How NetSuite features & functions boost business growth

Companies need access to real-time financial data when they plan their financials. NetSuite is a perfect tool that lets businesses see their financial position, the source of their funds, and the intended use of their finances, securing budgetary integrity.

Infrastructure issues in a city construct a lot of radiation that affects companies indirectly that is to say as a result of its enlargement or potentiality as the town grows M asking the obligatory expenses, such as when to expect cash coming in and going out, also helps to stick around on the right lane with the budget.

asking the obligatory expenses, such as when to expect cash coming in and going out, also helps to stick around on the right lane with the budget.

The software, NetSuite, a capable and expedient agent, assists those dealing with cash flow to control their trading expenses.

Sles Management in NetSuite

NetSuite is brilliant in condensing the tracking of sales representatives involved with customers.

A new client is associated with a sales rep to safeguard the correct commission calculation. Corporate customers usually need teams rather than individuals for their account management needs.

The involvement of a sales team makes it possible to log meticulous contributions. When the West Sales Team was responsible for a deal, their percentage of involvement was indicated to ensure the commission distribution was equal.

Marketing Subscription Features in NetSuite

NetSuite software acts as an intermediary in managing subscribers of marketing materials.

An email containing a link to unsubscribe might be one of the things you received. By selecting the unsubscribe link, the subscription status in NetSuite is revised to opt out.

Websites inquire if they are allowed to dispatch newsletters.

NetSuite keeps these preferences in checkboxes for billing communication, product updates, surveys, and marketing newsletters to ensure you only get the requested communication.

Setting Credit Terms in NetSuite

Payment terms refer to the conditions under which payments are made for selling goods. For example, if the terms specify payment after, NetSuite will automatically calculate the due date of invoices based on these conditions.

A simple illustration of this is a credit card statement generated on the 18th, with payment due by the 6th of the following month providing a credit period.

When a credit limit of one hundred thousand rupees is set, NetSuite restricts additional sales until the limit is increased through direct customer payment.

Additionally, customers receive automatic alerts when the credit limit is exceeded, enabling them to manage their financial position more effectively.

