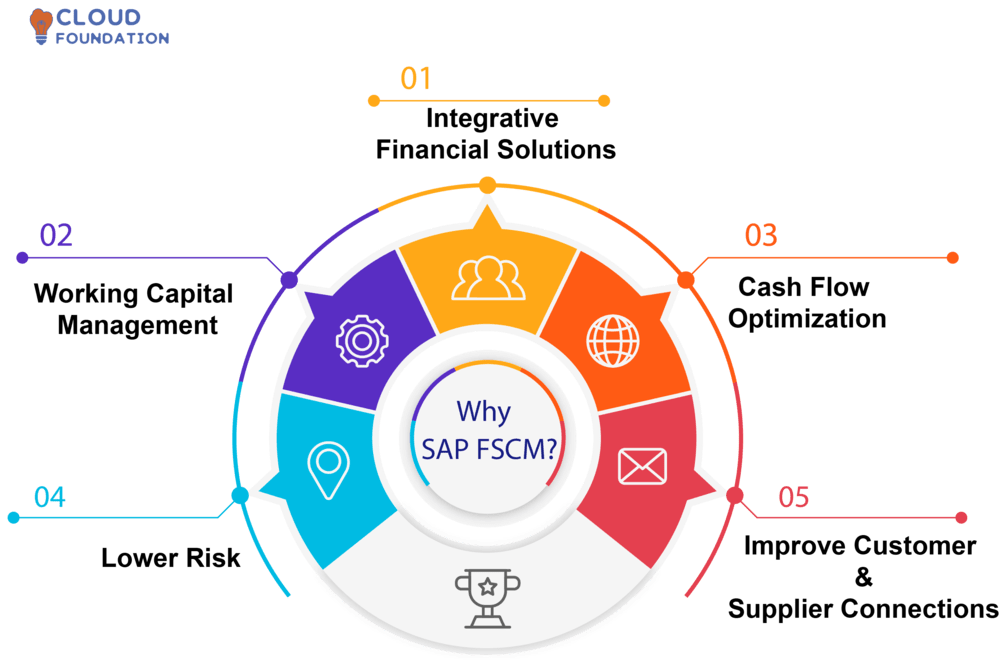

Why SAP FSCM

SAP FSCM integrates technologies to optimise financial processes and cash flows within businesses, helping ensure optimal cash management practices are in place for improved efficiencies.

The following reasons why we should use SAP FSCM:

Integrative Financial Solutions: SAP FSCM interacts smoothly with other SAP modules like ERP, CRM and supplier Relationship Management (SRM).

Integrating SAP FSCM allows firms to employ more effective financial management approaches and make better business decisions with all financial data in one central repository.

Working Capital Management:it is an integral component of SAP FSCM.

This solution aids organisations in optimising their working capital by efficiently overseeing accounts receivable, payable and cash flow management. Businesses can lower the risk associated with shortages in operating capital as a result, improving overall financial health.

Cash Flow Optimization: Through SAP FSCM, firms can view their real-time cash status. With this knowledge, proactive steps may be taken tooptimise cash flow by effectively overseeing payments and collections.

Businesses can mitigate late payment risks, improve cash flow and gain greater financial control through this action.

Lower Risk:SAP FSCM equips firms with capabilities for monitoring and mitigating financial risks such as credit risk management, cash flow forecasting and fraud detection.

Businesses can take proactive steps to lower financial risks and protect their bottom lines if they understand them.

Improve Customer and Supplier Connections:Proper financial oversight allows a business to maintain strong relations with its customers and suppliers, leading to happier working environments.

SAP FSCM’s working capital solutions help organisations improve their payment processes, leading to faster supplier payments and happier consumers.

Overall, this working capital management software solution should be an indispensable addition for organisations looking to enhance financial processes while decreasing risks and optimising cash flows.

By using its integrated solutions, businesses can gain more control of their finances, build stronger relationships with consumers and suppliers, and remain compliant with financial regulations.

