Oracle Fusion Financials Certification

You will discover an assortment of subjects on this blog; for instance, certifications within IT fields and how best to prepare and pass any associated exams will also be discussed; furthermore, we offer study advice anda comparison of certification programs.

Introduction to Oracle Fusion Financials

Organizations can streamline financial operations and enhance decision-making with Oracle Fusion Financials – an all-in-one financial management solution designed for organizations.

Oracle Fusion Financials is an innovative financial management system built from cutting-edge features and functions to offer a flexible and extensible platform.

Oracle Fusion Financials provides businesses with a comprehensive financial management solution featuring an intuitive user interface and various modules, such as general ledger accounting, payable/collectible accounts management, cash management and asset tracking.

Connectivity between Oracle Cloud apps is seamless and controls are improved for faster transaction processing in real-time.

Oracle Fusion Financials’ goal of helping businesses streamline financial operations, gain insight into data analysis, and boost operational efficiencies has transformed financial management worldwide. There are multiple certification paths for Oracle Fusion Financials certification available to businesses wishing to use it as part of their financial management solution.

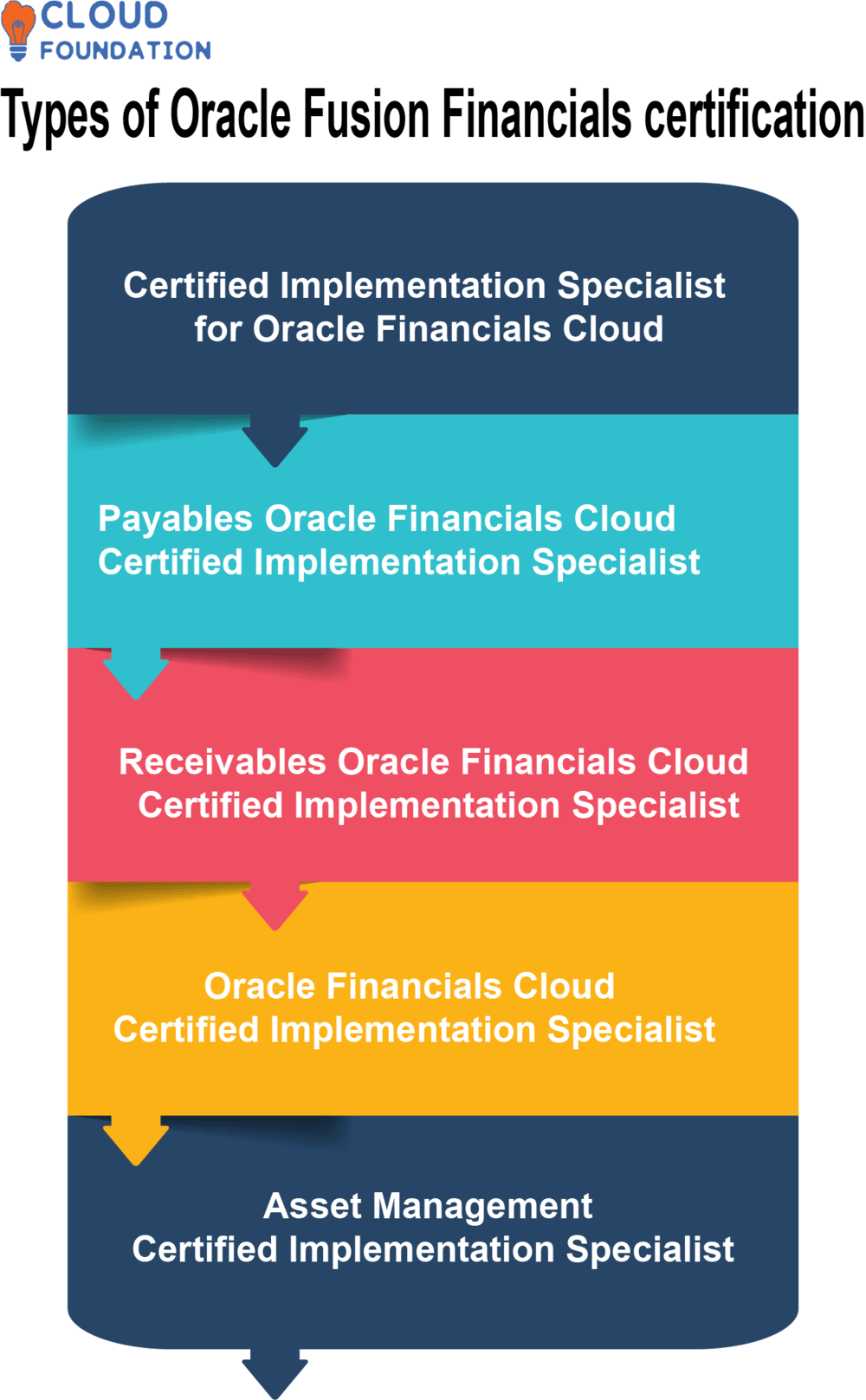

Types of Oracle Fusion Financials certification

Oracle Fusion Financials solutions certifications provide an entryway into financial expertise. Here is your opportunity to become certified.

Certified Implementation Specialist of Oracle Financials Cloud: General Ledger: This certification validates your skills and knowledge necessary to install and configure the General Ledger module of the Fusion Financials General Ledger module.

Payables Oracle Financials Cloud Certified Implementation Specialist:This certification covers the installation and set-up of Payables module features such as supplier management, invoice processing, payments processing and expenditure reporting.

Receivables Oracle Financials Cloud Certified Implementation Specialist: This certification is intended for professionals specialized in implementing and configuring the Receivables module of Oracle Financials Cloud Financial Management Suite – such as customer account management and invoicing collections revenue recognition.

Oracle Financials Cloud Certified Implementation Specialist: Cash Management, this certification verifies your skills in implementing and configuring the Cash Management module, covering areas like bank reconciliation, cash forecasting and liquidity management.

Asset ManagementCertified Implementation Specialist:Oracle Financials Cloud This certification covers the installation and setup of Asset Management in Fusion Financials, which encompasses managing fixed assets, depreciation and capital expenditures.