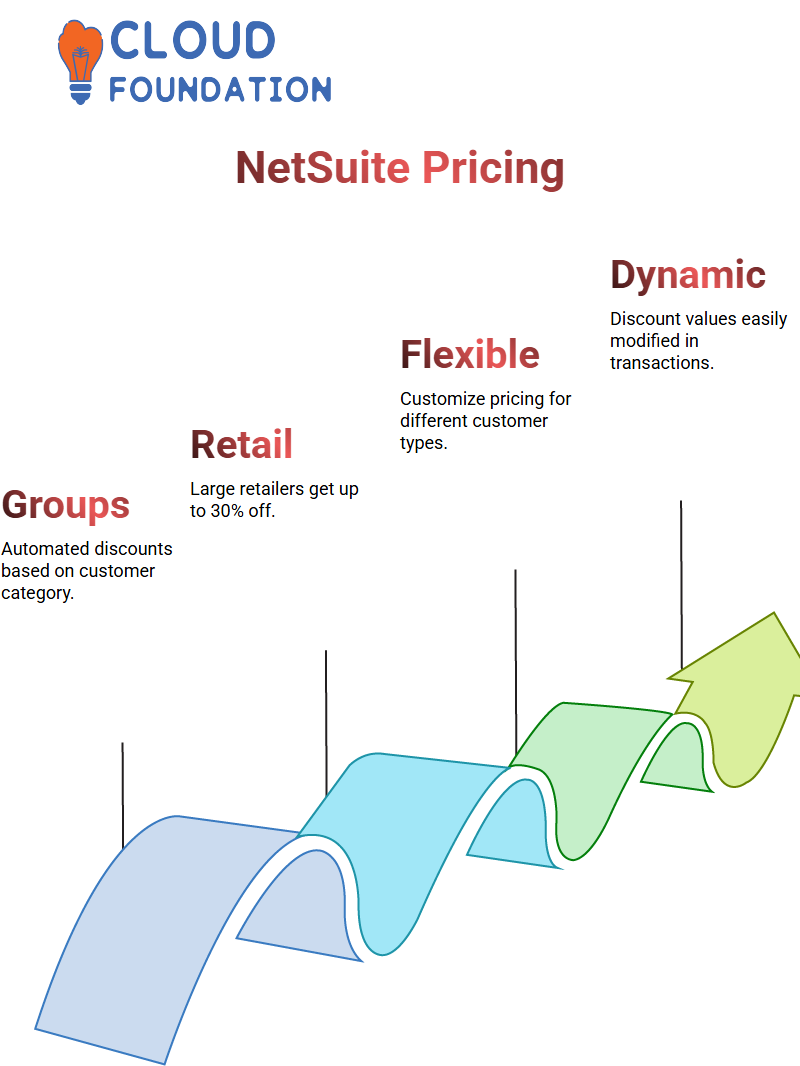

Taking advantage of Group Pricing in NetSuite

As a browser-based application, NetSuite is ideal for businesses seeking to implement fair and consistent pricing strategies for different customer types.

Large retail chains, such as Pantaloons and Shoppers Stop, might receive discounts while smaller shops might qualify for only 15%. Pricing groups can be used to set up automated discounts based on the customer’s category.

For example, a shirt manufacturer whose primary customers are larger retailers can assign this group a discount. Medium-sized stores may receive different discounts, while small shop owners.

These values can be easily modified in NetSuite, and the appropriate discounts will be automatically applied during transactions.

Flexibility in Netsuite Pricing Tactics

NetSuite is very flexible in setting the prices for its products. With this, you can set default customer price levels, construct group pricing based on your strategy, and even haggle with a special price for a particular item.

This guarantees that each consumer enjoys a modified pricing plan, which helps their purchasing habits, as they threaten the structured pricing.

