How does Guidewire Claim Center Work?

Guidewire Claim Center: Extending Entities

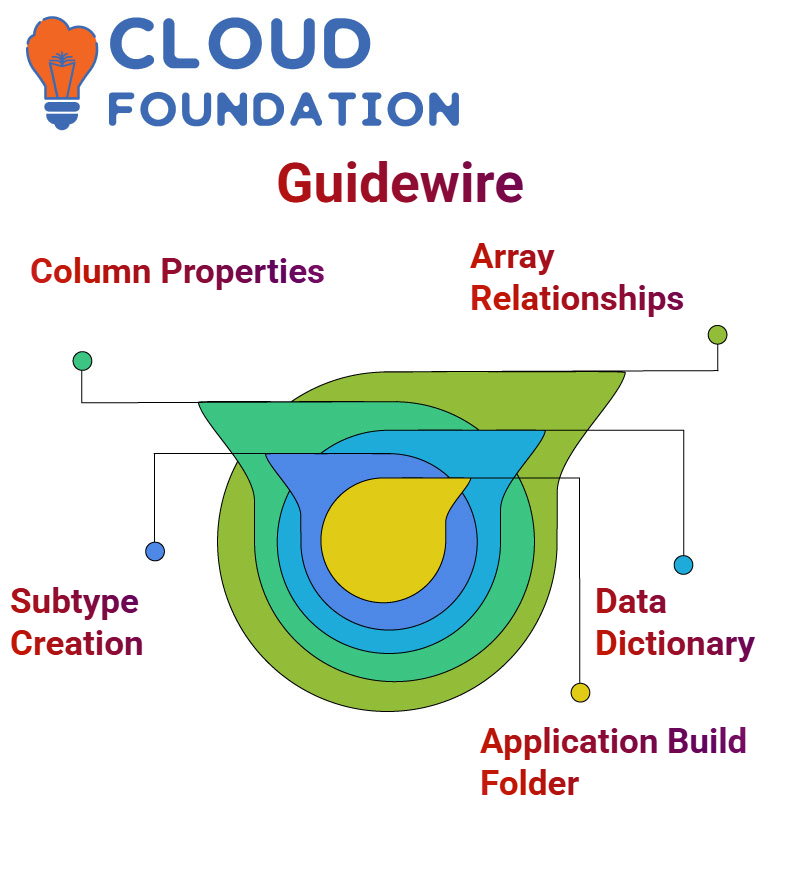

Today we will explore how to extend entities in Guidewire Claim Center. Launch Guidewire Claim Center’s entity editor by using Control+Shift+N and typing out an entity, such as “AB Contact.” If necessary, an ETI file with custom fields already present should contain an underscore “EXT”, while out-of-the-box fields don’t. To edit, edit any modifications you made. If additional fields need to be added manually using EXT files this could take time as custom fields differ significantly.

As part of creating custom fields, prefixed with “EXT” or even organization-specific names is one way to indicate customization; an entity with all fields containing “EXT” means its fields can all be customized without needing an extra “EXT”. Addition of columns involves specifying their properties.

For instance, creating a type list field would involve creating a type key and specifying its name; when needed you could also provide details like mandatory or optional status as well as optional default values when required. When adding a varchar column it’s key that its size be specified so as to prevent errors from arising.

Guidewire Claim Center allows for the setup and establishment of relationships among entities. Creating array relationships requires selecting an array key and then specifying its reverse foreign key; this step ensures that entities such as AB Contact and Building EXT have been connected properly.

Creation of subtypes and parent-child relationships are also integral parts of entity extension. If you need to add another entity under AB Contact, navigate to Guidewire Claim Center’s extension file, define both subtype and supertype before creating. Once created, this entity will appear in your data dictionary for future modifications.

Guidewire Claim Center: Adding Columns and Relationships

Guidewire Claim Center allows users to define column properties such as its name, type, size and default values when adding new columns. For instance, adding a nickname field of type varchar with an acceptable size limit of 50 characters. Furthermore, optional or mandatory fields could also be set depending on personal requirements. Guidewire Claim Center provides an essential means for creating relationships among entities.

An array relationship requires setting an array key, linking entities like AB Contact and Building EXT together and configuring its reverse foreign key if needed for completion.

Subtypes allow you to define parent-child relationships between entities. For instance, creating a new subtype for an AB Contact requires selecting their supertype (parent entity) as the super type and configuring specific fields within it – creating effective organization of entity relations in Guidewire Claim Center.

Guidewire Claim Center: Regenerating the Data Dictionary

Regenerating the data dictionary after making significant modifications is an integral step when working with Guidewire Claim Center, so I often run this command multiple times after making any significant alterations.

