Oracle Fusion Financials Tutorial

With any luck, this short brief overview of Oracle Fusion Financials has helped you see the system’s potential usefulness. Okay, so let’s get started.

Introduction to Oracle Fusion Financials

Oracle Fusion Financials provides an advanced software solution designed to streamline Financials operations for organizations of any size.

For easy and automated Financials activities, Fenomastic uses leading technology, analytical insights and user-friendly navigation features to streamline Financials operations.

Oracle Fusion Financials powerful features and real-time information allows organisations to make informed Financials decisions that enhance operational efficiency while meeting regulatory compliance and increasing overall corporate success.

Oracle Fusion Financials equips companies to meet the complex and ever-evolving Financials demands of contemporary enterprises, whether that means optimising cash flow, managing spending or producing precise reporting

Oracle Fusion Financials are tools designed for Financials management that offer comprehensive functionality.

Oracle Fusion Applications suite – which comprises linked business applications designed to simplify and automate multiple business procedures – contains Oracle Business Process Automation Server as one component.

Oracle Fusion Financials provides businesses with a host of modules and features designed to enable more effective management of their Financials operations.

These courses cover topics related to general ledger accounting, accounts payable/receivable management, cash administration, fixed assets administration, expense control management and Financials reporting.

How Does Oracle Fusion Financials Work?

This amazing collection of financial software helps business professionals manage finances. Oracle Fusion Financials is the best tool for budgeting, financial analysis, and invoicing and payment tracking. This blog will explain Oracle Fusion Financials’ internals.

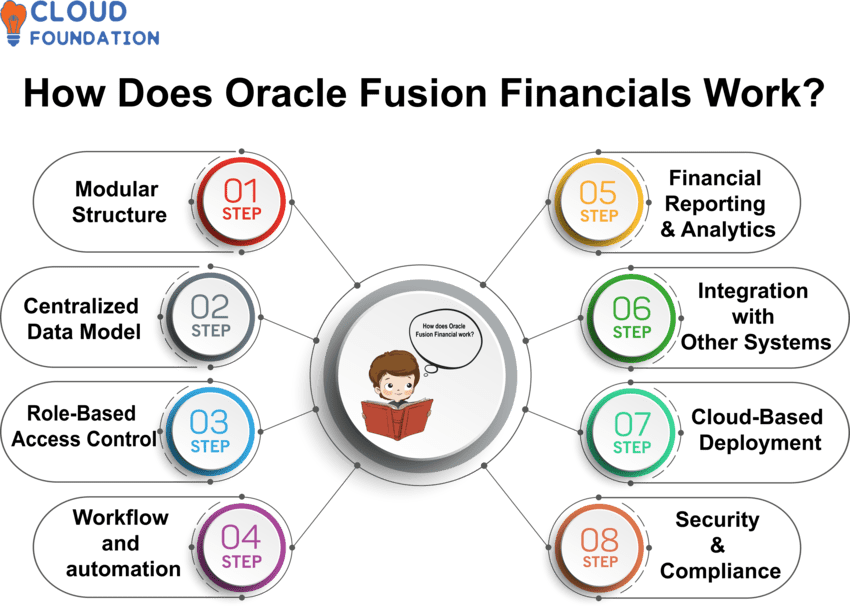

Modular Structure:Oracle Fusion Financials is composed of interrelated apps which may be used separately or all at the same time – General Ledger, Accounts Payable/ Receivables/ Cash Management, Fixed Assets Management and Expense Management are key elements.

Centralized Data Model:Fusion Financials uses a centralised data model, ensuring all Financials data resides in one repository for real-time reporting, analytics, and seamless interaction of different components. This ensures efficient real-time reporting and seamless interaction among components.

Role-Based Access Control: Our system utilizes role-based access management, which enables users to complete activities according to their roles and responsibilities, guaranteeing only authorized individuals have access to sensitive Financials data.

Workflow and Automation: Oracle Fusion Financials automates multiple Financials processes, such as invoice processing, payment approvals and reimbursements, while routing transactions according to established procedures and rules in accordance with corporate policies and laws.

Financials Reporting and Analytics: This package features powerful reporting and analytics tools for creating real-time Financials statements, management reports, and performance measures in real time.

Users may generate customized reports as needed or perform ad hoc analyses through interactive dashboards – creating real-time statements is possible!