Oracle Fusion Financials Training

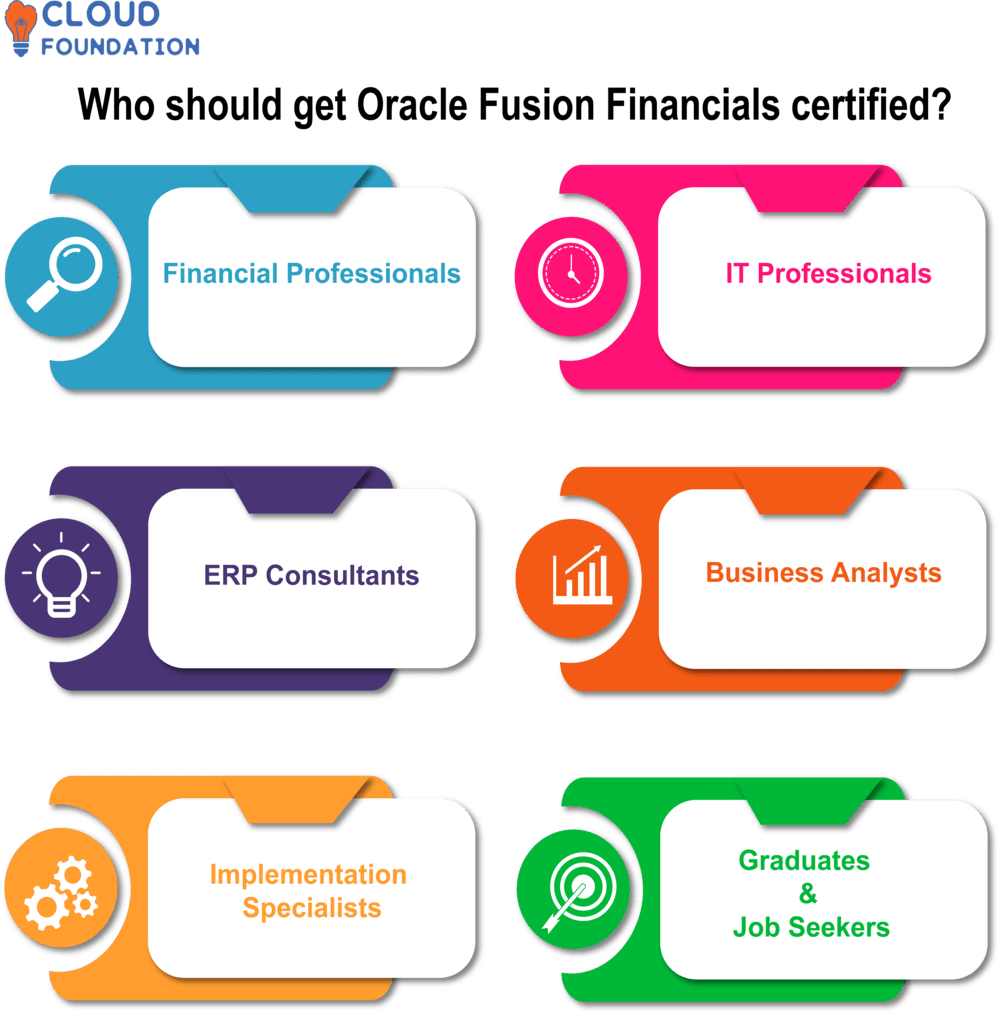

Who Should Get Certification on Fusion Financials?

Are You Curious about Oracle Fusion Financials? Below are the steps involved in becoming certified.

Financial Professionals: Certification can assist finance managers, controllers, accountants and analysts who use Oracle Fusion Financials in managing operations effectively while producing accurate reports that demonstrate sound business decisions using this solution.

ERP Consultants: Consulting firms that specialize in customizing Oracle Fusion Financials solutions for their customers may benefit by becoming certified consultants, showing they can deploy and personalize solutions suited for individual company requirements.

Implementation Specialists: Certification can provide significant value to professionals involved with implementing Oracle Fusion Financials within organizations, providing an opportunity to demonstrate knowledge about best practices, financial system setup, and integration processes.

IT Professionals: IT managers, system administrators and technical consultants responsible for overseeing Oracle Fusion Financials systems can gain much from certification by developing insightful knowledge and technical abilities that enable them to identify faults quickly, implement updates quickly and improve system performance efficiently.

Business Analysts: Certification may help professionals who analyze financial data, set financial procedures and recommend changes. Oracle Fusion Financials gives these analysts an in-depth knowledge base, allowing them to match technology with business goals more quickly.

Graduates and Job Seekers: Individuals looking to enter financial management or ERP may increase their employability by attaining Oracle Fusion Financials certification, showing they have committed themselves to professional growth while offering themselves an edge over competing candidates on the employment market.

