SAP FICO Step-By-Step Training

Why SAP FICO Matters in Real-Time

SAP FICO implementation I’ve managed, real-time data handling is of utmost importance.

From creating codes and managing tiers to setting up credit control areas, every step has an impact on the financial workflow, and missing even one configuration can halt progress completely.

Because SAP FICO goes far beyond just numbers, double-check entries, collaborate with the SD team, and record every action taken through Solution Manager.

SAP FICO goes well beyond simply supporting business operations smoothly and efficiently; instead, it serves to build robust systems that help them run smoothly and efficiently.

Why SAP FICO Structure Matters for Real-World Reporting

SAP FICO shines from a reporting standpoint when your structure is delineated.

Combining codes, business areas, and segments enables me to produce accurate profit and loss statements, and more importantly, isolate how much revenue was explicitly earned through desktops in Florida something that would be impossible without such detail.

Utilising SAP FICO correctly has enabled me to help students grasp the fundamentals of enterprise resource planning. More than just technical software, SAP FICO serves as an insightful data visualisation platform.

Organisational Structure in SAP FICO

Establishing an efficient organisation structure within SAP FICO is among the first tasks. For instance, created Billuous under Apple US.

Business areas in SAP FICO represent geographical operations, while segments represent the specific products we’re manufacturing.

Keeping this distinction clear makes financial reporting much simpler.

SAP FICO Segments for Product Lines

SAP FICO segments represent the various products a manufacturer produces.

SAP FICO does not mandate any particular naming convention for segment codes or alphanumeric values, which are used as segments of choice.

These help with profit analysis for each product category if, for instance, one wants to focus specifically on laptop sales, having dedicated segments would make that easy.

Vendor Data in SAP FICO

Vendors also benefit from having reconciliation accounts set up specifically for them in SAP FICO.

First, assign short keys and create appropriate groupings; for instance, it might have its reconciliation account, which is defined in SAP FICO, ensuring that financial transactions are conducted accurately and reliably.

First, assign short keys and create appropriate groupings; for instance, it might have its reconciliation account, which is defined in SAP FICO, ensuring that financial transactions are conducted accurately and reliably.

Customer Transactions in SAP FICO

As part of work with SAP FICO, one of the fundamental concepts is how customer transactions are recorded and processed.

If materials are to be billed to Bill and need to be recorded correctly in terms of accounting entries and revenue accounting entries, such as when goods are sold, then the revenue account would receive this credit amount instead.

SAP FICO ensures accuracy and consistency by utilising posting keys that determine how each transaction is processed. This aspect cannot be understated when understanding SAP FICO as a solution.