Integrate With Other Systems: Oracle Fusion Financials is designed to work seamlessly with other Oracle programs like Human Capital Management (HCM) and Supply Chain Management (SCM), providing a consolidated picture of Financials, human resources, and supply chain data which facilitates greater decision-making capabilities and operational efficiencies.

Cloud-Based Deployment: Oracle Fusion Financials can also be deployed as an Oracle Cloud Financials cloud-based solution, increasing scalability and flexibility while decreasing on-premise hardware maintenance requirements. Plus, frequent upgrades provide you access to new features and advancements.

Security and Compliance: Oracle Fusion Financials offers robust security safeguards to safeguard Financials data and transactions while aiding compliance with various regulatory frameworks such as GAAP (Generally Accepted Accounting Principles), IFRS (International Financials Reporting Standards), and SOX (Sarbanes-Oxley Act).

Oracle Fusion Financials Training

Features of Oracle Fusion Financials

Oracle Fusion Financials enables you to make confident choices about budgeting and planning, as well as reporting and analysis. Let’s look at the unique characteristics that set our solution apart from the competition.

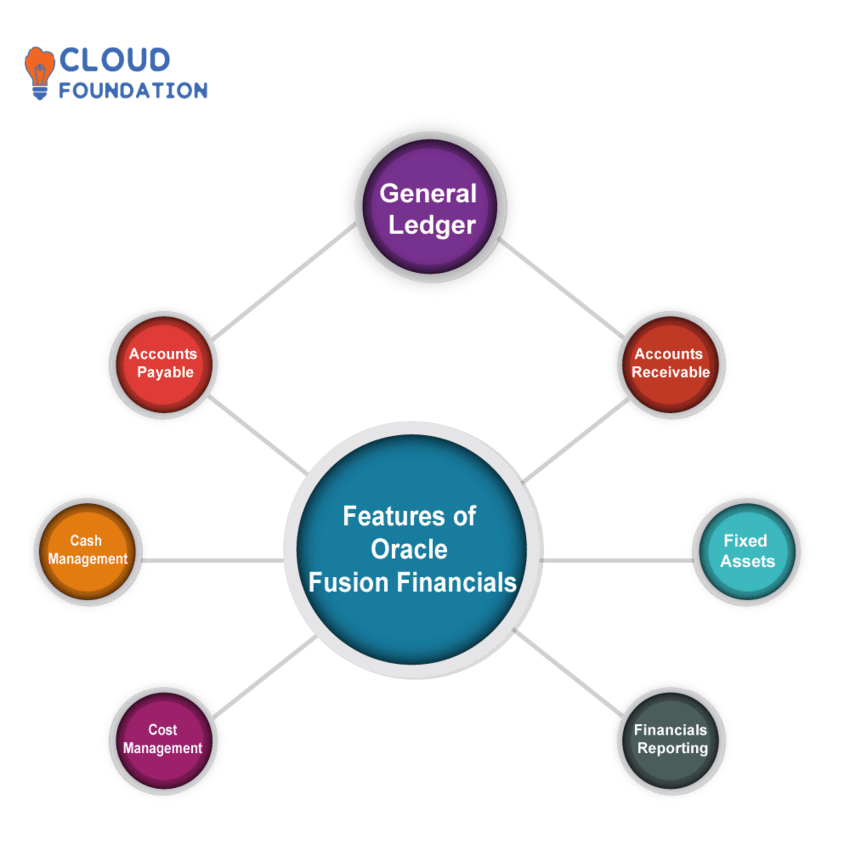

General Ledger:General Ledger is software that enables firms to effectively organize, track and report Financials data as it pertains to them and produce statements of performance for external and internal use.

Accounts Payable:Accounts Payable (AP) handles invoice management processes as well as supplier details in accordance with legal standards.

Accounts Receivable:Accounts Receivable is designed to assist organisations in handling client bills, tracking payments and maintaining customer information.

Cash Management:Cash Management assists organisations with cash flow monitoring, bank reconciliations and forecasts.

Fixed Assets: It assists organizations in monitoring and overseeing fixed assets such as purchase, depreciation, retirement or disposal.

Cost Management: This module automates cost reimbursement processes so workers may submit expenses directly for management review and approval.

Financials Reporting: Oracle Fusion Financials offers powerful reporting features that allow firms to develop Financials statements, generate ad hoc reports, and examine Financials information efficiently and comprehensively.

Oracle Fusion Financials Cloud Service

Cloud Service offers enterprises with modern, scalable financial process management.

It assists businesses in designing and managing their chart of accounts, performing journal entries, reconciling accounts, processing invoices and payments, and managing expenditures.