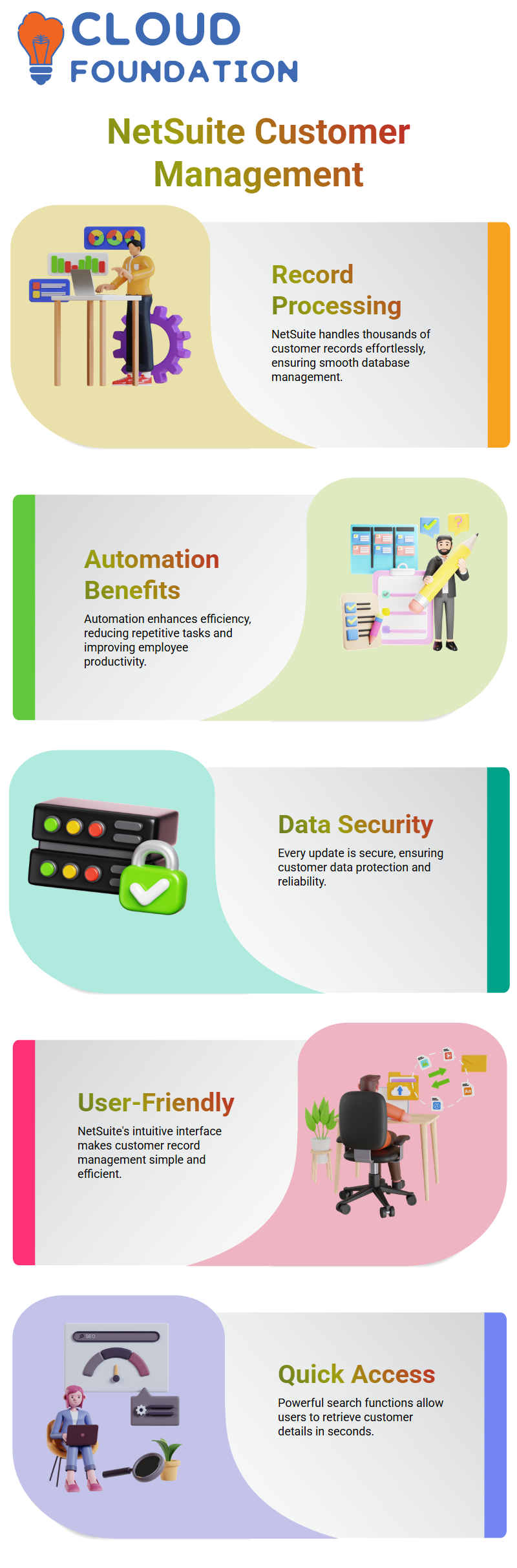

Customer Management in NetSuite

NetSuite is among the most potent contributors to organised Customer Management . Correspondingly, the tool’s main advantage is the possibility of processing thousands of customer records with no trouble.

So, Netsuite can be this simple if you’re adding, deleting or editing your customer database, and that’s why Netsuite is a significant advantage for your business and your staff.

Say that you can run a program in Netsuite, where customer records (thousands of them) are built in just one 1-stroke.

It’s not just a matter of convenience, though it’s a game-changer for those companies who want to increase their effectiveness by doing business in an extendable way.

Automation features provided by NetSuite make managing customers a non-issue, thus making employees’ work easier and augmenting their productivity significantly.

Engagement with NetSuite has highlighted the critical importance of customer records. NetSuite maintains a clean, easy-to-access, and well-structured customer register.

Companies can achieve superior customer intimacy by utilizing clear and straightforward data available on TrentNet.

Most of my acquaintances inquire if working with the Customer Maestro in NetSuite is an easy task. The answer is definitely yes.

A striking characteristic of NetSuite is its user-friendliness, which makes it exceptionally easy for users to find, edit, and retain customer records.

Every update in NetSuite is safe, meaning your customers’ data security will be perpetually ensured.

While talking about customer management in NetSuite, mentioning the great automation features of the Suite is mandatory.

These automation services will operate all the repetitive jobs for you, and you can concentrate on the other essential operations in your company.

With NetSuite, you can be sure that the system will personalise every customer interaction and will be based only on up-to-date data.

Gaining data from NetSuite is a quick and straightforward process. NetSuite’s search functions permit users to find any customer entry in seconds.

Regardless of whether you’re earning customer details or you’re in the process of modifying them, NetSuite guarantees fast and easy access and course-setting.

Managing Customer Evidence Uniformly in NetSuite

By employing NetSuite, a company can keep thorough customer records.

Business owners may store plenty of knowledge, such as their registered names, labels, destinations, dialogue, and even sales details.

Not only is all the data available, but the system also makes it readily accessible, aiding in transactions and customer service.

System Evidence and Customer Access in NetSuite

NetSuite’s system records a lengthy audit trail for each customer, which gives an explicit view of past alterations and actions at the same time, businesses can supply customer access so that they can log in to carry out their tasks and perform other operations safely

The system charts the login details, password policies, and access permissions to make sure that the usability is controlled and reliable.