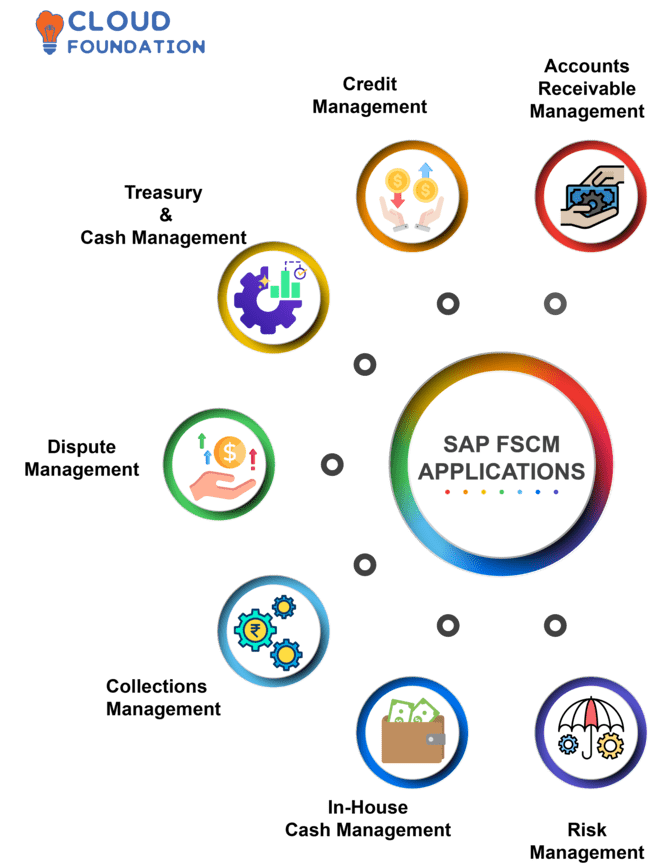

SAP FSCM Applications

SAP Financial Supply Chain Management, or SAP FSCM, is primarily used across a firm’s finances and accounting divisions.

SAP FSCM’s applications typically fall within these divisions:

Accounts Receivable Management – SAP FSCM can assist with managing overdue customer payments, decreasing sales outstanding (DSO) days, and improving cash flow.

Credit Management – Businesses using this solution can establish and administer consumer credit limits, conduct credit checks and monitor exposure in real-time.

Treasury and Cash Management – SAP FSCM provides modules for cash and liquidity management, debt and investment management and bank relationship management that assist businesses in optimising cash flow while mitigating risks to maximise financial safety and reduce financial exposure.

Dispute Management – With this module automating the dispute settlement process, businesses are better positioned to track and address consumer disputes more swiftly and efficiently.

Collections Management – SAP FSCM allows businesses to prioritise and track past-due payments and issue collection letters or dunning notices effectively and efficiently.

In-House Cash Management – Organizations with multiple subsidiaries can leverage this module to consolidate their cash management activities, reducing transaction costs while optimising cash flow.

Risk Management – SAP FSCM allows businesses to utilise it effectively for risk assessment, identification and mitigation related to credit, market and liquidity risks.

SAP FSCM integrates seamlessly with other SAP modules like Accounts Payable, General Ledger and Asset Management for complete financial management solutions for firms.

SAP FSCM Online Training

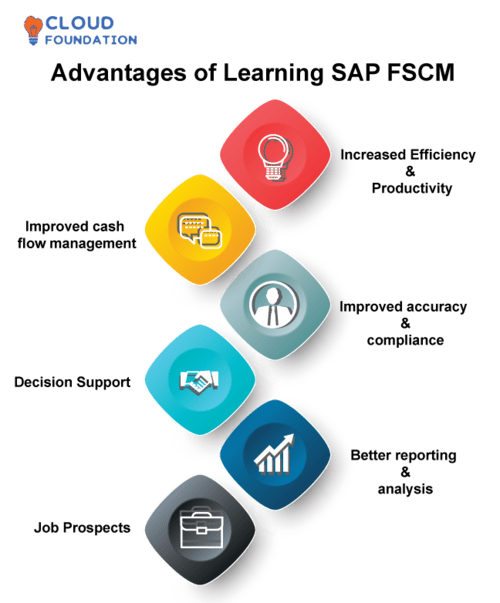

Advantages of Learning SAP FSCM

Increased Efficiency and Productivity: By learning SAP FSCM, you can automate routine operations and streamline financial procedures, increasing your economic team’s efficiency and productivity while freeing them up for more strategic activities.

Improved cash flow management:SAP FSCM gives real-time visibility into your cash flow and provides predictions for better investing, budgeting and cash management decisions.

Improved accuracy and compliance: SAP FSCM adhere to stringent accounting rules and standards, guaranteeing accurate financial reporting and government compliance while helping users avoid penalties or fines due to errors or oversights.

This helps minimise the likelihood of error-induced penalties or fines being assessed against their accounts.

Decision Support: SAP FSCM’s real-time data and analytics provide real-time support in making data-driven decisions about your financial processes, helping identify areas for improvement while optimising cash flow and making educated investment and budgetary decisions.

Better reporting and analysis:SAP FSCM’s reporting and analysis capabilities make for better reports and studies, enabling you to create custom reports and gain insight into your financial data, aiding in identifying patterns, trends and areas for improvement.

