Hands-on SAP FICO Certification training

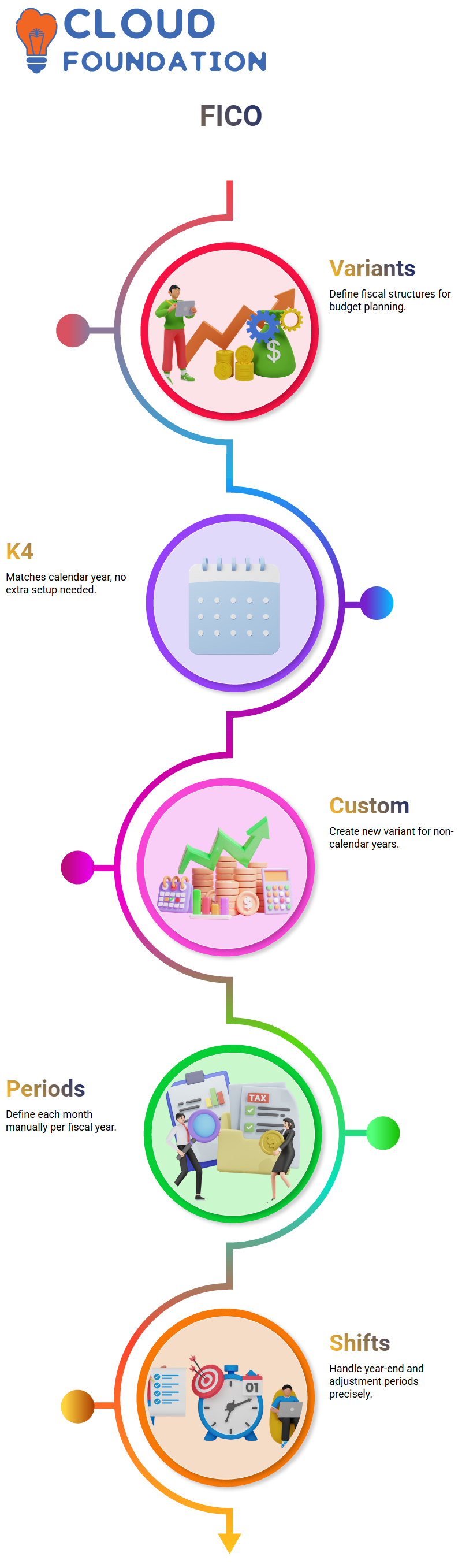

Fiscal Year Variants in SAP FICO

SAP FICO fiscal year variants provide the structure for organising budgetary years.

K4 is my go-to variant, as it aligns perfectly with calendar years, from January through December.

No special configuration for periods is necessary since this variant follows its natural calendar structure.

However, if our organisation follows an unconventional fiscal year, such as April to March, I must create another variant.

Typically, in SAP FICO, I manually define each period; for example, April becomes Period 1, May becomes Period 2, and so on.

To ensure accurate financial reporting and compliance. Furthermore, special periods, typically four additional ones, can also be set aside specifically for year-end adjustments, which are supported as special periods.

These periods provide more flexibility in our management of closing activities.

Fiscal Year Periods in SAP FICO

When working with non-calendar fiscal years in SAP FICO, each period must be defined manually.

For instance, if our fiscal year starts in April, then April is Period 1, May becomes Period 2, and so on. The setup requires scrutiny because it affects how transactions are recorded and reported.

As part of my job duties, I also take into account any year shifts. For instance, if our fiscal year ends in March and we are now in June 2025, then March 2026 is considered part of fiscal year 2025 and is assigned through year-dependent period assignments, which I manage in SAP FICO to ensure accurate reporting.