Features robust reporting and analytics capabilities. Standard financial reports, customised reports, and ad-hoc data analysis are all part of the service.

It connects to other Oracle Cloud applications and external systems to speed up end-to-end business processes and give a unified view of operations.

Benefits of Oracle Fusion Financials

Ready to upgrade your finances? Oracle Fusion Financials delivers high performance, transparency, and scalability.

Oracle Fusion Financials’ unified, standards-based platform speeds up complicated business activities, captures more insights, and improves financial performance.

This revolutionary solution blends contemporary technology with tomorrow’s strategic skills to improve efficiency, risk reduction, and operations.

Oracle Fusion Financials provides real-time financial analytics and improved financial management.

To maintain your funds, use broad functionality, scalability, and powerful features.

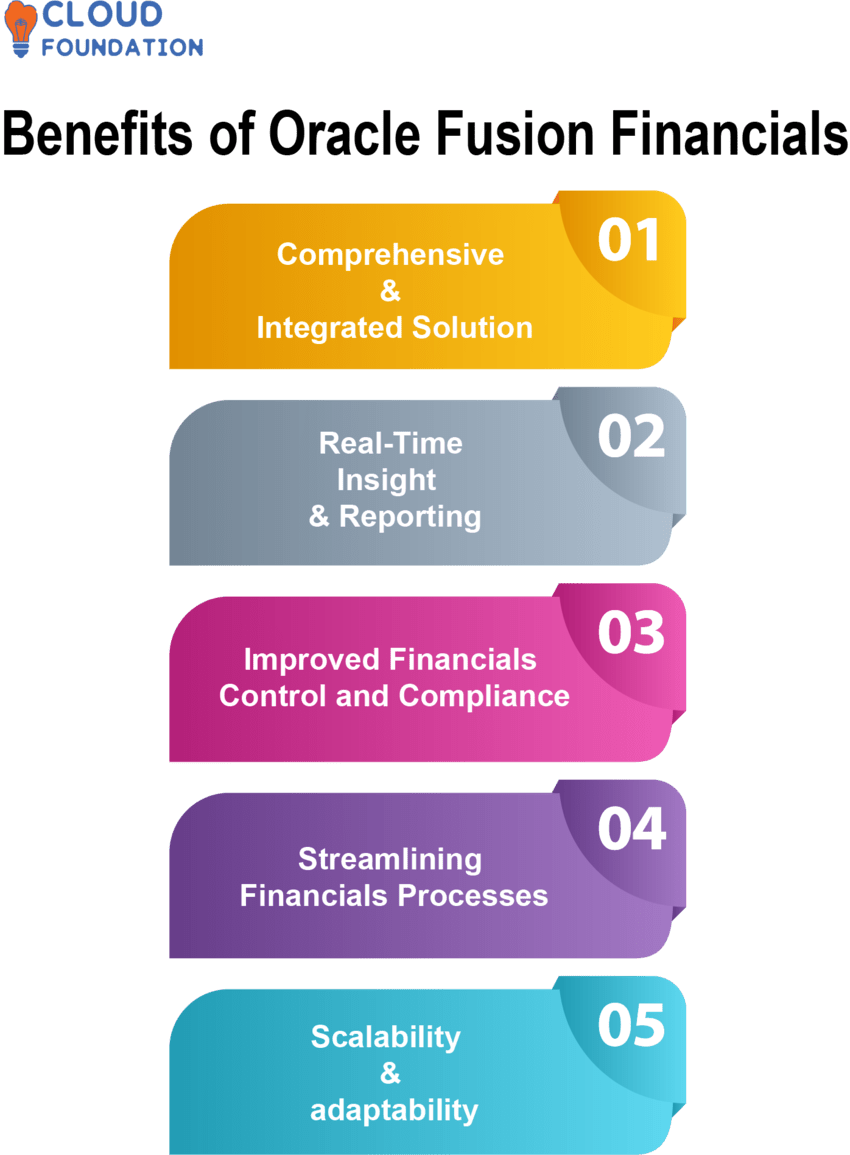

Comprehensive and Integrated Solution: Oracle Fusion Financials offers a comprehensive set of Financials management software designed to cover many elements of Financials operations. Integrating different modules enables continuous data flow while eliminating multiple systems thereby improving efficiency and accuracy.

Real-Time Insight and Reporting: Our system gives organizations real-time visibility into Financials information, giving them up-to-date details of their performance.