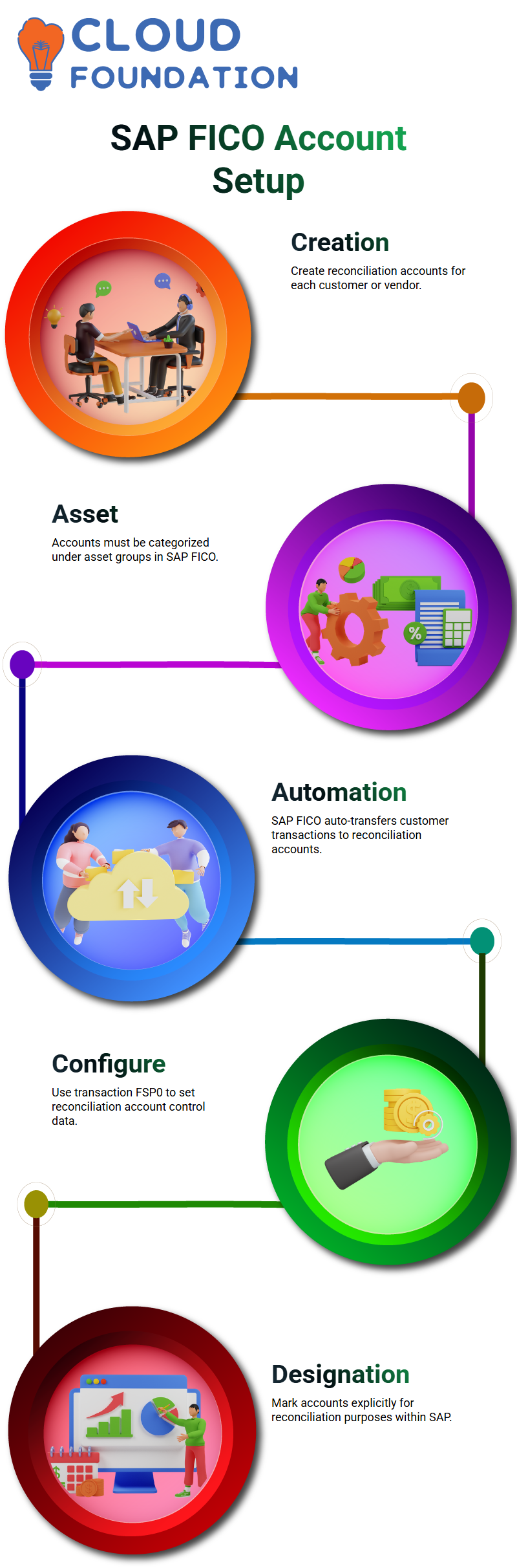

Reconciliation Accounts in SAP FICO

As part of the configuration process, reconciliation accounts must be created for every customer or vendor.

Created two general ledger (GL) accounts, one for Bill and another for those that reside on the asset side and are marked as reconciliation accounts in SAP FICO.

This ensures that customer transactions are automatically transferred into these accounts within SAP.

SAP FICO Reconciliation Accounts

SAP FICO requires customer reconciliation accounts always to be created under an asset category. When labelling it clearly as Bill Recon Account and placing it under its respective asset group.

Opened transaction code FSP0 in SAP FICO, entered the code, and began configuring control data.

SAP FICO automatically recognised the asset type; explicitly designated one account for reconciliation use cases by explicitly marking it as such; then set the special key while also marking the reconciliation account type.

This feature allows SAP FICO users to manage customer-specific reconciliation scenarios more easily than before.