Job Prospects: As SAP FSCM specialists become in demand, learning this module could open doors to employment in finance and accounting.

Being familiar with SAP FSCM makes you an asset to companies using this system.

Who should learn SAP FSCM?

SAP FSCM can be utilised and learned by anyone involved with finance or accounting who manages a company’s financial operations, including finance managers, accountants, financial analysts, treasurers, credit managers and other professionals working within these disciplines.

Supply chain management, sales and customer service professionals can benefit from studying SAP FSCM.

Individuals without experience in finance or accounting may still learn SAP FSCM with some effort.

Withappropriate training and experience, anyone can quickly understand and use this powerful system effectively.

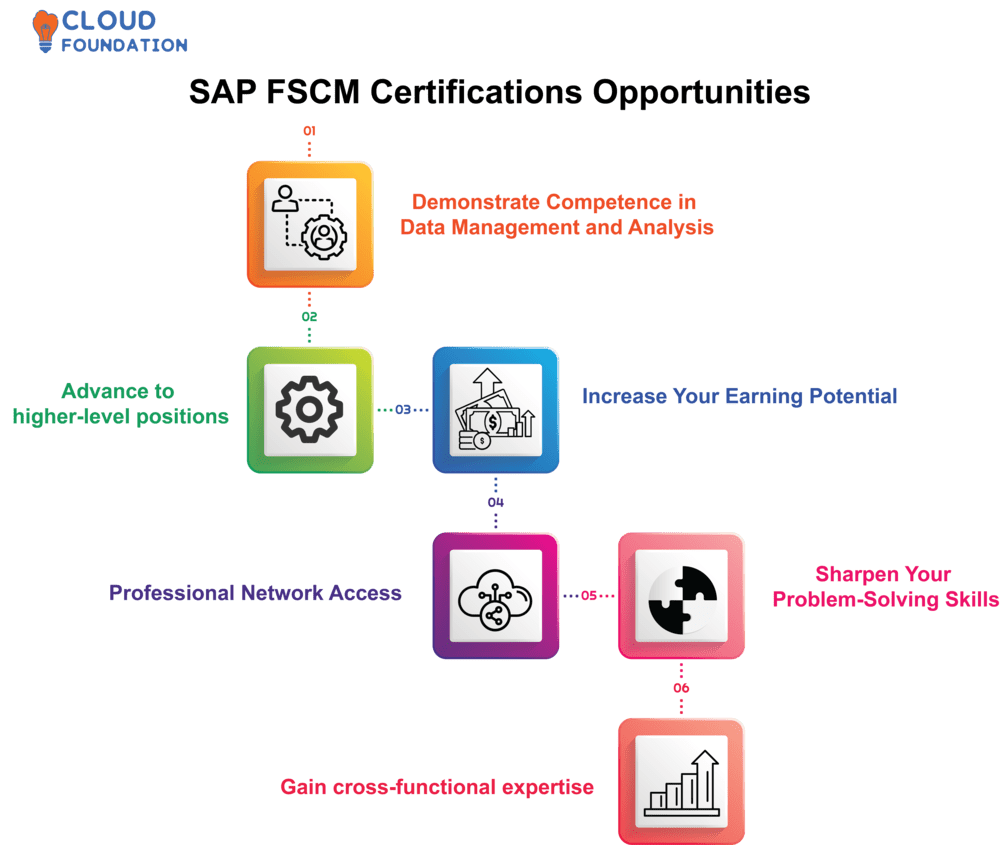

What are the opportunities from the SAP FSCM certifications?

Demonstrate Competence in Data Management and Analysis:SAP FSCM certifications demonstrate your mastery of their platform, which is in great demand by companies. By showing off your knowledge you may stand out among competitors while increasing employability.

Advance to higher-level positions:Acquisition of SAP FSCM Certifications can open doors to higher-level positions such as data analyst, data scientist or even leadership roles. Earning these certifications shows your dedication to professional growth as well as your ability to manage complex data challenges effectively.

Increase Your Earning Potential: Certified professionals often earn higher wages than non-certified persons, giving you the potential to raise your earning power and improve overall financial well-being by investing in education and attaining SAP FSCM certifications.

Professional Network Access: Earning SAP FSCM certifications offers professional network access. Joining this group offers opportunities for mentorship, collaboration, and professional growth; in addition, keeping up-to-date on data analytics trends keeps you in the know!

Sharpen Your Problem-Solving Skills: As part of the certification process, learning data analysis and visualization using Datorama platform helps hone problem-solving abilities which are invaluable in any business setting. By becoming certified you will improve your abilities to tackle challenging data-related problems effectively – something invaluable in business settings today.