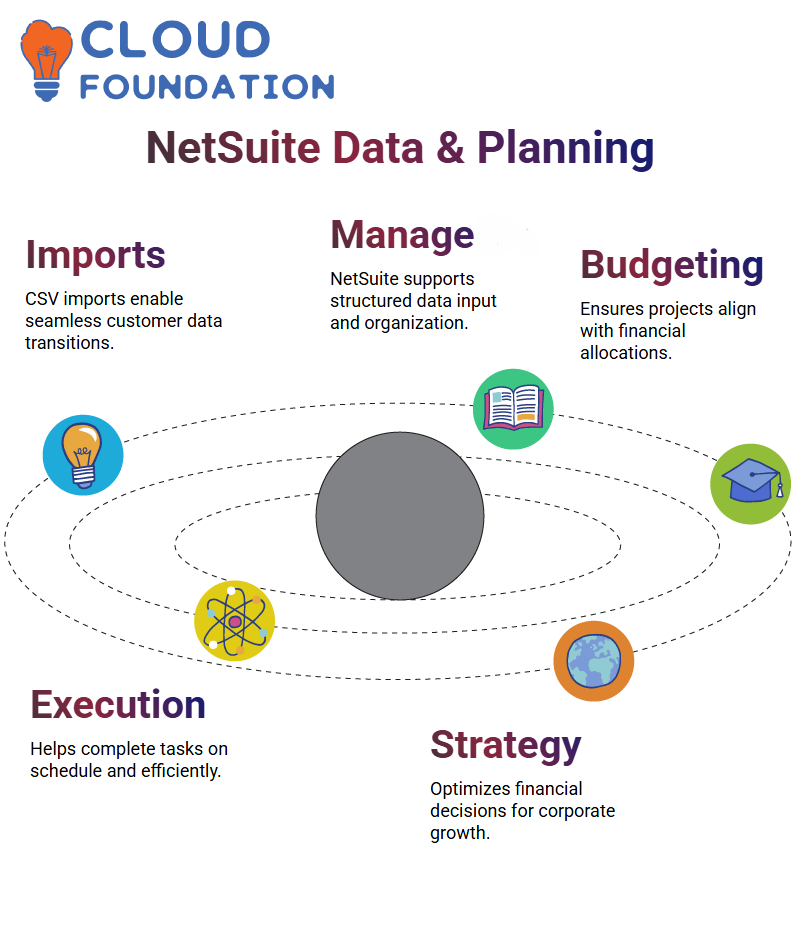

Customer Imports and Data Administration in NetSuite

During the process of switching to Netsuite, the moving of the existing customer data is something that can be done without any issues.

With CSV imports, businesses can transition up to thousands of records in a fast and reliable manner More than that, Netsuite brings to the table powerful tools which support organised input and management of data for both legacy and newly collected customers.

NetSuite and Infrastructure Planning

Infrastructure constructions have the advantage of free budgeting with the help of NetSuite. For representation, think about a highway that links major cities and will be constructed.

If money is made available but the construction is delayed, the businesses existing in those cities will be negatively impacted.

Netsuite will not only make sure that the budget corresponds to the projects but will also support the execution of the tasks punctually.

Besides, capitalising on NetSuite, the decision-makers in firms can ensure that the money is used powerfully by using the available data.

Corporate progression and national development are the two instances where NetSuite is the key to strategy and finance.