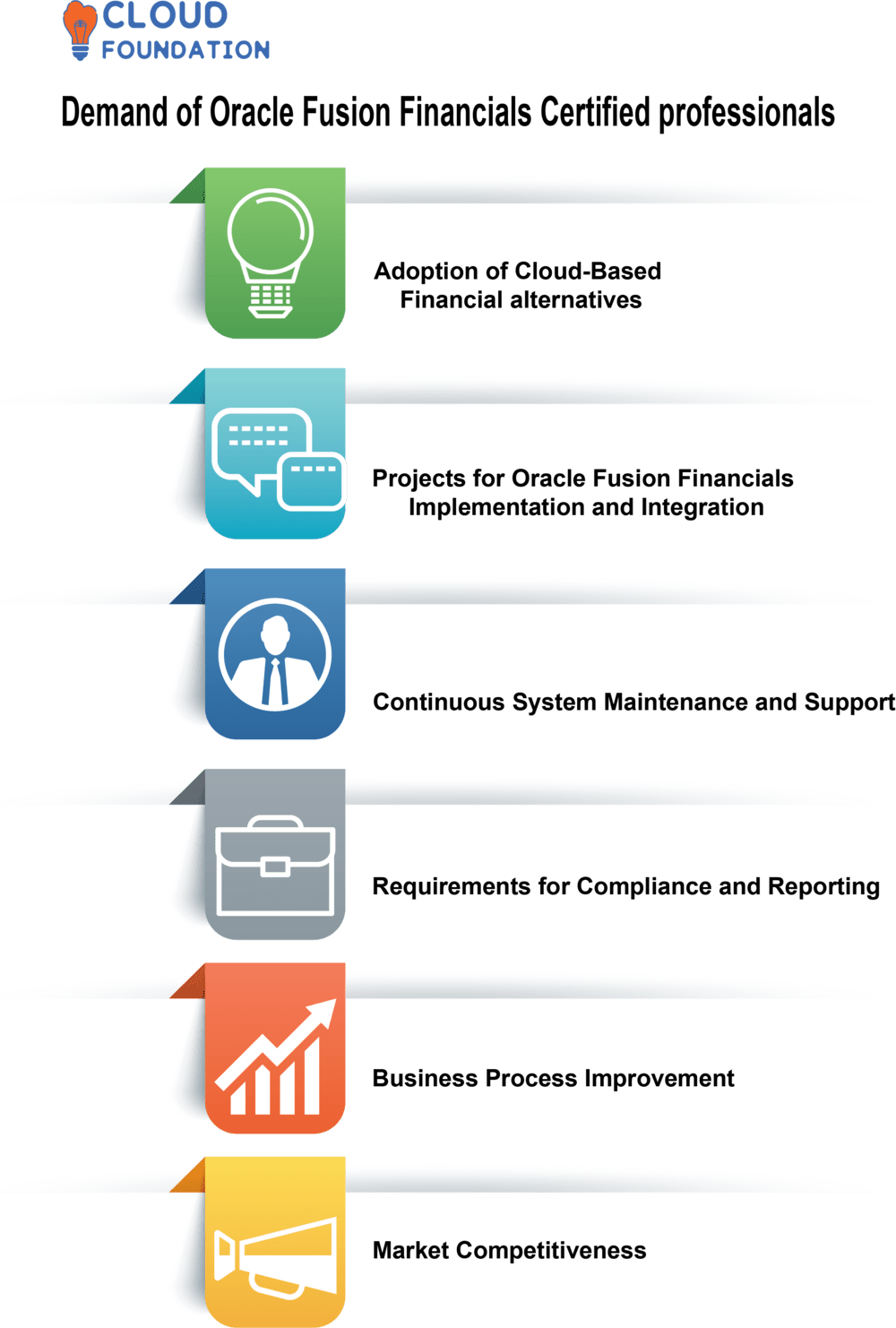

Demand of Oracle Fusion Financials Certified professionals

Increased competition within the industry has spurred an upsurge in demand for qualified Oracle Fusion Financials specialists.

Adopting Cloud-Based Financial Alternatives: Many businesses are switching away from on-premise financial management systems like Oracle Fusion Financials in favor of cloud-based alternatives like Oracle Fusion Financials.

Scalability, adaptability, and cost-effectiveness are driving this transition toward cloud technology. As more firms utilize it for financial management purposes, demand increases for experts of Oracle Fusion Financials, an innovative financial management platform available through the cloud.

Projects for Oracle Fusion Financials Implementation and Integration: Organizations often enlist qualified specialists to implement and integrate Oracle Fusion Financials into their current systems.

These projects encompass designing the system to meet business objectives, migrating data between systems, and ensuring a smooth transition process. Certified specialists often lead or participate in leading these efforts due to their specialized expertise and grasp of solutions.

Continuous System Maintenance and Support:After adopting Oracle Fusion Financials, organizations require specialists who will offer ongoing maintenance, support, and optimization of their systems.

Certified personnel possess the expertise to detect issues, make updates, maintain data integrity and optimize system performance. Their knowledge helps organizationssuccessfully harness solutions’ capabilities while optimizing operational efficiencies.