Utilizing its powerful reporting features, users are able to efficiently create Financials statements, conduct in-depth analyses and make educated choices based on up-to-date data.

Improved Financials Control and Compliance:Oracle Fusion Financials boasts robust Financials control capabilities such as custom approval procedures, division of roles and audit trails to enhance Financials control and compliance.

These characteristics help organizations enforce Financials legislation, internal policies and industry standards to reduce fraud risk as well as mistakes.

Streamlining Financials Processes: Oracle Fusion Financials automation and standardisation simplify Financials processes, decreasing human work while increasing efficiency.

Automation offers many potential time and error saving benefits in invoice processing, payment reconciliation and cost management tasks.

Oracle Fusion Financials is designed for maximum scalability and adaptability, helping organizations manage increased transaction volumes as they experience growth while supporting that expansion.

Scalability and adaptability:Oracle Fusion Financialsprovide organizations with flexibility and configurability, enabling them to tailor the system according to individual demands, industry requirements and business processes.

Oracle Fusion Financials Online Training

Do you fascinate about Oracle Fusion Financials future?

Oracle Fusion Financials has always piqued our interest. This is exacerbated by digitization. Fusion Financials leverages Oracle’s cutting-edge technology to provide contemporary cloud-based solutions that help businesses improve operations and remain competitive.

Oracle Fusion Financials enables businesses to enhance cloud performance and remain ahead of financial technologies.

Oracle Fusion Financials may be affected by various causes. Technology plays a central role, as will AI, ML, blockchain and data analytics that improve automation, decision making and security features within Fusion Financials solutions.

Oracle Fusion Financials will accommodate clients’ unique requirements by prioritising improved functionality, user-friendly interfaces and customisable features to meet an organisation’s need for efficiency, agility and real-time information.

Oracle Fusion Financials will also be guided by regulatory and compliance criteria, so as to meet increasingly stringent Financials restrictions. As part of achieving compliance, the system may need to change by adding compliance reporting functions as well as data governance features.

Oracle Fusion Financials may also benefit from cloud use. Modern businesses rely heavily on its scalability, cost-efficiency and accessibility; which cloud deployment provides. Oracle will work towards strengthening infrastructure integration as well as data security improvements within this realm of cloud.

Oracle Fusion Financials can develop industry-specific solutions. Software firms need revenue recognition while construction companies require project accounting – two areas in which Oracle Fusion Financials modules or configurations tailored specifically for these businesses.

Oracle Fusion Financials future is determined by market forces, technology innovations, consumer input, regulatory changes and competition in its field of finance. Oracle Corporation as solution provider will closely track these factors and adapt their product accordingly so as to meet evolving industry demands.