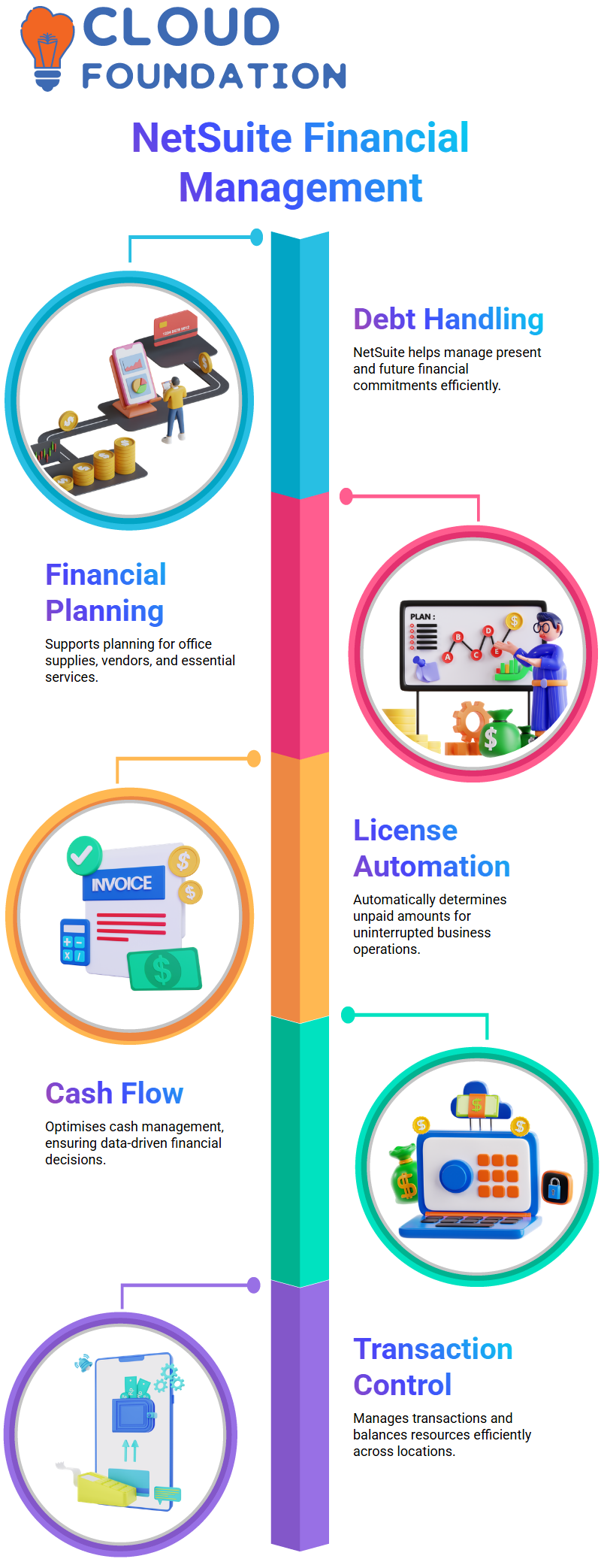

Managing Financial Commitments with NetSuite

An organisation’s present and future debts can be easily handled using NetSuite. Financial planning is a necessity not only for office supplies but also for vendors and security services.

NetSuite licenses are used to determine unpaid amounts automatically; thus, the business can run integrally without interruptions.

For representation, the fixed-term investments made by industry leaders need to be managed financially in a structured manner.

Thus, NetSuite is a system that enables businesses to satisfy their long-term devotion to resources, even as they optimise them.

NetSuite and Cash Flow Rationalisation

NetSuite is the tool to put in the hands of the finance department in the company to optimise their cash flow, have the requisite facts to make the correct conclusions, and control the available budget.

It is a financial manager’s task to keep the company’s spending and revenue synchronised, so that the company does not face financial difficulties.

With NetSuite’s developed reporting tools, businesses can evaluate their financial data and act quickly instead of traditional and slower decision-making.

One example is that a business must ensure sufficient cash is available for daily operations with more than one location in diverse areas.

NetSuite is involved in transaction management and financial balance and helps ensure the resources are used expeditiously.

Financial Tracking in NetSuite

Through customer guru data, NetSuite sets up finance and accounting, where Receivables accounts show the credits issued to customers, ensuring that financial reporting is in order.

The reference code gives the customer account for the product. These accounts can be managed manually through the account preservation transaction.

Credit provides a customer with permission to borrow money.

NetSuite for Future Financial Planning

Budget and sales projections need to be a part of the strategic planning to confirm the company’s sustainability in the future.

NetSuite’s available tools can compare historical budgets and actual expenses, enabling companies to set reliable financial targets for the coming year.

NetSuite eliminates the need to manually set up the new financial structures by automating calculations, making it possible for companies to plan competently.

With the included anticipative competence, NetSuite helps improve financial decisions.