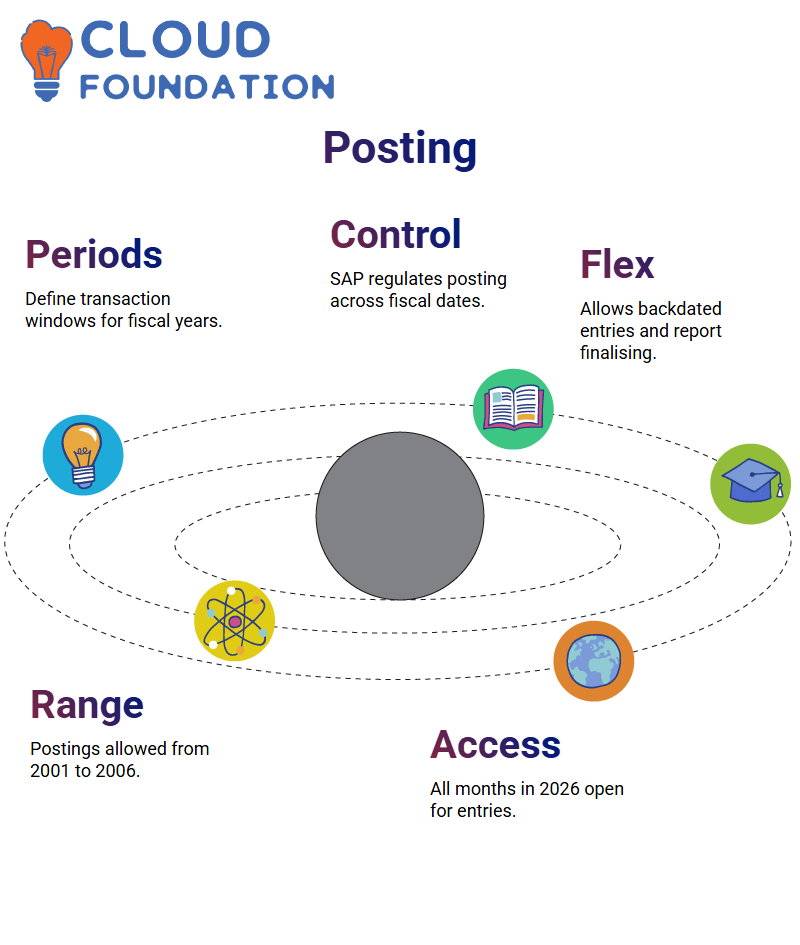

Navigating Fiscal Year Settings in SAP FICO

My experience working with SAP FICO has taught me it’s crucial to comprehend how fiscal years interact with posting periods.

SAP FICO will allow transactions posted between 2001 and 2006 as determined by your fiscal year setup, giving your organisation maximum flexibility when posting transactions within that window. In effect, SAP FICO regulates transaction availability.

Recently, I noticed that one of my clients posts entries under fiscal year 2026. According to SAP FICO, this indicates that all periods through 2026 can be posted – any month within that year may be open for postings.

Flexibility can be advantageous when backdating transactions or finalising annual reports.

Posting Period Variants in SAP FICO

SAP FICO also utilises an important concept called the posting period variant to control which periods are open for posting financial transactions.

Assuming our fiscal year extends from January through December and we’re currently in June, period 6 is currently closed in our system. Any transactions can be posted unless this period is explicitly reopened.

As part of my SAP FICO practice, I make sure the posting period variant is correctly configured through SPRO > Financial Accounting Global Settings > Ledgers.

Once there, I create or copy and assign a posting period variant specific to our company code; this ensures only authorised periods remain open, preventing accidental postings to inappropriate fiscal periods.

Setting Up Posting Periods in SAP FICO

Once I have decided upon my fiscal year, the next step should be setting posting periods in SAP FICO.

This step is critical because it determines when financial transactions can be posted. I begin this step by accessing the posting period variant and creating an entry for one company code, 1100 days before the start of the posting period variant.

After creating the variant, I assigned it to a company code so that the system would know which periods are open for posting.

With SAP FICO, this setup serves more than just as a formality — it helps prevent unauthorised postings outside of specified time slots.

Open and Close Periods in SAP FICO

Once I have set up my posting period variant, the next step is to identify open periods using SAP FICO’s “Open and Close Posting Periods” feature.

Here, I specify my variant and set a range of periods that should be open. For instance, if I wish to allow postings between January and June, I can put the range from Period 1 to 6.

SAP FICO gives me the precision needed to efficiently handle month-end or year-end closing tasks, whether that means posting just in June. By opening period 6-6, I can easily control this activity.

Special Periods in SAP FICO

SAP FICO special periods -13 to 16–are explicitly tailored for audit or tax adjustments, or when posting final entries after closing their general ledger.

I frequently use them when providing clients with final entries after their general ledger is closed out; I find that SAP FICO allows me to keep these periods open solely for financial reporting requirements.

As part of my year-end processes in SAP FICO, clients frequently ask whether they can post in special periods.