Over time it becomes second nature; one of those things you learn by doing and applying frequently on the database side. Your generated data dictionary should typically reside within the build folder for whatever application you’re working on – for instance if you are in training app it will likely appear there; similarly if running commands within Guidewire Claim Center generate a data dictionary within its build folder.

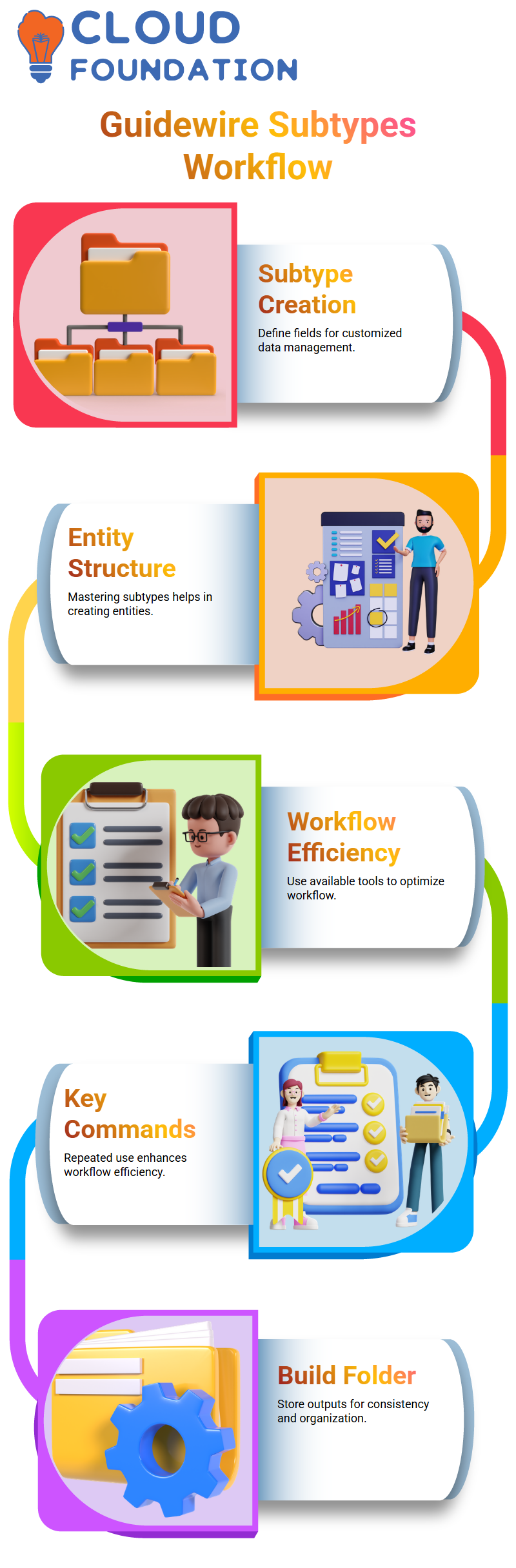

Guidewire Claim Center: Managing Subtypes and Fields

Guidewire Claim Center makes creating subtypes easy. Just as with other entities, subtypes allow users to define any number of fields to customize and manage data efficiently within the system.

It offers flexibility that enables customized data management strategies. Once you master creating subtypes, the skills for creating new entities will come naturally to you. Understanding their structure is key here – use all available tools within Guidewire Claim Center to facilitate your work flow efficiently!

Guidewire Claim Center: Key Commands and Workflow Tips

One of the advantages of working with Guidewire Claim Center is becoming familiar with key commands. By repeatedly using them, these become part of your daily workflow: from regenerating data dictionary entries or managing subtypes – processes you will improve with experience.

If ever in doubt, remember the build folder as your go-to location for outputs – whether working on an app training app or the Guidewire Claim Center itself. Consistency of organization is invaluable when managing complex data flows.

Understanding the Core of Guidewire Claim Center

At the core of every Guidewire Claim Center lies what’s commonly known as its main entity or “claim entity,” often referred to by staff members. This integral element serves as the backbone that supports all processes within our center.

Imagine yourself involved in an unfortunate car accident and seeking compensation through insurance claims. A customer service representative (CSR), using Guidewire Claim Center software to document every detail you provide as you begin filing the First Notice of Loss (FNOL) document will begin processing this request immediately.

How the First Notice of Loss Works in Guidewire Claim Center

When your CSR creates an FNOL, they enter essential details about you policy number, damages and any injuries into the Guidewire Claim Center screens step-by-step to enter all this data into one transaction and store it all as part of their claim database. For mobile app-users filing their claims via front-end portals, data collection takes place before being transmitted directly to Guidewire Claim Center as JSON or XML format for processing by their system which then generates and saves an FNOL and all related claims details in an entity file.