Requirements for Compliance and Reporting:Organizations need people who understand financial rules and reporting regulations to set up Oracle Fusion Financials to guarantee compliance correctly.Organizations will increasingly require people who possess Oracle Fusion Financials expertise so that compliance requirements are met by setting them up perfectly in their organization’s Oracle Fusion Financials database.

Certified specialists possess proven abilities in this area by configuring systems to produce accurate financial reports while meeting regulatory requirements.

Business Process Improvement: Oracle Fusion Financials offers various tools and features to assist businesses in streamlining and optimizing their financial operations.

Trained specialists may utilize these capabilities to identify areas for process optimization, automate manual operations, increase data accuracy and boost efficiency.

Businesses value financial managers who can link financial management with strategic objectives and deliver tangible results, like those found with FinCorp Financial Consulting Group.

Market Competitiveness:Organizations seek a competitive advantage by exploiting technological innovations in today’s market environment.

Hiring Oracle Fusion Financials certified experts demonstrates a dedication to modern financial practices and advances while emphasizing innovativeness within an organization’s ability to oversee financial operations successfully.

Oracle Fusion Financials Online Training

Value of Oracle Fusion Financials Certification

Oracle Fusion Financials Certification An investment in an Oracle Fusion Financials Certificate can be an excellent financial professional investment.

No matter, if you’re just getting started in accounting or are an established expert, taking this route to certification, will allow you to develop skills necessary for long-term business success.

Oracle Fusion Financials Certification will equip you with an in-depth knowledge of accounting standards, procedures and laws; budgeting strategies; performance targets for any organization, and expertise needed to meet them successfully.

Oracle Fusion Financials Certification instills trust that you possess the knowledge and abilities to effectively oversee and dive deeper into a company’s finances and dive deeper into them.

Oracle Fusion Financials Certification can significantly bolster a financial analyst’s expertise.

Therefore, this certificate allows individuals to be assessed for various roles within the financial industry and confirms that they understand financial reporting and associated topics.

An IPSA Certificate adds tremendous value to a professional’s CV and increases their chances of employment on the job market.

Oracle Fusion Financials Certification builds the expertise to interpret and process financial data using Oracle solutions while improving individual and collective operating capabilities.

How hard is Oracle Fusion Financials certification?

Financial professionals looking to advance would benefit significantly by becoming certified in Oracle Fusion Financials. Certification largely depends upon an individual’s financial management expertise, experience, and certification status.

Oracle Fusion Financials certification exams cover various financial management subjects and functions. Exams assess applicants for knowledge about components, configuration options, integration capabilities, and best practices of this solution.

Financial or accounting professionals familiar with Oracle Fusion Financials should find certification easier.

Experienced financial managers may find certification more accessible newcomers to Oracle Fusion Financials or its components could find certificate more complex.

They may require much of their time familiarizing themselves with its features, setup, and integration into existing financial procedures or rules, as well as understanding all its many features that could make implementation more complicated than anticipated.

Oracle provides extensive training materials, documentation, and tools for certification applicants. Gaining hands-on practice using answers may also prove valuable for learning new information.

Oracle Fusion Financials Certification Cost

Certification price may depend on a range of factors such as type, frequency of examinations taken, and desired areas for specialization fees typically fall between $400 and $800.

Oracle Fusion Financials certification exam

Professionals familiar with Oracle Fusion Financials may take an official certification exam from Oracle Corporation to demonstrate their expertise.

Oracle Fusion Financials certification requires candidates to demonstrate proficiency in money management, Oracle Fusion applications and basic economics. Candidates will be evaluated based on program knowledge, setup, andproblem-resolution skills.

The test covers expense management, consumer procurement, balance sheets, P&L statements, cost allocation, and projections as part of this exam.

How to get Oracle Fusion Financials certification

CloudFoundation provides you with an avenue for becoming certified in Oracle Fusion Financials.

Oracle Fusion Financials training courses must be attended and passed successfully before certification. CloudFoundation always has an up-to-date listing of classes; take any number and pass the resulting test, and you’ll become certified.