My answer? Absolutely. Provided they use SAP FICO correctly, posting during special periods keeps their books clean and auditor-ready. My recommendation is only to open what’s necessary to avoid accidental postings of records.

SAP FICO Special Periods

Working with SAP FICO often raises queries regarding special periods (namely, periods 13 through 16).

These extra periods allow for financial adjustments after the regular fiscal period has closed; SAP FICO enables these extra periods for post-period adjustments, such as tax postings or carry-forward entries.

Though special periods are optional, they can prove invaluable when closing your books at year-end.

For instance, if your fiscal year runs from January to December but you still need to record tax information for December after the year-end closing, SAP FICO allows you to post this entry under period 13.

I have used this feature extensively during implementations to manage late adjustments or advances for the new fiscal year.

SAP FICO does not impose special periods, yet I find them very useful when transactions are missed by the closing deadline. I utilise them when transactions need to be captured before the closing date.

Compliance checks ensure that financials remain compliant without disrupting closed financials, with adjustments reflected in subsequent period reporting, thanks to SAP FICO’s flexibility.

Cross-Module Integration in SAP FICO Period Handling

SAP FICO integration with other modules, such as Materials Management and Sales Distribution, is another challenge I face.

However, I oversee financial postings directly; my collaboration with the MM and SD teams for material or sales entries during monthly closings makes my life much simpler.

SAP FICO enables accounts to be segregated by department. I, for instance, can close all FI accounts at the end of the period, while the MM and SD teams use SAP FICO as part of their closing procedures.

By keeping accounts separate, this policy ensures that no one accidentally closes an account in another department without prior agreement from those involved.

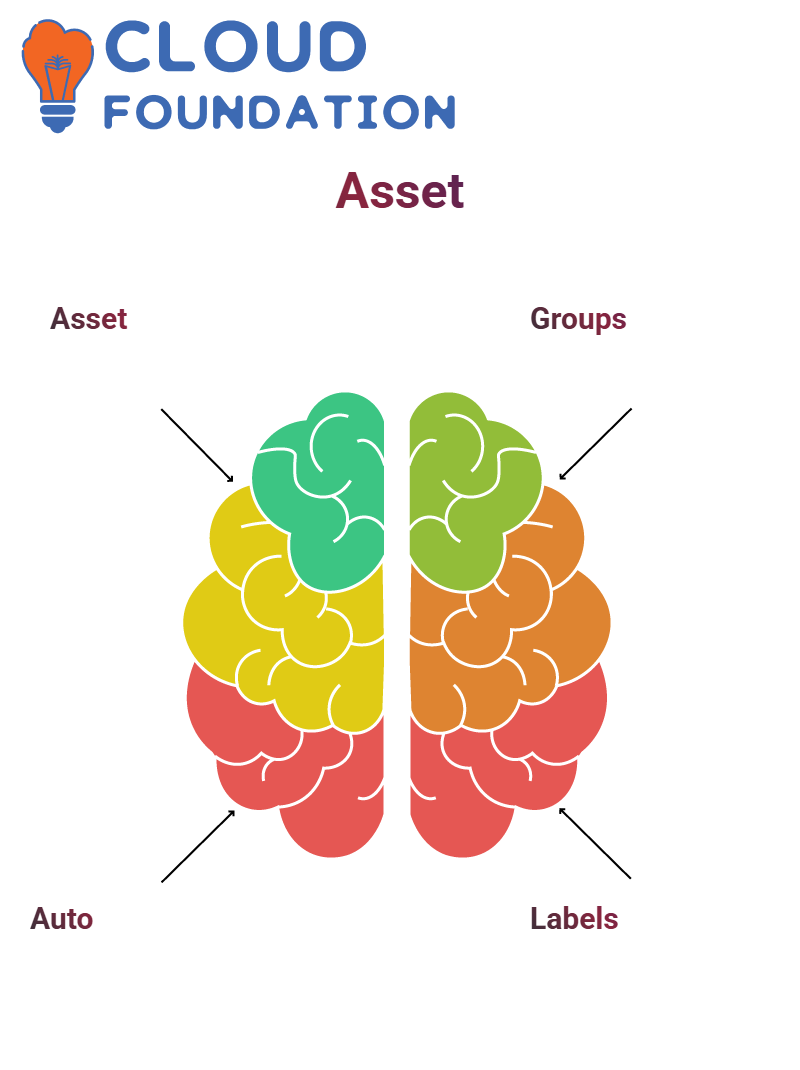

SAP FICO Field Status Variants

SAP FICO makes use of field status variants (FSVs). I was inspired when I first faced configuring GL accounts by how SAP FICO uses FSVs to control screen input during document entry.