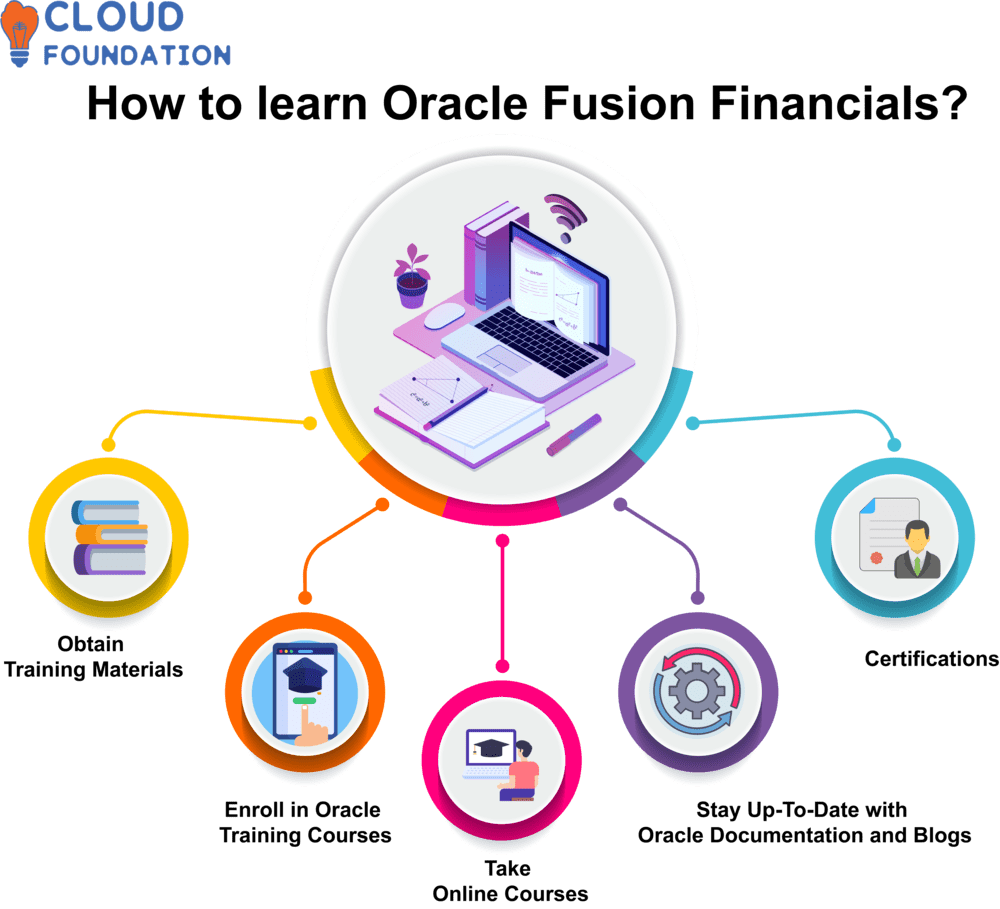

As of now, we know the required information. now let us know how to learn this Oracle Fusion Financials?

You can easily manage and monitor financial activities in the cloud with this full collection of strong cloud apps.

It provides a broad variety of capabilities and features that help organisations save expenses, improve efficiency, and boost cash flow.

Oracle Fusion Financials, with its simple user interface and real-time data, may assist your organisation in making informed choices and optimising operations.

In this course, we will look at how to master the Oracle Fusion Financials package to maximise your business’s potential.

Obtain Training Materials:These documents, guides, tutorials and videos explain its features and functions in depth.

Enroll in Oracle Training Courses:CloudFoundation Offers Training Oracle Fusion FinancialsCourses. These instructor-led Fusion Financials training classes give attendees in-depth system understanding and practice, functional installation, administration and reporting courses are also offered depending on your job duties and abilities.

Take Online Courses: There are various platforms offering Oracle Fusion Financials courses online. Trustworthy ones feature extensive training modules with video lectures, quizzes and assignments such as Udemy, LinkedIn Learning or Coursera which all serve as reliable learning systems.

Oracle Fusion Financials demo environments provide the ideal way to explore and experience this system’s interface, capabilities and operations.

Stay Up-To-Date with Oracle Documentation and Blogs: Oracle Fusion Financials offers updates, new features and best practices regularly – keeping current with these features can ensure maximum system effectiveness and maximum return. Take the initiative by staying current with official documentation from Oracle as well as their blog updates – staying informed is the only way you’ll stay ahead of the game and maximize system potential!

Certifications: Oracle Fusion Financials certifications demonstrate your expertise and advance your career prospects. Consider certifications such as the Oracle Financials Cloud Certification to demonstrate this technology’s potential benefits to you.

Oracle Fusion Financials Rest API

The Oracle Fusion Financials Rest API allows for rapid service rollouts. Because of the platform’s adaptability and dependability, we’ve come to dominate the field of automated financial management. We’ll teach you how to increase your profits with this robust platform at a low cost.

Oracle Fusion Financials has a sophisticated set of REST APIs that enable developers to interface with the system’s financial components programmatically.

Developers may securely and efficiently obtain, produce, edit, and remove financial data using the Oracle Fusion Financials REST APIs. The APIs allow you to query transactions, issue payment requests, create journal entries, manage invoices, and do bank reconciliations.

To utilise the Oracle Fusion Financials REST APIs, developers must use the OAuth 2.0 protocol to authenticate their requests, which assures safe access to the system’s resources. Developers may then submit HTTP calls to the relevant API endpoints, including the needed parameters and payload in the request body.

API answers are often delivered in JSON format, which allows developers to easily analyse and handle the data. Error management is also offered through standardised HTTP status codes and error messages, enabling developers to properly handle exceptions and debug difficulties.