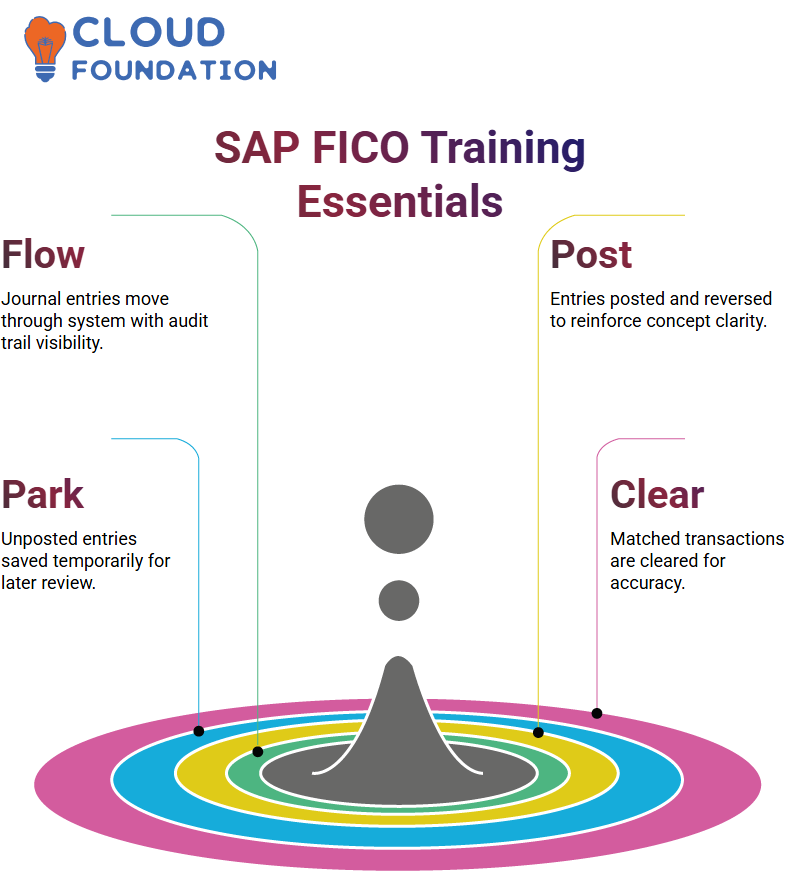

SAP FICO: G/L Posting Practice

SAP FICO excels at offering maximum flexibility when configuring general ledger (G/L) accounts. Recently, while setting up a scenario that required me to track office print expenses separately from travel expenses.

As I attempted to post the document, SAP FICO asked me for a reference number as validation measures – these small but significant checks are what make SAP FICO such an efficient financial system; when data is missing or incomplete, SAP FICO allows me to park it and return later if required.

Reversing Transactions in SAP FICO

Reverse transactions in SAP FICO, if we post to an incorrect GL account, SAP FICO allows us to quickly reverse it and correct it immediately, reinforcing why testing and validating inside a sandbox environment are so vital before going live.

SAP FICO also keeps track of “parked documents”, or draft documents that you save before officially posting them.

Parking works when saving an unposted document as a draft; later on, you can retrieve and verify its entries before finally publishing it formally.

Features like this are part of what makes SAP FICO a user-friendly and flexible solution.

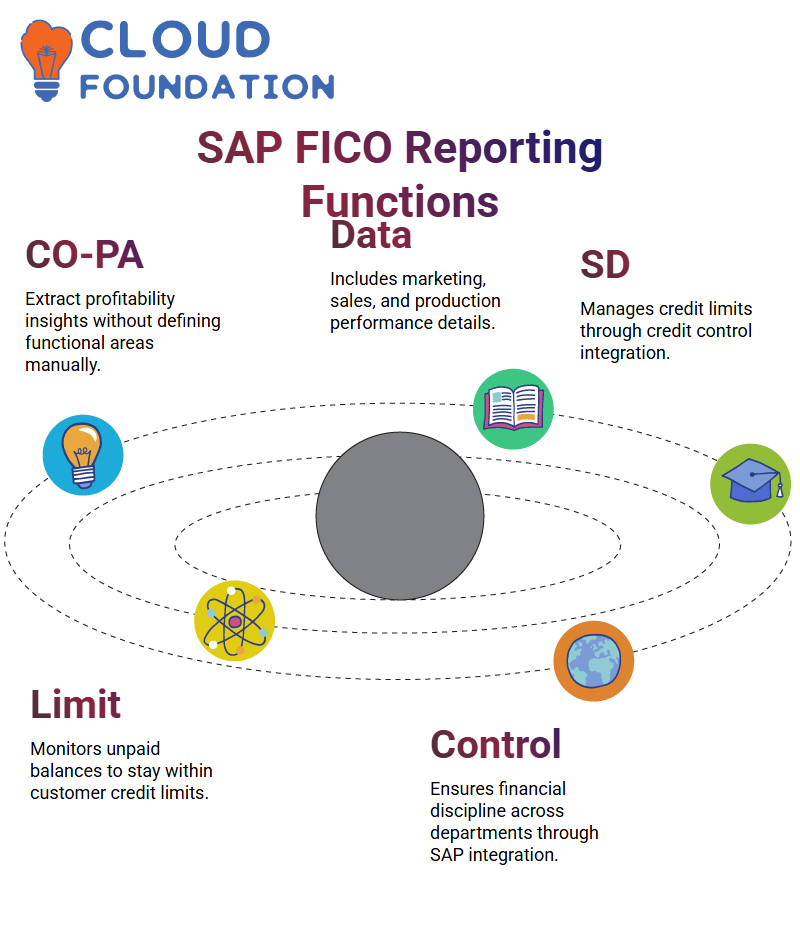

Reporting with SAP FICO CO-PA

CO-PA is one of my favourite features in SAP FICO; it enables me to gather profitability data without manually delineating functional areas.