Role of Claims and Contacts in Guidewire Claim Center

Guidewire Claim Center claims are more than records: they’re structured entities containing all related data and even generate their own claim number for easy reference. While claims remain the primary unit in terms of data storage and organization, some elements could potentially link back out via foreign keys to other entities within Guidewire Claim Center.

Contacts play an essential part in any system. They could include customers, CSRs or anyone affected by an incident who need documentation of events accurately. Each contact may play their own unique role within that context – like being payer or claimant respectively – which are essential components for accurate documentation purposes.

Understanding Incidents in Guidewire Claim Center

Incidents encompass all damages associated with one claim. For instance, if your car collided with both another vehicle and a building at once, these incidents would each fall under one claim. With Guidewire Claim Center you are able to document multiple incidents at once for a comprehensive overview.

Tracking Payments Through Exposures in Guidewire Claim Center

Guidewire Claim Center uses exposures as a tracking mechanism. Exposures are virtual entities used to track payments and activities related to specific incidents; multiple incidents may even be tied together under one exposure for quick processing. Reserves, which indicate how much the insurance company would pay out should there be an accident, are carefully calculated in each policy to ensure fairness and accuracy in payout amounts.

Understanding the Role of Reserve Lines in Guidewire Claim Center

Guidewire Claim Center features reserve lines as a key factor, as they play an essential part in its operation. Reserve lines represent an insurance company’s maximum allocation to an exposure and often can contain multiple reserve lines – for instance, as an adjuster when investigating claims I might set aside one reserve line but then, upon receiving documentation proving additional damages from claimant I can quickly create additional reserve lines to adjust exposure accordingly.

Guidewire Claim Center allows every incident to seamlessly link with exposures, reserve lines and checks – seamlessly tracking payments with each one and processing payments efficiently and smoothly. Once these components have been established for an incident, check creation takes place naturally – an exciting sight! It is exciting seeing how easy and streamlined this connection process is through Guidewire Claim Center!

The Significance of Checks in Guidewire Claim Center

Guidewire Claim Center deducts checks created within it from their respective reserve lines – for instance if I create a $200 check from my $500 reserve line – then processes payment quickly before sending this data off to third-party systems in order to ensure claimants get what is owed them.

Guidewire Claim Center provides seamless claim handling by connecting reserve lines, exposures and checks as an interdependent system. Whether adjusting reserve lines or monitoring payment flows – everything is taken care of here!

Managing Activities and Documents in Guidewire Claim Center

Guidewire Claim Center activities are another integral element of claim processing. Each activity comes complete with due dates and assignments to make sure nothing slips through. As an adjuster myself, I know first-hand how these activities – whether investigating claims, collecting documents or creating reserve lines – keep everything running on schedule.

Document Management features are impressive as well. Users and Customer Service Reps (CSRs) alike can upload documents directly, such as evidence provided via email or uploaded directly into Guidewire Claim Center – making sure every detail remains safe, readily available and easily retrievable.

The Role of Notes and Matters in Guidewire Claim Center

Notes in Guidewire Claim Center can serve as a digital logbook of claims. For example, when handing off claims between adjusters, I can leave detailed comments in this area to ensure they understand its history and can take over seamlessly. Matters on the other hand cover legal aspects, like third-party liability coverage.

I find it fascinating that Guidewire Claim Center manages such intricate relationships between claims and matters in such an efficient fashion – guaranteeing even complex cases are resolved efficiently while fulfilling all legal obligations before processing their claim.

Exploring the Claim File Interface in Guidewire Claim Center

Guidewire Claim Center provides an organized view of an entire claim file, from contact incidents and exposures, reserve lines, activities and reserve line activities, etc. Everything is listed clearly – for instance the exposure tab displays all exposures related to claims while policy section details outline policy specifics; all this intuitive functionality makes claims management simple!

Litigation and matter screens provide insight into ongoing disputes, while the notes section documents key observations. With its holistic view and straightforward claims administration process, Guidewire Claim Center truly facilitates claim management with transparency and ease.

Assigning Activities in Guidewire Claim Center

Guidewire Claim Center makes activity assignment an effortless process, enabling me to set due dates and activity patterns for each task, so if a claim investigation requires specific follow up actions. I can set activity rules to automatically assign and track them – keeping me proactive and organized throughout!

Guidewire Claim Center Activity Patterns

Let me describe how activity patterns work within the Guidewire Claim Center. Imagine you need to recover emails; here’s your strategy: create a new activity pattern by specifying all required fields, such as an activity subject and unique identifier code; these details form the framework of your activity pattern and form its ground rules.