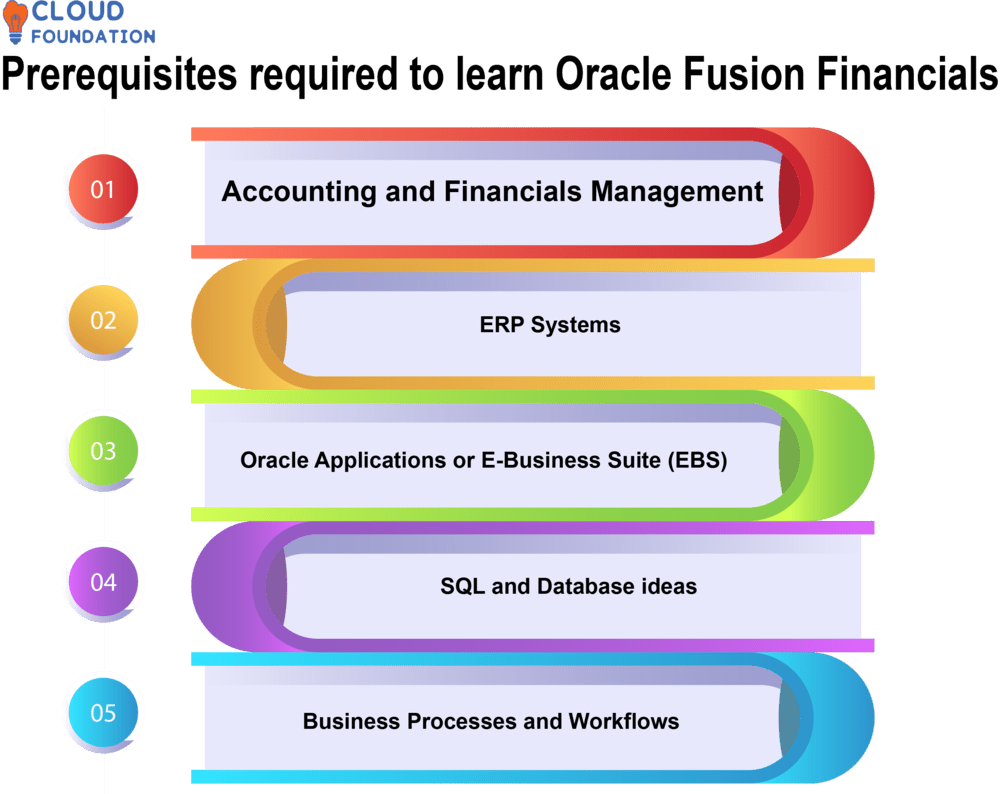

Now let us know what are the prerequisites required to learn this technology?

As technology advances, staying ahead is becoming more crucial. Learning new technology helps.

That stated, this page provides a detailed reference to technical requirements. We will examine the skills and resources required to master the technology.

It will also provide ways to improve weak abilities.

Accounting and Financials Management: Mastery of accounting concepts as well as Financials management is required, from understanding Financials statements, the general ledger, accounts payable/receivable reconciliation processes and reporting issues to understanding what factors go into decisions made regarding accounts payable/receivable balances and reporting needs.

ERP Systems: Gaining an in-depth knowledge of ERP systems will lay a firm foundation for studying Oracle Fusion Financials Understanding their features – for instance how finance, procurement, and project modules interact – is also vital in order to better comprehend business activities that utilize such modules as finance.

Oracle Applications or E-Business Suite (EBS): Oracle Fusion Financials builds upon the foundational concepts and capabilities embodied by prior Oracle systems like EBS or earlier versions of Applications, drawing inspiration for its design from those preceding it.

SQL and Database ideas:Understanding Structured Query Language (SQL) and fundamental database ideas is of critical importance, from writing SQL queries and understanding database structures, through data retrieval/processing operations and retrieval operations, all the way up to retrieval/processing operations being implemented successfully.

Business Processes and Workflows: Explore typical Financials business processes including planning and analysis, budgeting, cost management and revenue recognition. Discover workflow concepts used within Financials systems.

Are you Curious about Oracle Fusion Financials Certification Exams?

To become certified in Oracle Fusion Financials, both 1Z0-1042 Oracle Cloud Platform Application Integration 2020 Associate and 1Z0-1043 Implementation Essentials certification exams must be passed successfully in order to receive your license to practice in this discipline.

The 1Z0-1042 test measures your knowledge of application integration fundamentals, Fusion App cloud services and building integrated applications.

The 1Z0-1043 exam tests an applicant’s ability to use integration to expand functionality, develop integrations in Oracle Integration Cloud and deploy and configure integration solutions.

Both exams include questions that require matching, drag-and-drop or simulation answers to be submitted by way of answer options.

You need to pass two tests to get certified in Oracle Fusion Financials.

Oracle Fusion Financials Course Price

Saniya

Author