From marketing expenditures, production revenues, or sales performance indicators, CO-PA seamlessly extracts it all.

CO-PA makes SAP FICO much more dynamic; functional areas are no longer mandatory to evaluate departmental performance effectively.

Thanks to SAP FICO CO-PA, you can easily assess how each department contributes to our bottom line without spending hours creating separate structures.

Thanks to SAP FICO CO-PA, you can easily assess how each department contributes to our bottom line without spending hours creating separate structures.

SAP FICO and the Role of the SD Department

THE SAP FICO SD department plays an essential part when it comes to credit control. Create the credit control area, while they manage actual credit profiles, open orders, and billing documents in their system.

Updating automatically into SAP ensures compliance and maintains credit limits accordingly.

Example: If a customer purchases a laptop worth $1,000 but only pays $550 upfront, the credit control area will monitor their remaining $450 balance to ensure it does not go beyond their customer’s credit limit. With SAP FICO integrated seamlessly into SD, financial discipline across your organisation is assured.

SAP FICO Tier Management

Real-world SAP FICO implementations make tier management a crucial aspect.

A project that requires data movement between systems such as from development through quality to production relies on an organised tier system; multinational businesses often involve hundreds of them.

Solution Manager has proven very efficient at helping me coordinate with the basis teameach request must move through the tiers accurately while maintaining data integrity across environments.

Leveraging SAP FICO Solution Manager

SAP FICO Solution Manager plays a significant role in SAP FICO projects. Working closely with the basis team, this platform allows me to monitor tier movements.

Once one is created, upload all required data and document any necessary steps taken. This may involve attaching functional specifications as needed and maintaining an audit trail of actions taken.

Solution Manager has become essential in larger companies due to the complex and large volumes of data being managed; for smaller organisations, however, it is due to cost considerations. Even so, having experience using Solution Manager has proved invaluable during interviews and real-time implementation projects.

Troubleshooting and Execution Flow in SAP FICO

SAP FICO requires mastery in understanding how to track and execute transactions once they’ve been saved, from posting documents or parking them, through transaction codes like FB03 to verify entries.

Only later did it become apparent that there had been a miscommunication regarding display settings in the selection screen.

Once corrected, SAP FICO displayed both open and noted items in real-time for review, providing me with immediate confirmation that everything is in working order.

Troubleshooting minor issues like these helps further develop SAP FICO skills.

SAP FICO may initially appear daunting for newcomers; however, I’ve discovered that practice makes SAP FICO less intimidating and more functional over time.

From creating accounts, managing special indicators or posting documents, SAP FICO offers comprehensive tools that make financial accounting robust yet dependable.

Mastering Real-World Scenarios with SAP FICO

Sessions always incorporate real-world scenarios — posting entries, creating master data sets, assigning reconciliation accounts, and managing payment tolerances to demonstrate the effective use of SAP FICO. These components form its core.

Once you understand this connection between concepts in SAP FICO – from general ledger accounts, reconciliation workflows and subledger mapping – and their effect on your overall financial ecosystem, navigating SAP FICO becomes intuitive.

Practical SAP FICO Training Through Real

As part of SAP FICO training sessions, we often utilise real-life examples. This helps students understand how journal entries, such as ‘Travel Expense A/C Dr.

To Bank A/C Cr.’, flow through the system. SAP FICO makes simulation, analysis, and reverse posting easy; you even get an audit trail from transaction entry to balance display.

As we explored SAP FICO’s features, we emphasised the importance of regular practice.

Each time we posted, rewove, parked or cleared an entry, we reinforced core SAP FICO concepts – eventually building fluency and confidence when applying SAP FICO effectively in real-world situations.

Vinitha Indhukuri

Author