Workday Procurement To Pay Step-By-Step Guide

Optimizing Business Operations: Spend Categories and Organizational Management

In modern business environments, efficient systems for expense management and organisational structuring are critical.

Companies need transparent processes to manage procurement, categorise spending, track costs, and assign roles accurately.

Understanding these processes helps businesses improve efficiency, reduce errors, and make informed decisions.

Spend Categories: Hierarchy vs. Standalone

Spend categories allow businesses to classify expenses and track spending effectively. There are three main approaches:

Creating New Spend Categories: Enables multiple categories such as age, travel, or region-specific groups (e.g., India, Hong Kong, Malaysia).

Maintaining Existing Hierarchies: Adds new categories under an existing parent group for structured reporting.

Creating Standalone Categories: Does not attach to any hierarchy, offering flexibility for unique expenses.

Proper categorisation improves visibility into costs and simplifies reporting for management and finance teams.

Workday Procurement and Fulfilment Sources

Procurement strategies outline the process by which goods and services are acquired and paid for. Systems typically manage:

Purchase Orders (PO): The supplier raises a PO, and payment is made only by the company.

Direct Payments: No PO is issued; the team receives a pre-determined amount.

Repetition fulfilment sources, such as procurement, suppliers, and expense categories, ensure consistency in recurring transactions.

Classification into goods (such as office supplies) and services (like teachers, vendors, or security personnel) helps maintain compliance and manage budgets efficiently.

Managing Purchase Item Groups in Workday

Grouping items through purchase item groups—such as Spank and Any—provides a clearer view of total costs. Each item can have a default ordering price (e.g., $ 100) and a base unit of measurement.

The system automatically calculates unit prices based on usage, ensuring accurate tracking of costs and expenses.

Related work tags further enhance expense tracking by linking cost values to each item. Without proper cost entry, the system prevents saving incomplete information, ensuring data accuracy.

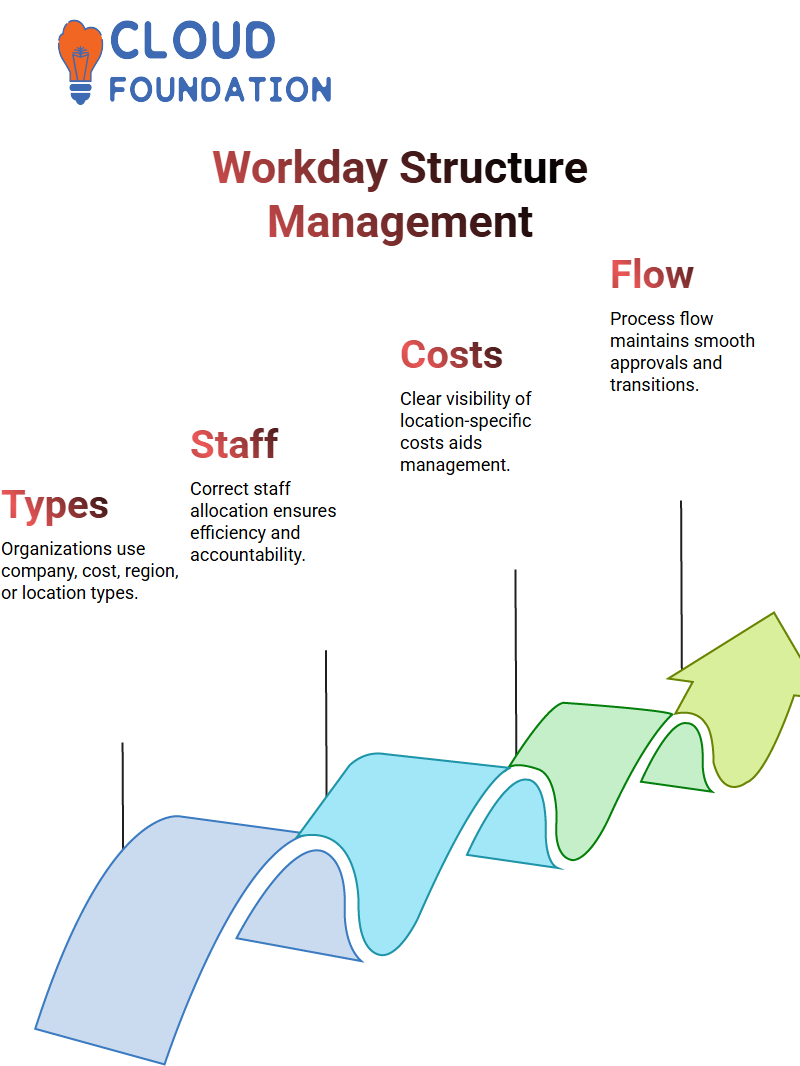

Workday Organizational Structures and Cost Centers

Organisations often have multiple types and sub-types, such as company, cost, region, or location. Subtypes, such as cost centres, can be defined for finance, payroll, IT, or procurement. Maintaining these structures is critical for:

Daily operations management

Role assignment accuracy

Clear visibility of location-specific costs

Hierarchy management ensures that transitions, approvals, and assignments occur smoothly, preventing errors like double-assigned roles or misplaced cost allocations.

Related Work and Transaction Management in Workday

The concept of related work is essential for understanding business processes. It involves adding relevant details to transactions to make them meaningful.

For example, in a call centre setup, each object in a transaction is linked to its context, ensuring clarity and accountability.

Key tasks include:

Maintaining related work

Taking usage (documented in PDFs or system logs)

Assigning correct cost centres and locations

Proper management of related work prevents operational errors and improves the efficiency of business processes.

System Challenges and Customisation in Workday

Despite well-designed systems, challenges exist:

Screen refresh and background noise issues

Misassigned roles

Dependencies on client-specific requirements

Limited financial training or access to historical recordings

Customisation is crucial. Businesses can adjust the order of tasks, create subtypes, and implement custom solutions tailored to their operations.