Each field status group in SAP FICO corresponds with one account type or account usage: expense, revenue, asset or liability accounts.

SAP FICO determines which fields should be mandatory or optional when configuring these GLs based on this purpose; cost centres become required while profit centres are enforced when configuring revenue accounts.

One of my SAP FICO projects involved working closely with over 40 field status groups, and SAP FICO enabled me to tailor field behaviour granularly across each account type. Utilisation-related General Ledgers automatically enforce reconciliation account fields, which are crucial for maintaining integrity across asset postings.

One thing I particularly value about working with SAP FICO is its well-structured yet customizable nature.

Field Status Groups in SAP FICO

As part of my practice with SAP FICO, one of the core elements emphasised is understanding field status groups.

These groups determine how data entry fields behave during transaction postings based on specific General Ledger accounts; they also define whether any particular field is required, optional, or suppressed.

As I navigate to groups such as YB01, general data fields are not mandatory. When I switch over to cost entries (G0C4) and fill out cost center fields relating to costs incurred on transactions (ie. G0C4 is for cost entries), then cost center fields become required to proceed with transactions; without these filled-out the transaction won’t proceed which ensures data integrity and compliance with financial reporting standards – all key components when configuring SAP FICO!

SAP FICO allows us to customise field status groups easily. I typically duplicate an already predefined group and modify its name according to our company code.

I assign it as needed, so we can maintain consistency while meeting specific needs in an efficient and tailored manner.

How SAP FICO Handles Mandatory and Optional Fields?

Let’s consider an example. Imagine creating an asset account in SAP FICO; SAP FICO prompts me for reconciliation accounts automatically–this step is required and shouldn’t be left optional; SAP FICO mandates it!

By linking your asset register automatically through postings of assets back onto its record system, without requiring manual effort, reconciliation accounts ensure that every posting automatically links back to asset register entries, eliminating manual mistakes during their creation or posting process.

I recall exploring Transaction OB-A7 of SAP FICO to gain access to the field status group configuration. From there, I could view which fields were mandatory and required configuration.

SAP FICO provided me with labels such as ‘suppress’, ‘optional’, and ‘required’, which allowed me to customise data entry forms precisely according to my needs. Plus, using its preview feature, I could test how various settings would behave before taking them live.

SAP FICO impressed me by ensuring consistency among entries. For example, if an invoice attempts to post without all necessary fields like an assignment number being filled in correctly, the system halts you before you can go ahead.

No workaround exists unless valid data are supplied; adhering to this discipline, even though sometimes strict, saves much-needed cleanup work down the line.

Plus Symbol for Account Types in SAP FICO

SAP FICO utilises the “+” symbol as a wildcard setting that applies across account types, making configuration easier while maintaining consistency across modules, such as GL, AP, and AR.

I find this especially helpful when opening periods in each of them (GL, AP or AR) simultaneously. Using it simplifies configuration while guaranteeing consistent reporting throughout.

However, in production environments, I typically define each account type explicitly to enable individual departments, such as Finance, Materials, or HR, to operate autonomously while adhering to the SAP FICO framework.

SAP FICO Projects

Every time I create or analyse a GL account, I rely heavily on SAP FICO field behaviours as guides for my actions.

At company code 1710, for example, we created multiple accounts, including bank interests, liabilities, and receivables, using SAP FICO reconciliation account checks that we implemented through field status groups.

Once I select YB67 as my field status group, SAP FICO automatically adjusts the visible fields while I transact.

From invoice references to assignment numbers, everything is laid out, with SAP FICO helping me define optional and suppressed fields.

Meanwhile, transaction screens remain user-friendly and organised.

In some advanced instances, I’ve even adjusted these settings specifically for specific user roles. SAP FICO provides administrators with the necessary administrative flexibility to accommodate different departments and user responsibilities without compromising control.

SAP FICO stands out as an outstanding ERP module, thanks to this dynamic balance; users find its use both satisfying and effective daily.

Navya Chandrika

Author