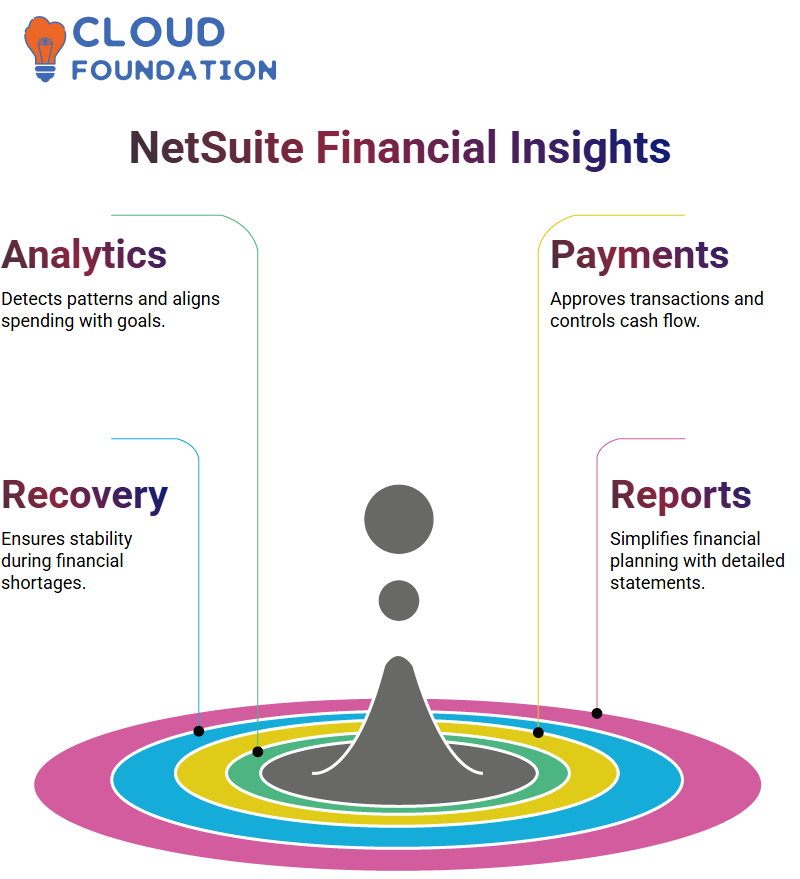

NetSuite’s Impact on Financial Decision-Making

NetSuite enables the finance team to make decisions based on data. Using NetSuite’s analytics, enterprises can detect patterns, govern resources more productively, and confirm that spending is aligned with achieving long-term aspirations.

NetSuite supplies CFOs with the tools to approve payments, control cash in and out, and confirm that money is spent as initially planned.

The given functions guarantee that the companies will have a fast recovery in case there is a shortage of money, and at the same time, follow their long-term plans.

How NetSuite Helps in the Financial Statements Organisation

Financial planning is considered effective when a company ensures that sufficient funds are available to cover its expenses.

One of the most efficient ways to simplify this process is by utilizing NetSuite to produce detailed financial reports that greatly assist decision-makers.

For large international corporations, financial planning is crucial to maintaining a stable and continuous cash flow, which is essential for covering wages, vendor payments, and utility bills.

Consider the scale of the workforce that organizations must pay monthly salaries to thousands of employees.

NetSuite helps businesses plan and advance to have fully optimised cash management.

The software ensures that all expenses, including salaries, rent, and electricity, are recorded, thus preventing the risk of default or penalty.