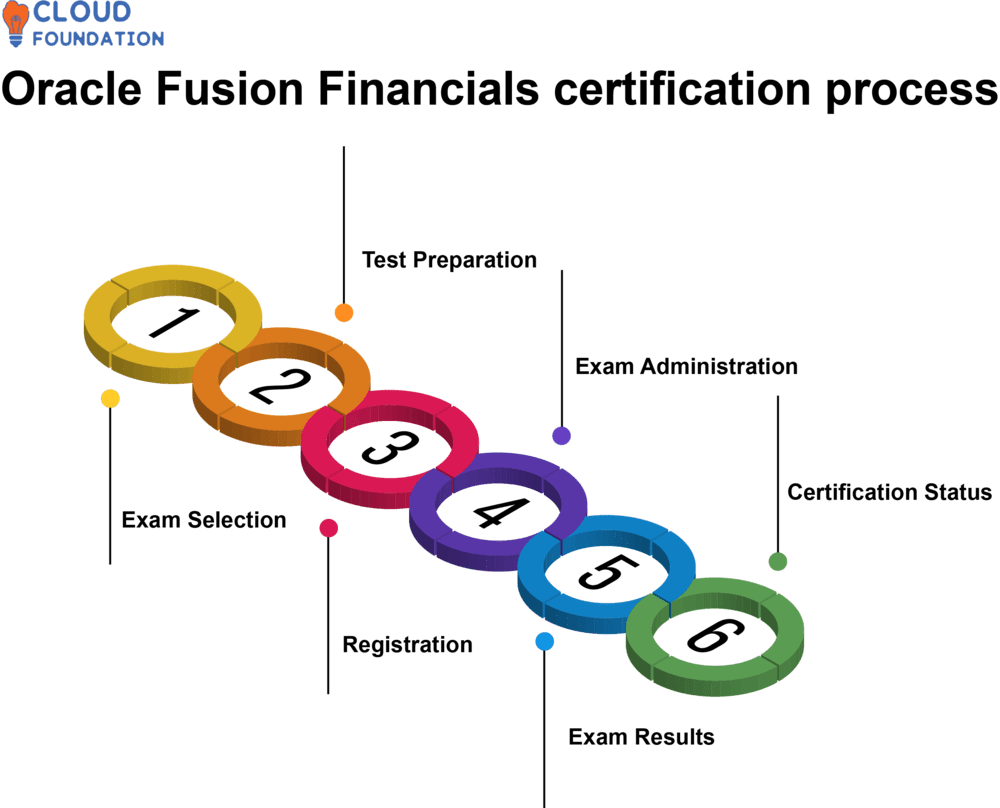

Oracle Fusion Financials certification process

Exam Selection:Exam Selection for Oracle Fusion Financials Certification Certification options from Oracle can vary significantly; select those that best align with your job goals and interests to participate in this certification process.

On Oracle’s website, you may explore and select one or more certifications that best correspond to your area of expertise or module – be it General Ledger, Payables Receivables Cash Management, Asset Management, etc.

Test Preparation: Once you’ve chosen to pursue certification, the next step should be preparation for its examinations. Oracle provides official exam training courses, study aids, and practice exams that can assist your study efforts and prepare you to pass.

Familiarise yourself with the test themes, review suggested study resources and set aside ample time for preparation. Furthermore, exploring Oracle Fusion Financials capabilities through hands-on practice may prove worthwhile.

Registration: When preparations have concluded, the next step should be registering for your certification test. Create an account on the CloudFoundation website and book training sessions as soon as you are ready.

Exam Administration: On exam day, travel to your designated testing center or take an online proctored exam, depending on available alternatives.

Follow the directions outlined by your exam center or online proctoring provider when taking an exam, usually consisting of multiple-choice questions varying in length depending on which certification exam it’s for.

Exam Results:Your results should arrive soon after taking it at an examination center or online proctoring provider.An online proctored exam result is usually available within days.

Certification Status: If you pass the certification in Oracle Fusion, Financials will become official and accessible immediately after that.

Your digital certificate and badge can help highlight your accomplishment on professional networking sites or your resume, with certification typically lasting two or three years before needing recertifying to keep it valid.

Oracle Fusion Financials Course Price

Saniya

Author