This flexibility ensures that the system meets the unique needs of each organisation while enhancing overall efficiency.

Global Capability Centres and Strategic Investments in Workday

Investments in Global Capability Centres (GCCs), like the 26 million USD AI-focused centre in Chennai, illustrate the importance of centralised operations.

GCCs enable scaling, process standardisation, and innovation. However, location decisions must consider infrastructure, governance, and political stability to maximise operational effectiveness.

Streamlining Financial Workflows: From Spend Categories to Fiscal Schedules

Managing company finances in modern platforms like Workday or Amazon’s accounting system requires more than just technical setup—it demands clarity in mapping, rule-setting, and ensuring that every transaction has a defined flow.

Let’s explore how Venetian trees, spend categories, and fiscal schedules can be leveraged to maintain accuracy, prevent errors, and optimise reporting.

Spend Categories and Posting Rules in Workday

Spend categories, often predefined in platforms like Workday, help classify expenses into operational groups. For example, travel, software, or vendor payments can each have their own categories.

Here’s how spend categories interact with posting rules:

Default Accounts: If a spend category matches a rule, the transaction is automatically posted to the designated ledger account.

Error Handling: If no match is found, the system flags it for correction.

Flexibility: Users can create or edit posting rule sets by searching and adding categories directly.

This structure helps finance teams manage spend visibility while maintaining compliance.

Workday Online Training

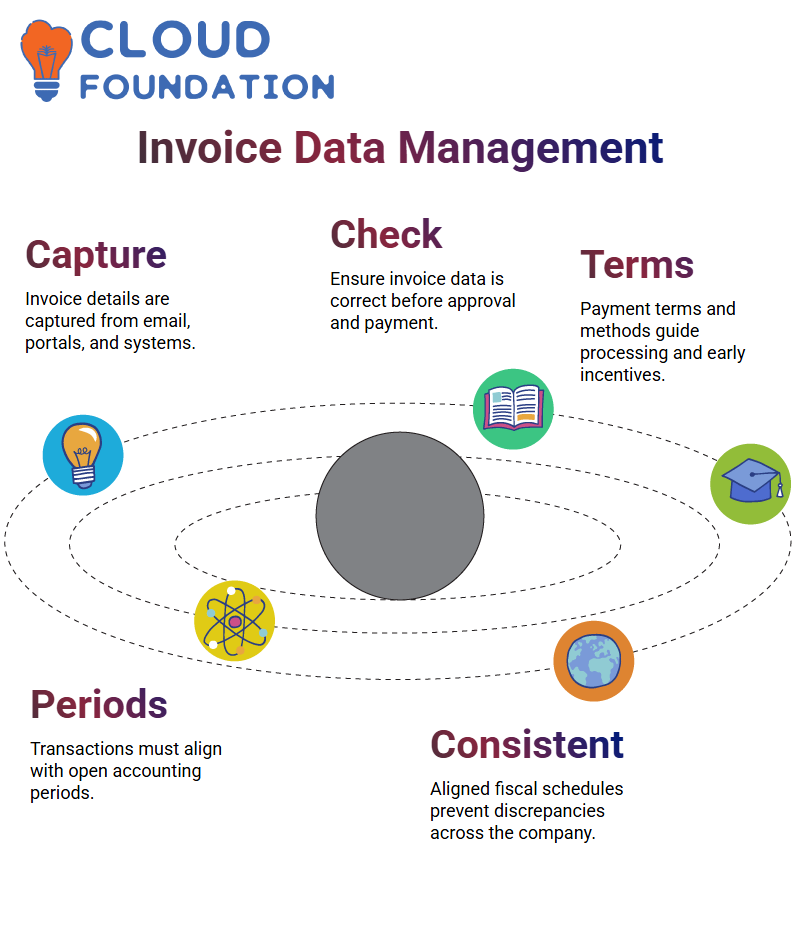

Invoices, Noise, and Vendor Data

When invoices arrive—whether through email, vendor portals, or supply chain systems—the company must capture and validate the data. In some cases, the process is referred to as creating a “noise task” to capture invoice details such as:

Vendor information

Invoice number (noise number)

Currency and payment terms

Line items and cost centres

Payment terms like 4% 10, net 30, incentivise early payments, while default methods like cash ensure consistency.

Systems allow for flexibility in overwriting dates, adjusting methods, or applying discounts.

Systems allow for flexibility in overwriting dates, adjusting methods, or applying discounts.

Fiscal Year Schedules and Accounting Periods in Workday

A critical component of financial accuracy is aligning transactions with fiscal schedules. Without proper period management, companies risk misplaced entries or rejected postings.

Key considerations include:

Period Validation: Transactions can only be posted if the accounting period is open.

Mask Updates: Used to update or reopen periods.

Consistency: Every company under the same umbrella must use aligned fiscal year schedules to avoid discrepancies.

For example, Maria, an accountant responsible for managing fiscal schedules, ensures that her company adheres to the standard 2025 rules and cost centres. By doing so, she consistently reports relevant information.

Approvals and Business Process Flow in Workday

No accounting process is complete without approvals. Business workflows often require multiple checkpoints to ensure accuracy before transactions are reflected in financial reports, such as the trial balance.

A typical flow looks like this:

Recognition of Spend (e.g., RFQ or PO)

Mapping Spend Categories to Posting Rules

Invoice Entry and Validation

Approval by Designated Specialists

Posting into Ledger Accounts

Reconciliation in Trial Balance and Reports

This step-by-step flow reduces errors, ensures compliance, and maintains trust in the financial system.

Workday Course Price

Vinitha Indhukuri

Author