Gain cross-functional expertise:SAP FSCM certifications cover an expansive array of data subjects, such as integration, transformation, modeling and visualization. These abilities make you invaluable no matter the industry or functional area within a business you work in – an asset no matter the team or department in which you reside.

Where Can I Learn SAP FSCM

First, familiarise yourself with SAP software and its features; itis necessary for learning SAP FSCM.

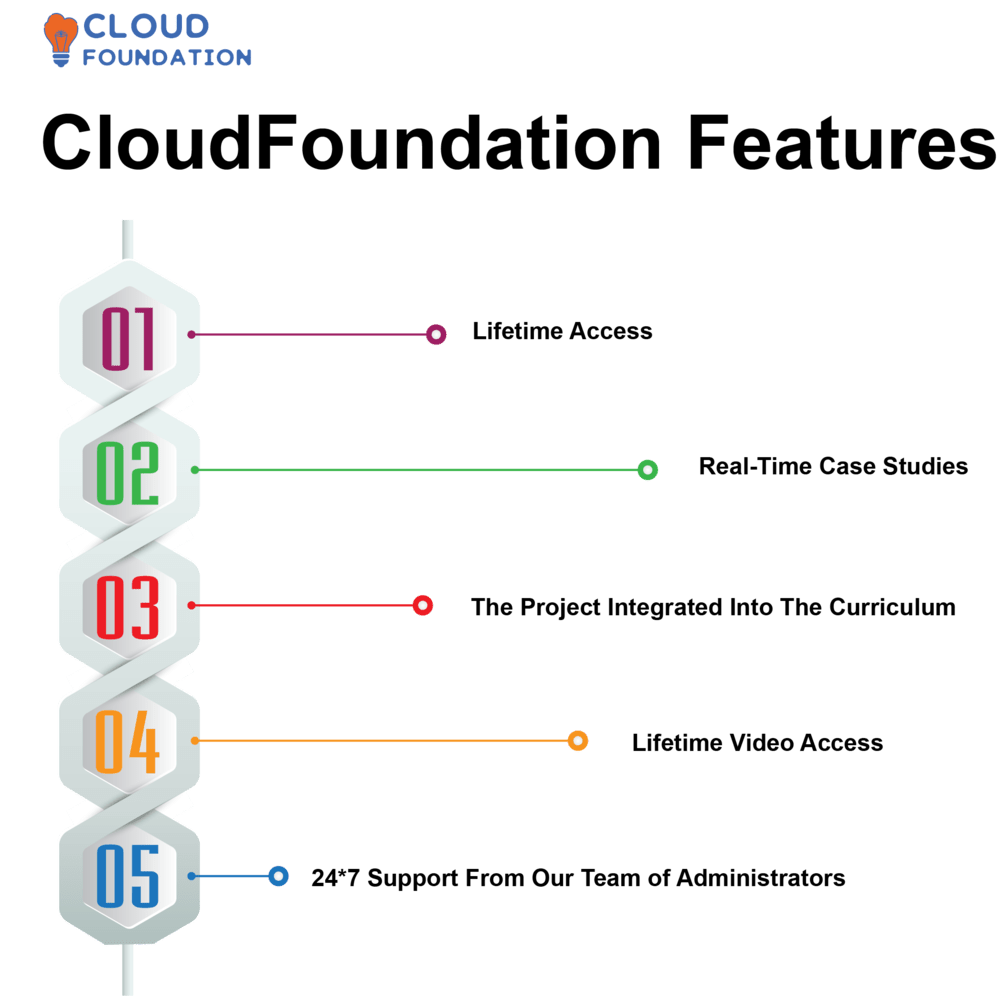

Once this step has been completed, sign up in CloudFoundation for SAP FSCM online training, which is available on the official website.

These training sessions will introduce you to the fundamentals of FSCM, its modules and functionality, and integration with other SAP modules such as General Ledger and Accounts Receivable.

The next step should be gaining real-world experience by working on real projects or practising in an SAP Sandbox environment.

Hands-on exposure will increase your knowledge of FSCM as an application in practical situations and strengthen your proficiency.

CloudFoundation also offers SAP FSCM certification tests to validate your expertise in this area, along with access to SAP FSCM blogs, SAP FSCM documents and SAP FSCM training videos that can quickly assist you in making SAP FSCM work for you.

Read my earlier post on the SAP FSCM if you want to learn more.

In conclusion, I can say that this blog helped you establish a smooth road in learning and understanding the concept of SAP FSCM.

So, what are you waiting for? Sign up in CloudFoundation and take the certification program to explore your ideas and make working life easier.

“Change Is the End Result of All True Learning”

All the best!!

SAP FSCM Course Price

Saniya

Author