Target days provide guidance as to when activities should be due; for instance, if an activity is created today with two target days set as its due date. Meanwhile, escalation days show how an unfinished task escalates over time: say an activity created today has three escalation days set on it that makes its due date three days after.

Guidewire Claim Center allows users to not only specify dates but also rate the importance of each activity; for instance, by marking it ‘high’. Once an activity pattern is in place, code can be written using either new keyword in studio or classes to create activity objects which then reflect in admin screen.

![]()

Guidewire Claim Center Business Logic for Activities

Guidewire Claim Center can create activities easily; yet another challenge lies in activating them. When customers file bodily injury insurance claims, specific activities will need to be triggered immediately. Activity patterns declare activities but define trigger logic through code; then this conditional logic activates those specific activities when needed. Have a claim object with multiple activities attached to it.

With the ‘create activity from pattern’ method, you can attach any activity pattern name directly to a claim and have it assigned accordingly based on this pattern from your database. Each pattern comes equipped with its own code to guide how an activity should form and become connected with that claim object.

Guidewire Claim Center Work Plans and Activity Flow

Work plans are crucial for managing activities in Guidewire Claim Center. These rules kick in when claims or exposures are created. Based on initial conditions, activities are triggered automatically. For example, when a claim is filed, a review activity might be generated for the supervisor.

Once completed, another activity can be assigned to an adjuster to investigate the claim. You can debug existing flows and check configurations to understand the Guidewire application’s behavior. Logs often provide insights into which files or methods were triggered. By placing debug points, you can navigate modules effectively and solve any issues.

Guidewire Claim Center Screens and Processes

Guidewire Claim Center screens act like wizards, leading users through data entry and processes with ease. For instance, when saving claim data using submit, clicking submit will run backend rules sequentially while debugging logs provide insight into which files methods were executed in which gives greater insight into how claims are being processed.

Guidewire Claim Center provides efficient workflows for claims and activities by streamlining them onto PCF files or debugging modules, offering seamless processes tailored to suit organizational requirements. Thanks to its advanced infrastructure, users can efficiently configure and optimize claims processes tailored to fit organizational needs.

Guidewire Claim Center: Creating Objects Seamlessly

Guidewire Claim Center makes object creation straightforward. Say you need an entity, for example “EB Company”, you would simply name your variable with “var”, name the variable with ‘new’, initialize with an entity, and use its ID instead – unlike Java, this streamlines the process! Once an object has been created, its properties can be easily accessed using dot notation. For instance, to print its text ID property, simply use an object followed by “.text ID”. This ensures efficient handling of entities and properties within Guidewire Claim Center.

Guidewire Claim Center: Utilizing Documentation and Error Handling

Guidewire Claim Center provides powerful tools to better comprehend documentation and manage errors. Simply by pressing Control on an entity variable such as “EB Contact” or “EB Company”, its documentation can be displayed, providing details regarding functionality, return type, exception handling, etc. It makes understanding their behaviour much simpler! Guidewire Claim Center excels at error handling. Entities throw exceptions when necessary, providing you with ample opportunity to address issues effectively. Grasping these concepts is essential in operating smoothly within its environment.

Guidewire Claim Center Integration with Banking Systems

Let’s consider how Guidewire Claim Center seamlessly interacts with banking systems. Imagine this–once your claim has been approved in Guidewire Claim Center, it goes straight into bank processing, where it gets processed for claim payment and sent directly back out again for claimant payment. Since Guidewire Claim Center handles claims while the billing center handles invoices/premiums separately, all related payments stay in Guidewire Claim Center without going via the billing center at all.

Claim Reconciliation Batch in Guidewire Claim Center

Each night, Guidewire Claim Centre’s reconciliation batch kicks into gear. First, it retrieves files from shared directories containing information on claims cleared by banks, reads these rows, and processes each claim, updating their statuses within Guidewire Claim Center to “Closed”. FTP servers are utilized to fetch these files to keep all claims up-to-date with banking actions and ensure timely reconciliation processes are followed through on.

Guidewire Claim Center Reporting Integration

Guidewire Claim Centre’s Reporting Integration Batch consolidates daily claim data into an XML format before sending it directly to an insurance reporting system via web services. Newer systems might accept JSON instead; legacy insurance systems often prefer XML instead for smooth operations when reporting.

Telematics Integration in Guidewire Claim Centre

Telematics integration adds another level to the Guidewire Claim Center. Imagine reporting a claim with an FNWL (First Notice of Loss). Once submitted, an integration batch checks if vehicle information like VIN is available as well as whether this claim meets the criteria to enter “New Loss Validation Level.” Once these conditions have been fulfilled, integration triggers and brings in data for that claim daily, ensuring timely updates within Guidewire Claim Center.

Gayathri

Author

“Empowering Your Digital Journey with Insightful Expertise”