NetSuite for Budgeting and Prophecy

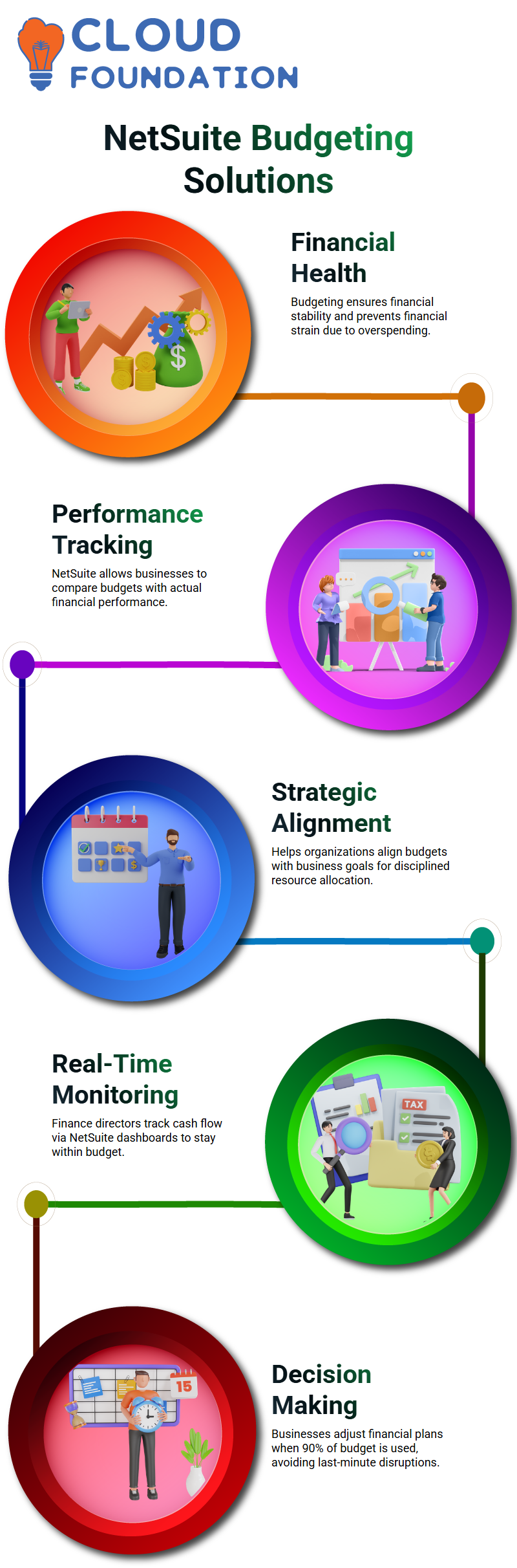

Budgeting is indispensable for financial health. NetSuite permits organisations to compare the same budget items with the actual financial case and suggests immediate remedial actions, if necessary.

Failure to use the budget can suffocate growth, and overspending can make the company financially strained.

NetSuite helps businesses align their budget with strategic ambitions and supports tracking financial performance and comparing plans with actual status, hence upholding financial discipline and proper resource allocation.

NetSuite for Smart Budgeting

Finance directors make it a point to lane the cash flow often, checking on the NetSuite dashboard to be sure that they are on budget Being out of the budget is one big reason of losing the profit margin, if this would still be before profit, the wise choice is to catch the tractions through real-time monitoring.

Using NetSuite, establishments can take the right resolutions when the budget is used. Businesses can plan and change the financial blueprints accordingly instead of being disrupted at the last moment.

Examining Budget vs Actual in NetSuite

One of the advantages of capitalising on Netsuite is that after the budget is defined, it gives reports like ‘Budget vs Actual’ and ‘Budgeted Income Statement’.

These reports are helpful for the financial department to understand the financial performance not only by comparing the actual expenses but also by the variance between the budgeted and the actual amounts.

If any variance is detected, the economic team are supposed to find out the.

As long as the amounts of the budget are not exceeded, the report will be a guarantee to the management.

This situation raises a question of management if the amount is not used.

Just as one case, a company plans to purchase a piece of land with its budget, but the contract is not signed, which means that the company leader will require an explanation.

Impact of NetSuite Budgeting on Business Growth

The budget of Netsuite, along with the business, enhances and speeds up the company.

Suppose funds are set aside to amplify an office, although unused, the growth is lost.

NetSuite assures that the financial plan will align with the company’s ambitions.

Also, similarly, government budgets are a significant part of the economic development of a country.

Thus, if healthcare money isn’t used correctly, this will lead to a situation where the citizens will become the victims, resulting in the country’s economy also being affected.

NetSuite is a tool that helps organisations and governments fine-tune financial resources to achieve maximum effect.

Vinitha Indhukuri

Author